The Pulsating Heart of Crypto: Understanding Impulsive Moves in Cryptocurrency Futures Trading

In the ever-evolving landscape of cryptocurrency, impulsive moves in futures trading are akin to the unpredictable storms that can disrupt even the most seasoned sailor’s journey. These sudden, dramatic shifts in price are driven by a mix of market sentiment, breaking news, and other transient factors. For traders, understanding these impulsive moves is not just an advantage—it’s a necessity for navigating the tumultuous waters of the crypto market.

The Nature of Impulsive Moves

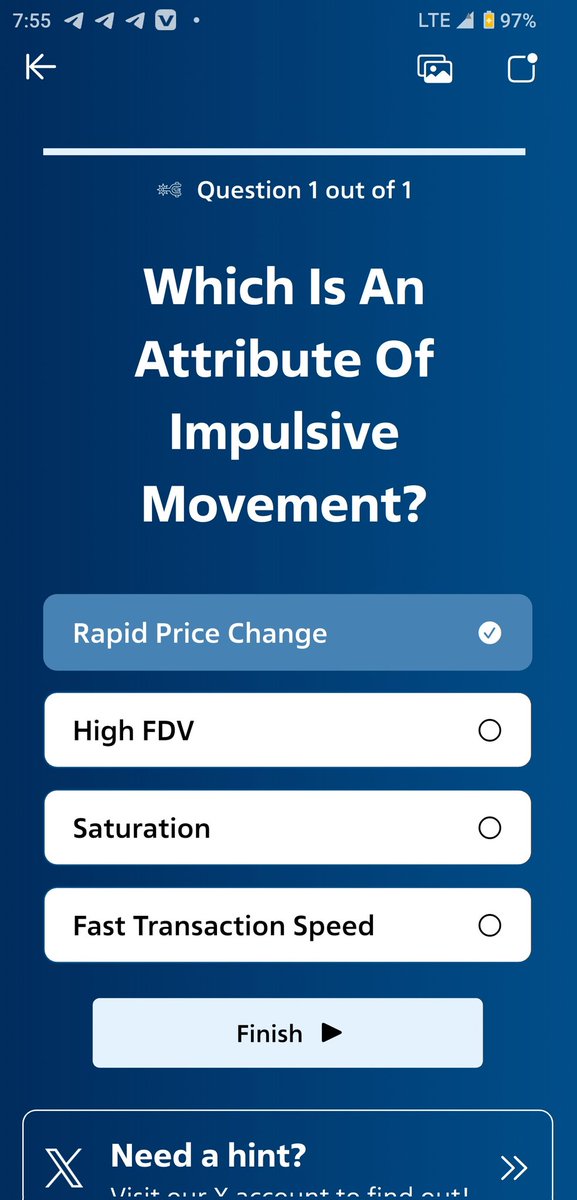

Impulsive moves in cryptocurrency futures trading are defined by their abrupt and substantial nature. Unlike the gradual price shifts that result from thorough fundamental analysis, impulsive moves are often the product of fleeting market sentiment, sudden news, or even viral social media trends. These moves can be both thrilling and daunting, offering the potential for significant gains or losses in a very short period.

The Anatomy of an Impulsive Move

To grasp the anatomy of an impulsive move, consider the following scenario: A well-known crypto influencer tweets about a promising new altcoin. Within minutes, the altcoin’s price surges as traders rush to buy, fearing they might miss out on potential profits. This sudden influx of buying pressure drives the price up rapidly, creating an impulsive move. Conversely, a negative tweet or news article can trigger a sell-off, leading to a sharp price decline.

Factors Driving Impulsive Moves

Several key factors contribute to impulsive moves in the crypto market. Understanding these drivers can help traders anticipate and react to these sudden shifts.

Market Sentiment and Social Media

Market sentiment, often shaped by social media and news outlets, is a primary driver of impulsive moves. A positive news story about a cryptocurrency can lead to a sudden price surge, while negative news can cause a sharp decline. Social media platforms like Twitter and Reddit are particularly influential, where influential figures and communities can drive market sentiment and, consequently, impulsive moves.

For instance, a tweet from a well-known crypto influencer can lead to a significant price movement, as seen in various instances where market sentiment was heavily influenced by social media posts[1].

Technical Analysis and Chart Patterns

Technical analysis is another crucial factor in impulsive moves. Traders often rely on chart patterns and technical indicators to make trading decisions. Patterns like head and shoulders, double tops, and flags can signal potential price movements. Indicators such as moving averages, relative strength index (RSI), and Bollinger Bands are also commonly used. These tools help traders identify trends and potential reversal points, which can lead to impulsive moves when the market reacts to these signals.

Regulatory News and Technological Advancements

Regulatory news can also trigger impulsive moves. Announcements from regulatory bodies about new guidelines, bans, or approvals can significantly impact cryptocurrency prices. For example, news about a country legalizing or banning cryptocurrencies can lead to sudden price changes. Similarly, regulatory approvals for new cryptocurrency products or services can drive impulsive moves. Technological advancements, such as the launch of a new blockchain platform or a significant upgrade to an existing one, can also influence market sentiment and lead to impulsive moves.

Macroeconomic Factors

Macroeconomic factors, such as changes in interest rates, inflation, and geopolitical events, can also contribute to impulsive moves. For example, a sudden change in monetary policy by a major central bank can affect investor sentiment and lead to price fluctuations in the crypto market. Traders need to stay informed about these macroeconomic developments to anticipate and react to impulsive moves.

The Role of News and Social Media

News and social media play a pivotal role in driving impulsive moves in the crypto market. The speed at which information travels in the digital age means that traders must be constantly vigilant, ready to react to breaking news and social media trends.

The Power of Influencers

Influencers in the crypto space wield significant power. A single tweet from a well-known figure can send a cryptocurrency’s price soaring or plummeting within minutes. This phenomenon highlights the importance of staying connected to the latest trends and opinions in the crypto community. Traders should follow reputable influencers and stay updated on the latest news to anticipate potential impulsive moves.

The Impact of Breaking News

Breaking news can have an immediate and profound impact on cryptocurrency prices. Positive news, such as a major partnership or regulatory approval, can lead to a sudden price surge. Conversely, negative news, such as a security breach or regulatory crackdown, can trigger a sell-off. Traders need to be aware of the sources of reliable news and be ready to act quickly when breaking news hits.

Social Media Trends

Social media trends can also drive impulsive moves. Platforms like Reddit and Twitter are hotbeds of market sentiment, where communities can rally behind a particular cryptocurrency, driving its price up. Conversely, negative sentiment can lead to a price decline. Traders should monitor social media trends and engage with the crypto community to stay ahead of potential impulsive moves.

Technical Analysis and Chart Patterns

Technical analysis is a cornerstone of cryptocurrency trading, providing traders with the tools to identify trends and potential price movements. Understanding technical analysis can help traders anticipate and react to impulsive moves.

Common Chart Patterns

Chart patterns are visual representations of price movements that can signal potential trends or reversals. Common chart patterns include head and shoulders, double tops, double bottoms, flags, and pennants. These patterns can help traders identify potential impulsive moves and make informed trading decisions.

Technical Indicators

Technical indicators are mathematical calculations based on price and volume data that can help traders identify trends and potential price movements. Common technical indicators include moving averages, relative strength index (RSI), Bollinger Bands, and MACD (Moving Average Convergence Divergence). These indicators can help traders anticipate impulsive moves and make timely trading decisions.

Combining Technical Analysis with Market Sentiment

While technical analysis provides valuable insights, it is most effective when combined with market sentiment analysis. By understanding both the technical and sentiment-driven factors, traders can gain a more comprehensive view of the market and better anticipate impulsive moves. For example, a bullish chart pattern combined with positive market sentiment can signal a potential price surge, while a bearish pattern combined with negative sentiment can indicate a potential price decline.

The Impact of Regulatory News

Regulatory news can have a significant impact on cryptocurrency prices, triggering impulsive moves. Traders need to stay informed about regulatory developments to anticipate and react to these moves.

Regulatory Approvals and Bans

Regulatory approvals and bans can lead to sudden price changes in the crypto market. For example, news about a country legalizing or banning cryptocurrencies can trigger impulsive moves. Traders should monitor regulatory developments and be ready to act quickly when new regulations are announced.

Regulatory Guidance and Guidelines

Regulatory guidance and guidelines can also influence market sentiment and lead to impulsive moves. For example, a regulatory body’s guidance on the classification of cryptocurrencies can affect investor sentiment and lead to price fluctuations. Traders should stay informed about regulatory guidance and be prepared to react to potential impulsive moves.

The Role of International Regulations

International regulations can also impact the crypto market, as cryptocurrencies are global assets. Traders should be aware of regulatory developments in different countries and be prepared to react to potential impulsive moves. For example, a regulatory crackdown in a major crypto market can lead to a global sell-off, while regulatory approvals can drive a global price surge.

Market Sentiment and Emotional Responses

Market sentiment is a powerful driver of impulsive moves, influenced by emotional responses such as fear, greed, and uncertainty. Understanding and managing these emotional responses is crucial for successful trading.

Fear of Missing Out (FOMO)

The fear of missing out (FOMO) is a common phenomenon where traders rush to buy a cryptocurrency due to the fear of missing out on potential gains. This can lead to sudden price surges, often followed by sharp corrections. Traders need to be aware of FOMO and avoid making impulsive trading decisions based on this emotional response.

Fear, Uncertainty, and Doubt (FUD)

Fear, uncertainty, and doubt (FUD) can also drive impulsive moves. Negative news or market sentiment can cause traders to sell off their holdings, leading to price declines. Traders need to be aware of FUD and avoid making impulsive trading decisions based on this emotional response.

Managing Emotional Responses

Managing emotional responses is crucial for successful trading. Traders should develop a trading plan and stick to it, avoiding impulsive decisions based on fear or greed. By staying disciplined and focused, traders can navigate the volatile crypto market and capitalize on potential opportunities.

The Altcoin Season Phenomenon

The concept of “altseason” refers to periods when alternative cryptocurrencies (altcoins) experience significant price increases relative to Bitcoin. This phenomenon is often driven by impulsive moves, as traders shift their focus from Bitcoin to altcoins in search of higher returns.

Identifying Altseason

Identifying altseason can be challenging, as it is influenced by various factors, including market sentiment, technical analysis, and regulatory news. Traders should monitor the altcoin market and look for signs of an impending altseason, such as increased trading volume and positive market sentiment.

Capitalizing on Altseason

Capitalizing on altseason requires a strategic approach. Traders should diversify their portfolio and invest in promising altcoins with strong fundamentals. By staying informed and managing risks, traders can capitalize on the opportunities presented by altseason.

The Role of Bitcoin Dominance

Bitcoin dominance, the percentage of the total cryptocurrency market capitalization that is accounted for by Bitcoin, is another important factor. A decrease in Bitcoin dominance often signals the beginning of an altseason, as traders move their investments to altcoins. Conversely, an increase in Bitcoin dominance can indicate a shift back to the leading cryptocurrency. Monitoring Bitcoin dominance can help traders anticipate impulsive moves in the altcoin market.

Total Market Cap Analysis

The total cryptocurrency market cap is a key indicator of market trends. Analyzing market cap movements can help traders identify potential impulsive moves and make informed trading decisions.

Breakouts and Reversals

A breakout from a descending channel with strong volume can signal a bullish trend, while a solid bounce can indicate a reversal. Traders should pay attention to these indicators to identify potential impulsive moves.

Resistance and Support Levels

Resistance and support levels are crucial in analyzing market cap movements. These levels can signal potential price reversals or continuations, helping traders anticipate impulsive moves.

Moving Averages

Moving averages are another important tool in market cap analysis. They can help traders identify trends and potential price movements, providing valuable insights into potential impulsive moves.

Navigating the Impulsive Moves

In conclusion, impulsive moves in cryptocurrency futures trading are an inherent part of the market’s volatile nature. Understanding the factors that drive these moves, from market sentiment and news to technical analysis and regulatory developments, is essential for successful trading. By staying informed and managing emotional responses, traders can navigate these impulsive moves and capitalize on the opportunities they present.

The crypto market is a pulsating heart, and those who understand its rhythms can thrive in its dynamic environment. By combining technical analysis with market sentiment and staying informed about regulatory developments, traders can anticipate and react to impulsive moves, turning volatility into opportunity.

References