“`html

Analysis: Why Trump’s Crypto Order Disappointed

Introduction

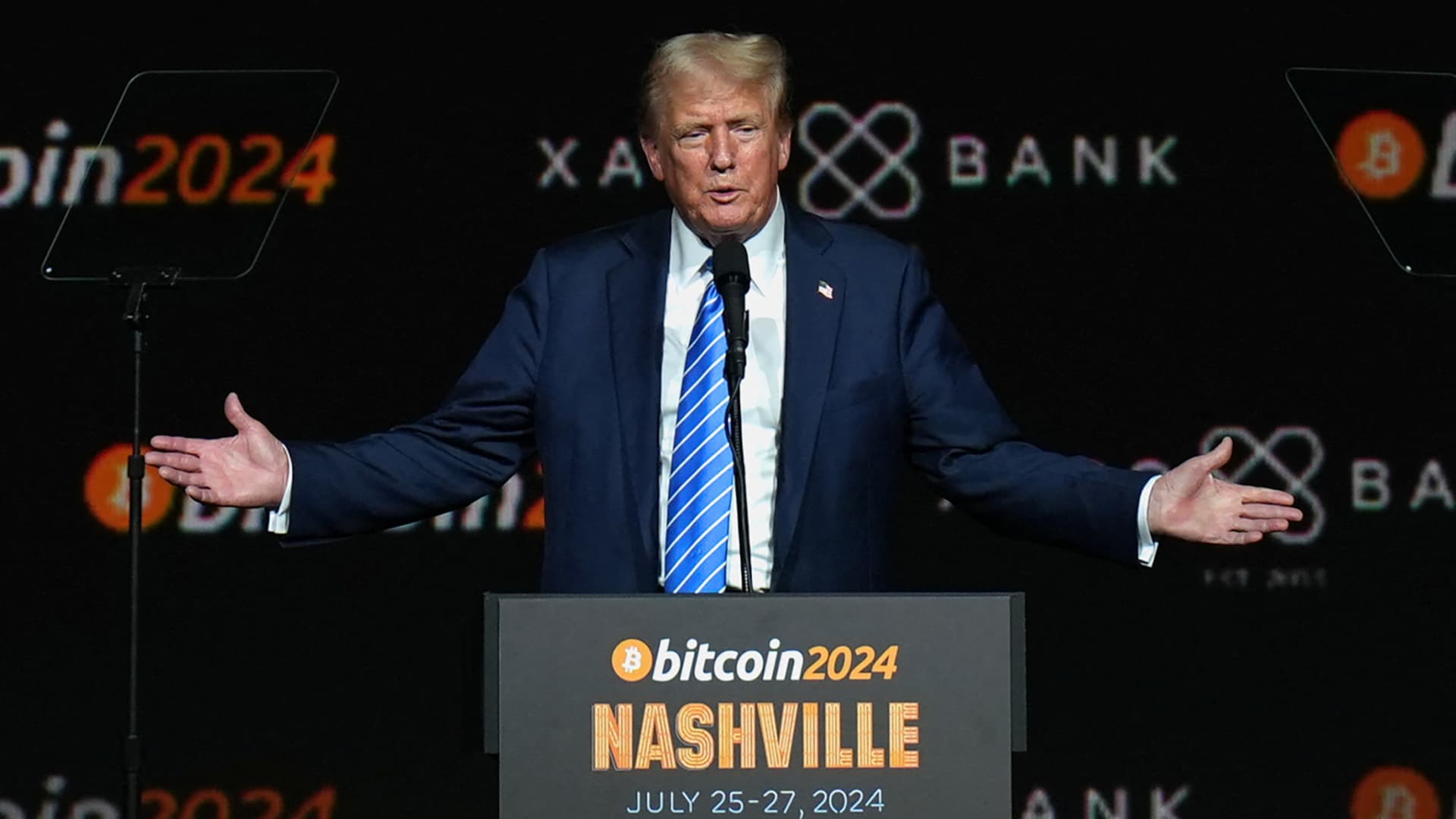

Imagine President Donald Trump signing an executive order to create a Strategic Bitcoin Reserve and a United States Digital Asset Stockpile. The crypto community hoped for a leap forward in how the U.S. approaches cryptocurrency. However, the news left many disappointed. Let’s delve into the reasons behind this letdown and what it means.

Background

The executive order sets out to form a safe haven for Bitcoin and other digital assets seized by the government. Picture this reserve as a “digital Fort Knox,” a secure spot to store these valuable assets. But here’s the catch – no new purchases of Bitcoin or other cryptos are allowed, much to the chagrin of investors and enthusiasts.

Disappointment Factors

1. Lack of New Acquisitions

– The order prevents fresh buying of Bitcoin or other cryptos, meaning the reserve will only house already seized assets, falling short of expectations.

– Some had hoped for an aggressive approach, like countries stockpiling gold reserves.

2. No Market Impact

– The decree caused a drop in Bitcoin’s price by almost 5% to $85,000 while other cryptos like Ethereum and Ripple saw declines too.

– This reaction reveals that investors wanted a stronger commitment from the U.S., anticipating a price boost.

3. Perception of Inaction

– Critics suggest the initiative lacks substance without a buying strategy, likening it to “putting lipstick on a pig.”

– Charles Edwards of Capriole Investments nails it with his description, highlighting the lack of real depth in this move.

Implications and Future Directions

- Global Impact: Despite the letdown, the Bitcoin reserve could prompt other nations to follow suit, potentially giving Bitcoin more global acceptance as a strategic asset.

- Policy and Legislation: The order stresses the need for clearer laws and policies regarding digital assets, nudging the U.S. to reconsider and refine its approach to harness crypto’s potential.

- Market Sentiment: Investors’ caution towards government actions that don’t directly support crypto investments means future policy decisions will be under scrutiny for signs of deeper involvement in the crypto market.

Conclusion

Trump’s order on the Strategic Bitcoin Reserve and Digital Asset Stockpile didn’t hit the right notes due to its limits and absence of new acquisitions. While a step towards acknowledging crypto’s strategic worth, it misses the mark on the robust reserve-building some expected. This underscores the call for more comprehensive policies to boost market trust and drive wider digital asset adoption.

References

[1] Coindesk: Trump Signs Order Setting Up Bitcoin ‘Fort Knox’ and Digital Assets Stockpile

[2] Atlantic Council: Commentary and Testimony

[3] White House: Establishment of the Strategic Bitcoin Reserve and United States Digital Asset Stockpile

Additional Insights

– Economic and Geopolitical Context: The U.S. diving into digital assets comes at a time of global economic uncertainty. Emerging markets are sturdy but still susceptible to external jolts. The role of multilateral bodies and the dominance of the U.S. dollar play key roles in this scenario.

– Future Policy Directions: The U.S. may need to explore proactive strategies to manage and expand its digital asset holdings. This could involve tweaking laws or engaging in global partnerships to set clear rules for digital asset management.

“`

Related sources:

[1] www.coindesk.com

[4] news.va.gov