XRP Surpasses Ethereum on Coinbase

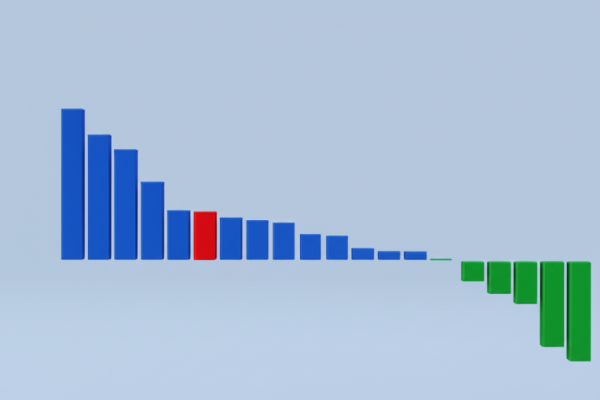

The Ascent of XRP: An Analysis of Coinbase’s Q2 2025 Revenue Shift Introduction: A Seismic Shift in the Crypto Landscape The cryptocurrency market, known for its rapid fluctuations and groundbreaking innovations, has once again demonstrated its unpredictable nature in Q2 2025. Coinbase, a prominent cryptocurrency exchange, unveiled a surprising transformation in its revenue composition: XRP,…