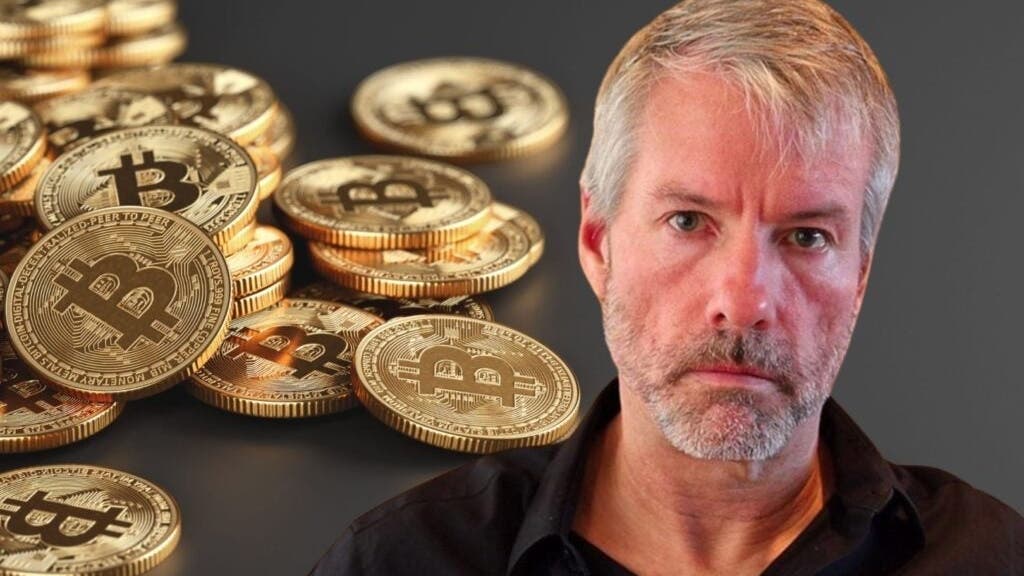

Dive into the Crypto World with Michael Saylor

Imagine a world where treasure lies not in vaults of gold, but in the digital realm of cryptocurrencies. Michael Saylor, the mastermind behind Strategy (formerly MicroStrategy), has been a trailblazer in championing Bitcoin’s cause, whispering about the prospect of Uncle Sam stockpiling a hefty stash of Bitcoin as a strategic reserve. This groundbreaking idea has sparked a frenzy of discussions on how digital money could shape national economic strategies. Let’s journey through the looking glass and explore the repercussions of such a daring move.

Unlocking Michael Saylor’s Bitcoin Crusade

In the land of cryptocurrency, Michael Saylor stands tall as a fearless warrior, known for his daring Bitcoin investment strategies through Strategy. Armed with over 471,000 Bitcoins, worth a fortune, Saylor’s relentless support for Bitcoin as a valuable asset class echoes across the financial skies. He paints Bitcoin as a shield against the ravages of inflation, a treasure chest brimming with potential value.

Enter the Bitcoin Fortress

The dream of creating a U.S. Strategic Bitcoin Reserve emerged from the shadows when President Donald Trump unleashed an executive order to build this fortified treasure trove using seized assets. Caught in the winds of change, Saylor proposed a grand vision – the U.S. snatching up a million Bitcoins over four years, a plan inspired by Senator Cynthia Lummis’ crypto crusade. But caution must dance hand in hand with ambition to avoid unsettling the market equilibrium.

Unleashing Waves of Change

Market Impact: Picture a storm brewing in the cryptocurrency sea as the U.S. waves its Bitcoin banner. Experts foresee a grand surge in Bitcoin’s value, triggered by a massive acquisition that could skyrocket its worth. Rumor has it that up to $460 billion might flood into Bitcoin’s digital coffers, bolstering its market stature by 25% and inflating its price by a colossal 20 times.

Global Domino Effect: While the U.S. sets sail on uncharted crypto waters, a global ripple follows in its wake. Faraway lands like Japan and U.S. states harbor restless eyes, pondering their own cryptocurrency reserves, mirroring the U.S.’ bold leap.

Economic and Geopolitical Shifts: Should nations embrace Bitcoin into their coffers, the very fabric of wealth management could rewrite its history. Economic landscapes could sway under this cryptocurrency’s influence, sparking a race among giants like China and Russia to retain their competitive edge.

Tackling Dragons on the Path

- Financing: The road to a Bitcoin fortress is paved with monetary challenges. Suggestions to convert gold to Bitcoin might not be the golden ticket for all, posing hurdles in funding this colossal crypto endeavor.

- Regulatory Maze: Untangling the web of cryptocurrency regulations is a necessary quest before integrating them into national economies. Clarity in digital asset distinctions and transparent transactions are key pillars in this crypto kingdom.

- Market Swings: Brace yourself for the tempestuous tides of Bitcoin’s value rollercoaster. A careful, steady approach, as advised by Saylor, could shield the initiative from the turbulence of market volatility.

Charting a New Voyage

The tale of the U.S. Strategic Bitcoin Reserve unveils a new narrative in the saga of digital currencies. While hurdles loom on the horizon, the prospects of merging Bitcoin with national economic tapestries shine bright. As nations observe the U.S. set sail on this uncharted course, eyes worldwide may turn towards integrating digital gold into their own treasuries, reshaping the global landscape of economic fortitude.

Related sources:

[5] www.benzinga.com