The Current State and Future Prospects of Bitcoin

Imagine standing at the edge of a digital frontier, where the air is electric with possibilities, and the ground beneath your feet is shifting with the weight of innovation. This is the world of Bitcoin in 2025. As of May 13, 2025, Bitcoin is trading at approximately $103,484. But what does this number truly signify? It’s a snapshot of a journey that has seen technological leaps, market turbulence, and a rollercoaster of investor emotions. Let’s embark on an exploration of Bitcoin’s current state and future prospects.

Bitcoin’s Market Performance

Recent Trends and Patterns

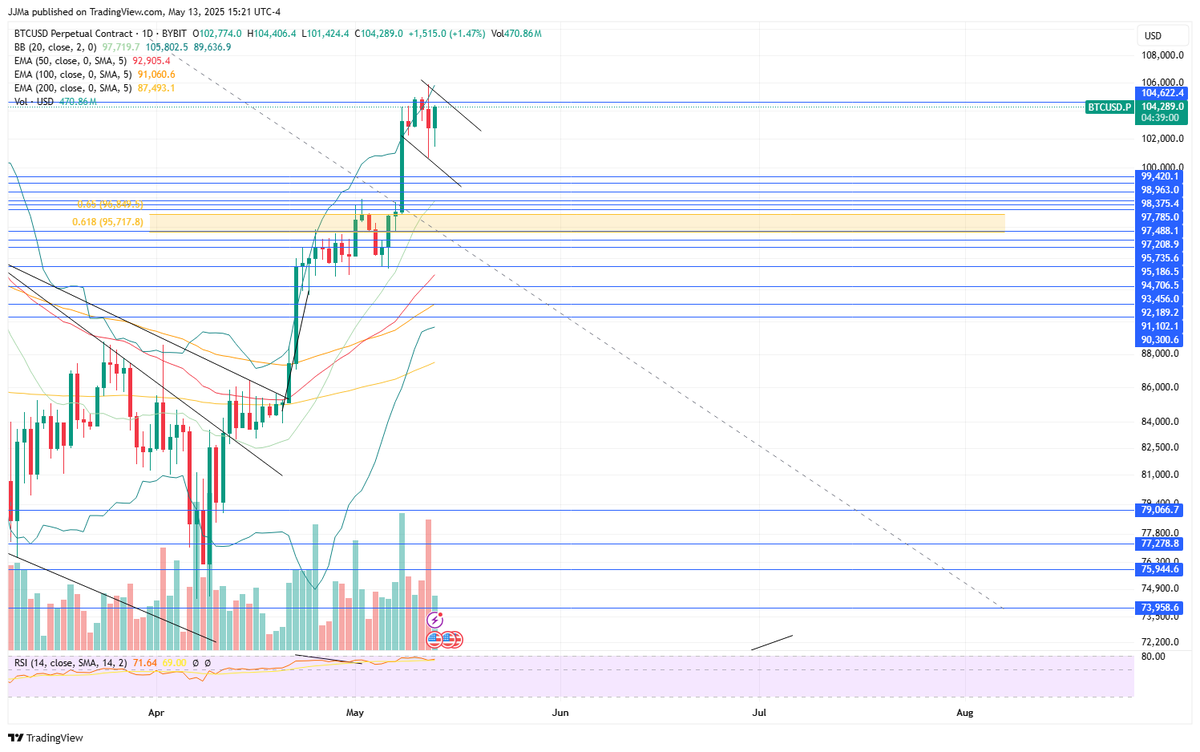

Bitcoin’s price movements are a dance of data and speculation, a ballet of bulls and bears. Analysts have been poring over charts, spotting patterns that hint at future movements. One such pattern is the ascending triangle formation, where Bitcoin has been trading within a defined range, facing rejection at the top. This pattern suggests a potential breakout, a moment of truth where the market decides whether to surge or stumble.

The Ichimoku Cloud, a technical analysis tool as complex as it sounds, has been providing a safety net below, supporting the upward trend. It’s like a guardian angel, watching over Bitcoin’s ascent, ensuring that the momentum doesn’t falter despite occasional setbacks.

Key Levels and Resistance

As of the latest analysis, Bitcoin is eyeing key resistance levels at $104,519 and $106,072. These aren’t just arbitrary numbers; they represent significant supply zones, areas where sellers might step in to test the market’s resolve. A breakout above these levels could signal a strong bullish trend, a green light for Bitcoin to charge towards new all-time highs.

Market Sentiment and Analysis

Bullish vs. Bearish Sentiments

The market sentiment is a tug-of-war between optimism and caution. Some analysts are predicting a strong multi-week rally for altcoins, citing a historic bullish divergence in their market cap relative to Bitcoin. This divergence is like a secret handshake among traders, a sign that altcoins might outperform Bitcoin in the short term, providing alternative investment opportunities.

On the flip side, there are whispers of a potential cool-off period. Bitcoin has shown strength above the $100K mark, but recent volatility has raised eyebrows. Some analysts believe that a pullback is imminent, a breather before the next big push. It’s like the calm before the storm, a moment of uncertainty that keeps investors on their toes.

Institutional and Retail Investor Behavior

Institutional investors have been the heavyweights in the Bitcoin arena, with businesses converting their cash reserves into digital gold. Michael Saylor’s strategy of Bitcoin accumulation has been a significant driver of this growth. It’s like a corporate treasure hunt, where companies are stashing away Bitcoin as a hedge against inflation and market volatility.

Retail investors, on the other hand, have been more cautious. The recent volatility has led to a mix of buying and selling, a dance of risk and reward. Some investors are taking profits, while others are accumulating more Bitcoin, betting on its long-term potential. It’s a delicate balancing act, a testament to the maturing market where investors are learning to navigate the waves of uncertainty.

Technical Indicators and On-Chain Data

On-Chain Analysis

On-chain data is like a treasure trove of insights, a window into Bitcoin’s market dynamics. The $2 trillion market cap has attracted a wave of new buyers, while seasoned traders turn cautious. This data suggests that Bitcoin’s price movements are influenced by both new and experienced investors, creating a dynamic market environment.

Technical Indicators

Technical indicators are the compasses guiding investors through the cryptocurrency wilderness. The Moving Average Convergence Divergence (MACD) shows a bullish crossover, a green light for a potential upward trend. Meanwhile, the Relative Strength Index (RSI) suggests that Bitcoin is overbought, a red flag for potential corrections. These conflicting signals highlight the importance of a comprehensive analysis, a holistic view that considers both technical and fundamental factors.

Future Prospects and Predictions

Short-Term Outlook

In the short term, Bitcoin’s price movements will likely be influenced by technical factors such as support and resistance levels, as well as market sentiment. A breakout above the key resistance levels could lead to a significant price increase, a surge that could catch even the most seasoned investors off guard. Conversely, a pullback could provide a better entry point for investors, a moment of opportunity amidst the volatility.

Long-Term Outlook

Looking ahead, Bitcoin’s long-term prospects remain bullish. The increasing institutional adoption, coupled with the growing acceptance of Bitcoin as a store of value, suggests that Bitcoin’s price could continue to appreciate. However, investors should be prepared for volatility and potential corrections along the way. It’s like a journey on a rollercoaster, where the thrills and spills are part of the adventure.

Conclusion: Navigating the Bitcoin Landscape

Bitcoin’s journey in 2025 is a testament to its resilience and potential. As we navigate the complexities of the cryptocurrency market, it is essential to stay informed and adaptable. Whether you are a seasoned investor or a newcomer, understanding the current state and future prospects of Bitcoin can help you make informed decisions and capitalize on the opportunities that lie ahead.

As Bitcoin continues to evolve, one thing is certain: the future is bright, and the possibilities are endless. So, buckle up and get ready for the ride, because the Bitcoin revolution is far from over. The digital frontier is calling, and it’s time to answer.

—

Sources

– JJMaTrader

– PrimeXBitcoin

– Pakistani HODL

– TheRealPlanC

– BitcoinBottomTop

– DanCote303

– Daily Bitcoin Analysis

– SammysAnalysis

– CryptoBuletin8

– Dynamite_Fix

– Dex-Trade

– Leontrades

– CryptoPulse

– Robert cipher

– Dexplorer_10x

– Bitcoin Magazine NL

– Imperfect_Llex

– Andrea Souza

– MARLON_GOLDM

– LumenProto

– Keyanb