Supplier Spotlight: BAT & Mars

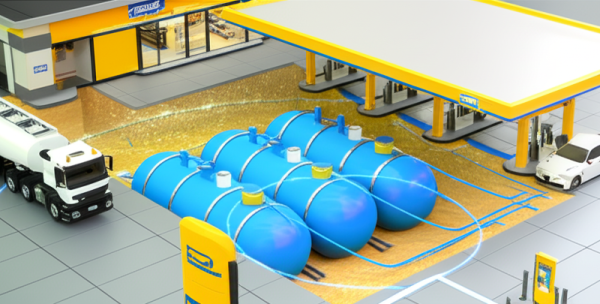

便利店行业正处在以客户体验为核心的转型阶段,供应商的策略与创新成为推动行业升级的重要驱动力。英国美国烟草公司(BAT)、多佛燃料解决方案(Dover Fueling Solutions,简称DFS)以及玛氏公司(Mars Inc.)在各自领域拥有显著影响力,它们如何通过产品组合、技术应用和社会责任实践,与便利店共同塑造未来格局,值得深入剖析。 英国美国烟草公司(BAT):创新与责任并重 BAT作为全球领先的烟草与尼古丁制品制造商,其在便利店渠道的布局不仅体现市场规模,更折射出对创新形态与合规经营的双重坚持。公司旗下子公司R.J. Reynolds Vapor Company(RJRVC)聚焦现代口腔烟草产品(如无烟产品)的研发与推广,形成与传统卷烟并行的产品矩阵。VELO等无烟替代品的推出,标志着BAT在迎接成年消费群体口味与偏好多样化方面的持续探索。 在市场策略层面,BAT强调以成年消费者为核心的营销边界控制,严格规定面向21岁及以上的受众投放,力求平衡创新与社会责任。这种以合规为前提的创新路径,帮助 BAT 在监管日趋严格的环境中维持稳健的市场表现与品牌声誉。利用数字化渠道进行消费者互动成为其重要手段之一,BAT通过社交媒体和官方信息平台开展品牌传播,但对未成年人接触烟草信息实施严格屏蔽与内容控制,以降低合规风险并树立负责任的企业形象。 对便利店生态的影响方面,BAT的策略不仅影响商品组合的构成,也在供应链管理、门店的顾客体验设计和合规营销框架上形成示范效应。随着便利店向“一站式服务点”转型,现代烟草与尼古丁产品的定位也在经历再定制:既要满足成年消费群体对便捷与隐私的需求,又要符合日益完善的零售合规要求。BAT的经验提醒零售商,在追求创新产品与数字化营销的同时,必须建立起健全的风控机制、年龄验证体系以及对广告投放人群的精细化管理。 此外,BAT在区域市场的多元化布局也带来对供应链协同的启示。无论是在仓储、分销还是门店端的信息化管理, BAT及其合作伙伴通过标准化流程和数据驱动的运营,提升了门店库存周转率与产品可得性。这对便利店的盈利能力与客户满意度提升具有直接的现实意义。总体来看,BAT在便利店领域的表现呈现出“创新驱动+负责任经营”的组合拳,既推动了产品创新的前沿,又通过规范化营销维护行业健康生态。 多佛燃料解决方案(DFS):技术驱动的燃料供应革新 DFS作为能源与基础设施领域的技术提供商,在便利店网络中扮演着核心的“背后引擎”角色。其专注点是为便利店及加油站提供先进的燃料分配系统、智能加油设备、自动化管理以及数据分析支持。随着便利店越发向综合服务型运营转型,燃料供应的效率、安全性与数据化管理成为关键竞争要点。DFS通过引入智能化的加油桩、无人值守加油、以及与零售端POS、库存管理系统的深度对接,显著提升了运营效率,缩短顾客等待时间,并优化了能源资源的配置。 在技术层面,DFS强调设备的互联互通与云端数据分析能力。通过对加油量、销售结构、时段客流等多维数据的实时监控,零售商能够据此进行精细化排班、促销活动的时效性调整,以及能源采购的成本控制。这类数据驱动的运营模式,有助于门店在高峰时段保持高效服务,同时在低谷期保持合理的门店节能策略。安全性方面,DFS的系统设计通常涵盖防盗、火灾预警、漏油监测等联动机制,确保在高度分散的门店网络中对潜在风险的快速响应。 环保与可持续发展也是DFS在行业中的重要定位。通过推动低碳燃料应用、能效提升与设备的高效运行,DFS为便利店企业提供“绿色转型”的技术路径。这与全球能源结构转型和消费者对生态友好产品的关注形成了良性叠加关系。对于便利店经营者而言,选择DFS的技术解决方案不仅能提升运营效率与顾客体验,也能够在企业社会责任与品牌形象方面获得积极回报。DFS的角色体现了一种“基础设施+数据驱动”的综合价值:以科技降低运营成本、以数据提升盈利能力、以环境责任提升市场信誉。 在行业生态层面,DFS的系统化解决方案有助于推动全国性或区域性便利店网络的统一标准化建设。标准化的硬件与软件接口,降低了跨门店扩张的技术门槛,使连锁品牌能够更快速地复制成功模型,并在不同地区实现一致的顾客体验。这一趋势对代理商、系统集成商以及设备供应商的协同产生积极的外部性效应,促成更高水平的行业协作与创新。 玛氏公司(Mars Inc.):多元化产品与社区连接 玛氏公司在便利店渠道的成功,源于其广泛的产品线和对消费者生活方式的深度理解。糖果、零食、饮料以及宠物食品等品类,为便利店提供了丰富的高频购买商品组合。随着健康意识的提升,玛氏通过调整产品结构、推出低糖、天然成分的健康零食及功能性食品,回应了消费者对“口味+健康”的双重需求。品牌多样性不仅扩大了顾客在门店的购物篮尺寸,也增强了店员的推荐空间,提升了结账时的附加销售机会。 在市场策略层面,玛氏强调与便利店零售商建立紧密的合作关系,通过共同的促销活动、店内陈列优化与社区化营销,提升品牌与门店的互动密切度。玛氏在社区活动与企业社会责任方面的投入,帮助品牌与消费者建立情感连接,提升品牌美誉度。通过参与地方社区建设、教育与公益项目,玛氏在便利店生态中不仅是产品提供者,更成为社区参与者与信任伙伴。这种情感层面的连接,有助于提升重复购买率、增强消费者对门店的忠诚度,以及在竞争激烈的零售环境中形成差异化竞争力。 产品创新方面,玛氏在口味创新、包装改良与健康定位上不断探索。例如开发更低糖分的糖果线、引入更自然成分的原料组合,以及在宠物食品领域推出符合不同生命周期需求的产品。这些举措使玛氏的产品线更具迁移性,能够在不同地区、不同消费层次的便利店中实现灵活的上新与推广。此外,玛氏还能通过市场数据分析了解区域偏好,制定更具针对性的促销与新品引入策略,从而提升门店的销售效率和库存周转率。 对便利店零售商的现实意义在于,玛氏的多样化产品和品牌故事为门店提供了丰富的销售话术与促销方案。零售商可以通过组合促销、跨品类搭配与主题活动,提升客单价并增加门店的来客频次。与此同时,玛氏在供应链协作、促销支持与渠道沟通方面的持续投入,帮助门店实现更稳健的经营态势,降低因商品波动带来的经营风险。这种以产品多元化与社区连接为核心的策略,使玛氏在便利店生态中成为一个值得信赖的长期伙伴。 便利店行业的未来趋势与供应商角色 在快速变化的市场环境中,便利店行业正经历几大共同趋势,供应商的角色因此变得更加关键。 – 技术创新驱动运营效率 – 智能设备、自动化管理与数据驱动的决策成为常态。无论是燃料分配、库存管理,还是顾客行为分析,数据化能力都直接影响门店的利润率和顾客体验。 – 供应商通过提供端到端解决方案,帮助零售商实现从采购、陈列到销售的全流程优化,降低人力成本、提升准确性。 – 产品多样化与健康环保偏好 – 消费者对健康、低糖、天然成分的需求持续上升,零食、饮品与日常消费品的健康化改造成为行业共识。 – 环保诉求驱动包装、生产与供应链的可持续改进,供应商需要在产品设计、材料选择和物流环节开展绿色实践。 – 社会责任与品牌信任 – 企业社会责任(CSR)成为影响消费者选择的重要因素。品牌与社区的互动、透明的营销合规、对未成年人的保护等,都会直接影响门店与消费者的关系。 – 零售商对供应商在合规、道德与社会影响方面的表现越发敏感,优先选择具备清晰责任框架的合作伙伴。 – 数字化与全渠道融合 – 线上线下一体化、移动支付、忠诚度计划与个性化营销成为提升顾客黏性的关键工具。供应商的数字化能力越强,越能帮助门店实现精准促销与高效客流引导。 – 供应商与门店关系的共生性 – 大型供应商以技术、产品与资源整合的方式,与零售商形成更加紧密的长期伙伴关系。共同学习与共创成为常态,门店不再只是商品的终端点,而是数据与体验的综合服务场景。 结语:供应商驱动便利店行业新篇章…