23 Cents to Pay U.S. Debt Interest

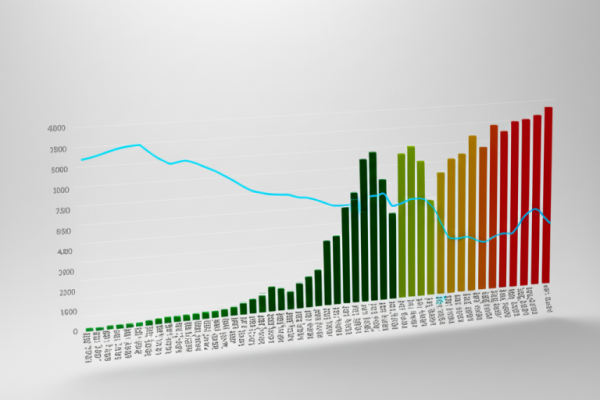

导言 在全球金融市场的风暴中,美国国债的利息支出正悄悄成为财政政策的隐形枷锁。每收取的一美元税收中,约有四分之一要用于支付债务利息,这一声音看似遥远,却深刻地改变了财政空间的边界。随着国债规模的扩大与利率的上行,利息支出在联邦预算中的比重日益突出,迫使教育、基础设施、公共卫生与社会保障等领域的财政支出面临更紧迫的压缩。本文将系统梳理美国国债利息支出的现状、形成原因、对财政的影响,以及在现有趋势下,政府可能的应对路径与政策取向。通过结构化分析,揭示这场“利息赤字”背后的财政约束逻辑,并提出务实且具有前瞻性的建议。 一、美国国债利息支出现状:数字背后的财政现实 截至2025年,美国国债总额首次突破37万亿美元的大关,利息支出预计达到1.4万亿美元,约占联邦财政收入的26.5%。换言之,每收取一美元税收,约有23至26美分用于支付债务利息,显著高于历史的水平。这组数字并非单一年度的“高点”叠加,而是长期趋势的放大效应所致:2024财年利息支出已超过1.13万亿美元,2025财年预计将突破1.2万亿美元。与之相伴的,是利息支出在联邦总支出中的占比快速攀升——从2020年不到5%,上升到近15%;净利息支出对赤字的贡献也从大约10%提升至近50%。这些数据共同勾勒出一个清晰的财政现实:利息支出正在逐步成为“财政硬约束”的核心要素,而非可自由调配的可选支出。 在财政收入与支出结构中,利息支出的比重之所以引人关注,原因并非仅仅在于数字大,而是它对预算灵活性的直接挤压。非利息支出在财政总支出中的占比由2020年的95%上下波动,降至大约85%上下,利息支出占比却由不足5%上升至近15%。这意味着诸如教育、基础设施、国防、科技研究、社会保障等领域的资金空间被挤压,财政政策的空间被“拉紧”,公共服务供给与宏观经济调控能力受到抑制。 与此同时,市场与评级机构对这一趋势已发出信号。2025年5月,穆迪将美国主权信用评级从AAA下调至AA1,彰显债务与利息负担对信用的负面影响在市场关注层面的上升。短期内的利率波动、长期负债规模的上升与财政可持续性的担忧,已经成为全球资本市场的共识预期之一。 二、利息支出上升的驱动因素:多重叠加的结构性压力 1) 国债规模的持续扩大 多年来的财政赤字积累、政府对财政缺口的持续回应,促使国债规模不断刷新历史纪录。为了维持日常运行和应对紧急支出,政府重复性地发行新债以融资,导致“总量效应”逐步显现。国债规模的扩大不仅意味着未来需要承担更高的利息成本,更意味着再融资周期中的利率敏感性显著提升,一旦市场利率走高,新的融资成本会迅速传导到财政预算中。 2) 利率环境的上升与再融资成本的传导 美联储为抑制通胀,在较高水平上维持联邦基金利率,通常被设定在4.25%-4.5%的区间。这一利率水平直接抬升了新发行债务的票面利率成本,同时也提高了存量债务的再融资成本。换言之,利率环境的紧缩不是一个“静态成本”,而是一个“动态传导”过程:高利率使得债务滚动成本上升,进而推高利息支出的增速,形成恶性循环。 3) 财政政策影响的长期叠加 2017年的减税以及“大而美”的财政政策框架在一定程度上削弱了税收收入的增速与稳定性,扩大了财政缺口。这一结构性因素放大了对债务融资的依赖,从而在利率水平持续高企的背景下,进一步推升利息支出对预算的挤压效应。尽管财政政策工具箱中包含增税与削减支出等选项,但在政治与经济现实的双重制约下,快速、根本性的结构性改革并非易事。 三、利息支出对财政的直接影响:空间挤压与信用风险 1) 财政空间的“挤压效应” 利息支出快速上升,直接挤压非利息支出所能占据的预算空间。非利息支出占比从高位的约95%一路下滑至约85%,而利息支出占比接近15%,这意味着教育、基础设施、社会保障、科研创新等领域的财政投入被动摇,公共政策的实施难度加大。尤其在经济复苏尚未完全稳固、人口结构改变带来长期需求上升的背景下,财政支出结构的紧缩风险显得尤为突出。 2) 国际信用与市场信号 利息支出占比的持续高位,与国际评级机构关于国家信用的关注高度相关。信用评级不仅影响借贷成本,还直接关系到市场对财政可持续性的判断。尽管美国在全球金融体系中的地位仍然独特,但信用评级下调成为对财政可持续性警示的强烈信号。短期内,评级与市场情绪可能引发资本成本的波动,从而进一步放大财政压力。 四、长期趋势与未来情景:从“利息赤字”看财政空间的收缩 财政部所属的权威分析(以财政问责机构的预测为参照)显示,利息赤字率将在2025年实现约3.2%,并在2035年上升至约4.1%。更为关键的是,非利息赤字率虽然也有波动,但预计在同一时期会有所回落,显示利息支出将成为财政赤字的主导因素。综合来看,利息支出对财政收入的占比预计将从2025年的26.5%进一步上升至2035年的约30%,财政政策空间将因利息负担而被“彻底锁死”。 人口老龄化是驱动社会保障与医疗支出持续攀升的关键因素。结合利息支出,社会保障、医疗保险等支出已经占财政总支出的高位区间,与债务服务支出共同组成“三驾马车”的财政压力结构——这使得财政空间更难通过简单增收或削减单一项支出来实现可持续性。 五、应对路径的思考:在收入与支出之间找到新的平衡 1) 强化财政可持续性的制度设计 – 稳健的财政框架:建立以长期可持续性为核心的预算制度,明确在不同经济周期中的支出上限与增長路径,避免周期性波动放大财政赤字。 – 自动稳健机制:引入结构性自动调节工具,如可触发的税制调整、福利制度的弹性设计,使财政在景气波动中更具韧性。 – 财政透明与评估:提升支出项目的绩效评估与结果导向,优先保留对经济增长、生产力提升与社会公平具有较高边际收益的项目。 2) 税收结构与税基的优化 – 税制改革的方向可以聚焦于扩大税基的同时提升公平性,减少对高税率阶段性征收的依赖,提升税收体系的稳定性与可预测性。 – 通过税制激励促进创新、生产性投资与人力资本提升,提升长远经济增长潜力,从而改善财政收支的长期均衡。 3) 支出结构的改革与优先级调整 – 社会保障与医疗改革:在保障基本福利的前提下,推进支出结构性调整,如延长受益年龄、优化药品价格与医疗服务采购、提升医疗效率等,以降低长期增速。 – 基础设施与教育的结构性投资:用更高的投资回报率来提升长期经济增长潜力,尤其在生产力、技能培训、科技创新领域实施有选择性的支出优化。 4) 债务与利率管理的治理工具 – 债务管理的现代化:通过更精准的期限结构、风险分散和市场化发行工具,降低融资成本和再融资的不确定性。 – 宏观审慎框架与货币政策协同:在通胀与增长的双目标下,政府应与货币当局建立更紧密的协调机制,确保财政可持续性在宏观层面得到稳健管理。 5) 增强财政韧性与社会共识…