The Evolution and Future of NFT Market Dynamics: A Deep Dive into Volume Trends and Whale Behavior

Introduction: The NFT Market’s Rollercoaster Ride

The Non-Fungible Token (NFT) market has been one of the most volatile yet fascinating sectors in the blockchain space. From its explosive rise in early 2021 to the subsequent corrections and resurgence, NFTs have captured the attention of investors, artists, and collectors alike. Recent analyses reveal intriguing patterns in trading volumes, whale behavior, and long-term holder dynamics. This report explores these trends, providing insights into the market’s past, present, and potential future.

—

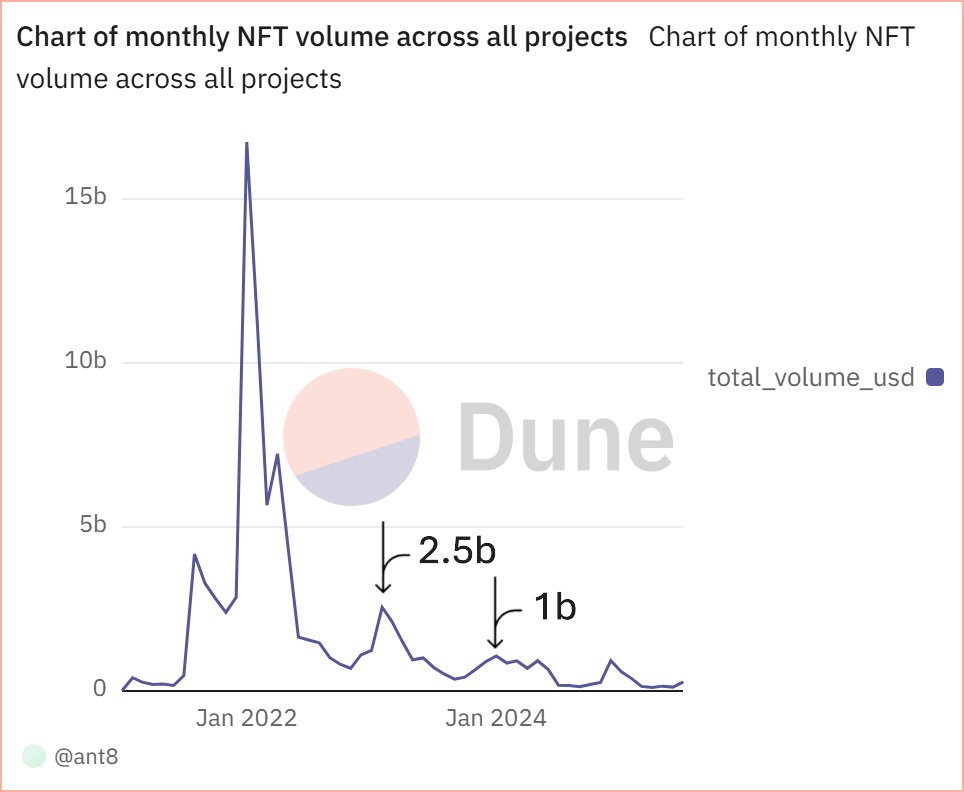

1. Monthly NFT Volume Trends: A Tale of Boom and Bust

The Bull Run of 2021-2022

The NFT market experienced a meteoric rise in early 2022, with trading volumes surging to unprecedented levels. This peak was driven by hype around high-profile collections, celebrity endorsements, and the broader crypto bull market. However, as the crypto winter of 2022 set in, trading volumes began to decline sharply, a trend that continued into 2023 and 2024.

The Gradual Decline and Potential Recovery

While the decline was steep initially, the market has shown signs of stabilization. Some analysts remain optimistic, pointing to potential catalysts for a resurgence, such as improved market infrastructure, increased institutional interest, and the emergence of new use cases for NFTs beyond digital art.

—

2. Whale Behavior: A Key Indicator of Market Sentiment

The Case of “Purt the Adventure”

A recent analysis highlighted a whale wallet holding 1,518 tokens of the “Purt the Adventure” collection, created by Red Planet DAO. Notably, this whale has not sold a single token and, in fact, acquired more in recent months. This behavior suggests strong confidence in the project’s long-term value, potentially signaling an upcoming price surge.

Why Whale Activity Matters

Whales—large holders of NFTs—often influence market trends. Their buying and selling patterns can indicate shifts in sentiment. If whales are accumulating rather than selling, it may suggest bullish expectations for the asset’s future performance.

—

3. Long-Term Holder Analysis: The Loyal “True Believers”

The Chimpers Case Study

An in-depth analysis of the Chimpers NFT collection revealed that out of 6,936 wallets that ever held a Chimpers NFT, 1,822 (26.2%) have never sold their tokens. This high retention rate suggests a dedicated community of long-term holders who believe in the project’s value beyond short-term speculation.

Implications for Market Stability

High long-term holder retention is a positive sign for market stability. It indicates that a significant portion of the community is invested in the project’s success rather than purely speculative trading. This could lead to more sustainable growth in the long run.

—

4. The Future of NFTs: Trends and Predictions

Emerging Use Cases Beyond Digital Art

While NFTs initially gained fame as digital collectibles, their utility is expanding. Use cases in gaming, virtual real estate, identity verification, and even real-world asset tokenization are gaining traction. This diversification could drive renewed interest and investment in the NFT space.

Technological Advancements and Market Infrastructure

Improvements in blockchain scalability, lower transaction fees, and better user interfaces are making NFTs more accessible. Additionally, the rise of decentralized marketplaces and cross-chain compatibility could further boost adoption.

Regulatory and Institutional Developments

As governments and institutions begin to recognize the legitimacy of NFTs, regulatory clarity could attract more traditional investors. Institutional involvement, such as hedge funds and venture capital firms, could provide the capital needed for sustained growth.

—

Conclusion: A Market in Transition

The NFT market has undergone significant changes since its peak in early 2022. While trading volumes have declined, the behavior of whales and long-term holders suggests underlying strength. The future of NFTs will likely be shaped by technological advancements, expanding use cases, and institutional adoption. As the market matures, it may transition from speculative hype to a more stable and utility-driven ecosystem.

The next few years will be critical in determining whether NFTs remain a niche interest or evolve into a mainstream asset class. One thing is certain: the NFT space is far from dead—it’s simply evolving.

—

Sources