The Intersection of Emotions and Analysis in the Crypto World

The Emotional Rollercoaster

Imagine riding a rollercoaster where the tracks are made of digital currency. The thrill of a bull run can send your heart racing, while the despair of a market downturn can leave you feeling like you’ve just plummeted from the highest peak. Welcome to the world of cryptocurrency, where emotions often run as high as the prices can fluctuate.

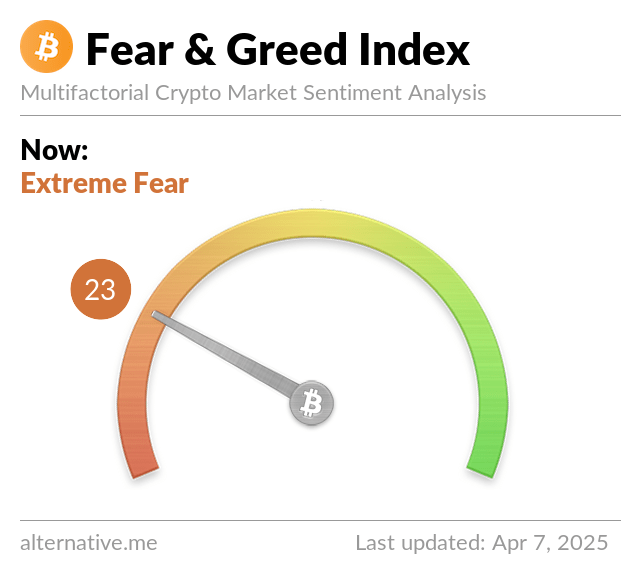

Cryptocurrency markets are infamous for their volatility. Prices can soar one day and crash the next, driven by a multitude of factors including market sentiment, regulatory news, and technological advancements. This volatility is both a curse and a blessing. For some, the emotional highs and lows are part of the allure, a testament to the wild, uncharted territory of digital finance. For others, it’s a relentless storm that can be overwhelming and disorienting.

In this emotional whirlwind, finding clarity and making informed decisions can be a monumental challenge. This is where expert analysis comes into play, serving as a beacon of light in the stormy seas of crypto trading.

The Role of Expert Analysis

Expert analysis is the compass that helps investors navigate the treacherous waters of the crypto market. By providing data-driven insights and trends, analysts can help investors identify potential opportunities and mitigate risks. In the crypto world, where emotions can often cloud judgment, this analytical clarity is invaluable.

Data-Driven Insights

One of the key ways analysts provide value is through data-driven insights. These insights are derived from a deep dive into market data, historical trends, and current events. For instance, @TAPfintech offers expert analysis to help investors drown out any negative feelings, especially on the timeline. By providing clear, concise, and actionable insights, TAPfintech helps investors find opportunities amidst the market’s volatility[1].

The Importance of Clarity

Clarity is another crucial aspect of expert analysis. In a market as volatile as crypto, it’s easy to get lost in the noise. Analysts like @CyberFrogsNFT emphasize the importance of clarity, analysis, and vibes in navigating the crypto market. By locking in before being locked out, investors can take advantage of potential opportunities and avoid the pitfalls of emotional decision-making[2].

The Power of Community

In the crypto world, community plays a significant role in shaping market sentiment and trends. From Twitter to Telegram, crypto enthusiasts are constantly sharing insights, tips, and strategies. This collective wisdom can be a powerful tool for investors, providing them with a wealth of information and perspectives.

Sharing Expertise

For example, @NFTBatGremlin shares his analysis of the SOL cryptocurrency, providing insights into potential support levels and market trends. By engaging with the community and sharing his expertise, Gremlin Guy helps other investors make informed decisions[3].

Fundamental Analysis

Similarly, @CryptoJournaal provides a fundamental analysis of EpicChain ($EPIC), a blockchain platform focused on delivering fast, secure, and scalable solutions for the emerging DeFi and NFT markets. By sharing his insights with the community, CryptoJournaal helps investors understand the potential of this emerging technology[4].

The Importance of Technical Analysis

Technical analysis is a key tool for investors looking to navigate the crypto market’s volatility. By analyzing price charts, trends, and indicators, investors can identify potential opportunities and make informed decisions.

Identifying Key Levels

For instance, @SammysAnalysis provides technical analysis of various cryptocurrencies, including SOL and EOS. By identifying key support and resistance levels, Sammy helps investors understand the market’s potential movements and make informed trading decisions[5][6].

Tools and Techniques

Technical analysis involves a variety of tools and techniques, from moving averages to Bollinger Bands. These tools help investors identify trends, patterns, and potential reversals in the market. By mastering these techniques, investors can gain a deeper understanding of the market’s dynamics and make more accurate predictions.

The Future of Crypto Analysis

As the crypto market continues to evolve, so too will the tools and techniques used to analyze it. From advanced algorithms to AI-driven insights, the future of crypto analysis is bright. However, one thing is certain: the intersection of emotions and analysis will continue to play a crucial role in shaping the market’s trends and opportunities.

Advanced Algorithms

Advanced algorithms are already being used to analyze market data and identify trends. These algorithms can process vast amounts of data in real-time, providing investors with up-to-the-minute insights and predictions. As these algorithms become more sophisticated, they will play an even greater role in crypto analysis.

AI-Driven Insights

AI-driven insights are another area of growth in crypto analysis. AI can analyze market data, social media sentiment, and other factors to provide investors with a comprehensive view of the market. By leveraging AI, investors can make more informed decisions and stay ahead of the curve.

Conclusion: Embracing the Emotional Journey

In the world of cryptocurrency, emotions and analysis go hand in hand. By embracing the emotional journey and leveraging expert insights, investors can navigate the market’s volatility and find opportunities amidst the chaos. Whether it’s through community engagement, technical analysis, or data-driven insights, the key to success in the crypto world lies in finding clarity amidst the noise.

So, the next time you find yourself on an emotional rollercoaster, remember that there are opportunities out there. Find them. Embrace the journey, and let the power of analysis guide you towards success.

[1]: Andy | (!FF) (@AndyRewNFT) April 7, 2025

[2]: Cyber Frogs (!FF) (@CyberFrogsNFT) April 7, 2025

[3]: Gremlin Guy (@NFTBatGremlin) April 7, 2025

[4]: CryptoJournaal (@CryptoJournaal) April 7, 2025

[5]: TASammy💜 (@SammysAnalysis) April 7, 2025

[6]: TASammy💜 (@SammysAnalysis) April 7, 2025

Andy | (!FF) (@AndyRewNFT) April 7, 2025

Cyber Frogs (!FF) (@CyberFrogsNFT) April 7, 2025

Gremlin Guy (@NFTBatGremlin) April 7, 2025

CryptoJournaal (@CryptoJournaal) April 7, 2025