Decoding the Future: Tokenized Real Estate, AI, and Blockchain

The Dawn of a New Investment Era

Imagine owning a fraction of a luxury penthouse in Dubai, a vineyard in Bordeaux, or a commercial property in New York—all from the comfort of your home, with just a few clicks. This isn’t science fiction; it’s the reality of tokenized real estate, powered by blockchain and artificial intelligence (AI). These technologies are reshaping property investment, making it more accessible, transparent, and efficient than ever before.

Tokenized Real Estate: Breaking Down Barriers

Traditional real estate investment has long been exclusive, requiring substantial capital, complex legal processes, and patience for liquidity. Tokenization is changing this by converting real estate assets into digital tokens on a blockchain. These tokens represent fractional ownership, allowing investors to buy and sell portions of properties with ease.

Accessibility and Affordability

Tokenization democratizes real estate investment by lowering entry barriers. Instead of needing hundreds of thousands of dollars, investors can purchase a fraction of a property for a much smaller amount. This opens up opportunities for individuals who previously couldn’t afford to invest in high-value properties.

Increased Liquidity

Traditional real estate is notoriously illiquid. Selling a property can take months, even years. Tokenized real estate offers increased liquidity, as tokens can be traded on exchanges, enabling faster transactions. This makes real estate investment more flexible and appealing to a broader audience.

Transparency and Security

Blockchain technology provides a transparent and secure ledger for tracking ownership and transactions. This reduces the risk of fraud and increases trust in the system. Every transaction is recorded immutably, ensuring that ownership is easily verifiable and tamper-proof.

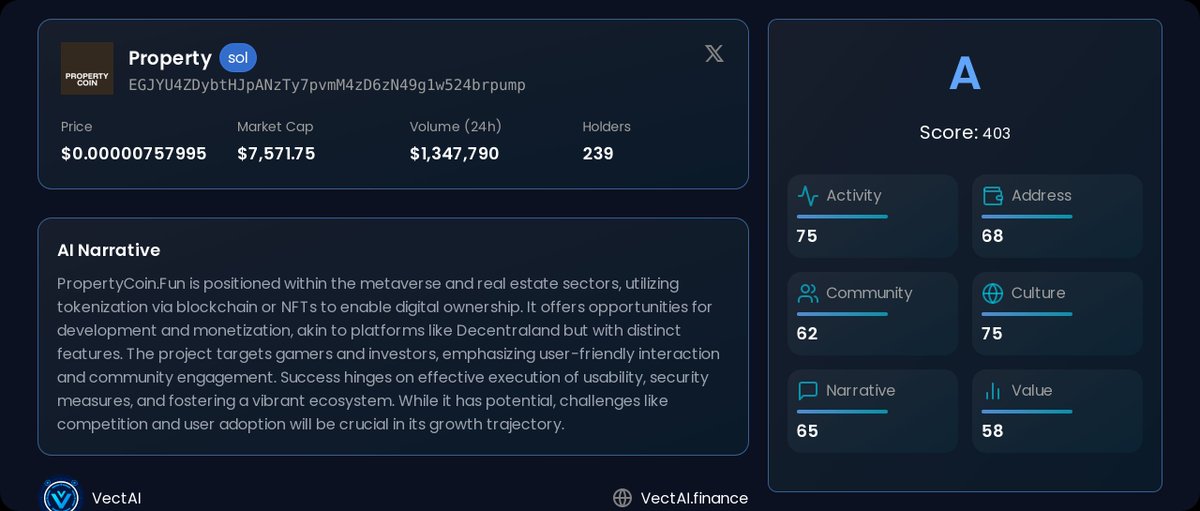

AI: The Intelligent Real Estate Analyst

AI is revolutionizing the real estate industry by providing data-driven insights that help investors make informed decisions. When combined with tokenized real estate, AI can analyze vast amounts of data to predict market trends, automate valuations, and manage risks.

Predictive Analytics

AI algorithms can analyze market trends, economic indicators, and property data to predict future price movements. Platforms like Token Metrics utilize AI to provide crypto trading and research data, which can be adapted to analyze tokenized real estate. This helps investors identify promising opportunities and make strategic decisions.

Automated Valuation

AI can automate property valuation, providing accurate and up-to-date assessments based on various factors. This reduces the need for costly appraisals and streamlines the investment process, making it faster and more efficient.

Risk Management

AI can assess the risk associated with different tokenized real estate investments, helping investors manage their portfolios effectively. By analyzing historical data and market conditions, AI can provide insights into potential risks and opportunities, enabling better decision-making.

Blockchain: The Foundation of Trust and Efficiency

Blockchain technology serves as the backbone for tokenized real estate, providing a secure, transparent, and efficient platform for managing ownership and transactions.

Immutable Record

Blockchain creates an immutable record of all transactions, ensuring that ownership is easily verifiable and cannot be tampered with. This reduces the risk of fraud and disputes, providing a higher level of trust and security.

Smart Contracts

Smart contracts automate many of the processes involved in real estate transactions, such as rent collection, distribution of profits, and transfer of ownership. This streamlines operations and reduces administrative costs, making the investment process more efficient.

Decentralization

Blockchain’s decentralized nature eliminates the need for intermediaries, such as banks and title companies. This reduces transaction costs and increases efficiency, making real estate investment more accessible and affordable.

Challenges and Opportunities

While the convergence of tokenized real estate, AI, and blockchain holds immense promise, several challenges need to be addressed for widespread adoption.

Regulatory Uncertainty

The regulatory landscape for tokenized real estate is still evolving. Clear and consistent regulations are needed to provide legal certainty and protect investors. As governments and regulatory bodies catch up with the technology, the market will become more stable and attractive.

Market Volatility

The value of tokenized real estate can be volatile, influenced by factors such as market sentiment and regulatory changes. Investors need to be aware of these risks and invest accordingly. As the market matures, volatility is expected to decrease, making it a more stable investment option.

Technological Adoption

Widespread adoption of tokenized real estate requires greater awareness and understanding of the underlying technology. Education and outreach are essential to encourage participation. As more people become familiar with the benefits of tokenized real estate, adoption will increase.

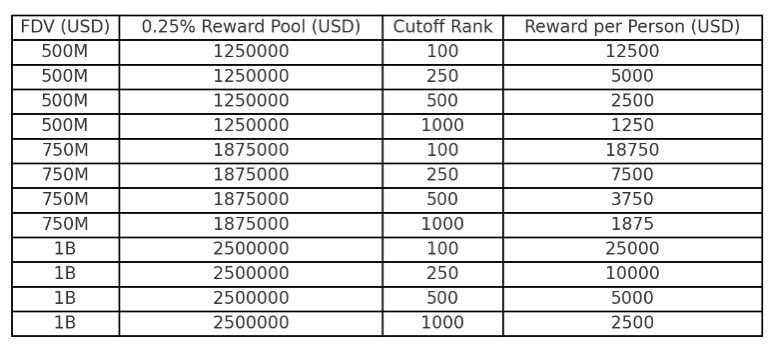

The ROI Calculator: A Glimpse into the Future

Tools like the Tokenized Real Estate ROI Calculator exemplify the practical applications of these technologies. These calculators allow investors to analyze potential returns, rental yields, and overall profitability of blockchain-based real estate investments. By providing data-driven insights, these tools empower individuals to make informed decisions, further democratizing the real estate investment landscape.

A New Era of Property Ownership

The fusion of tokenized real estate, AI, and blockchain is ushering in a new era of property ownership. By lowering barriers to entry, increasing liquidity, and enhancing transparency, these technologies are democratizing real estate investment and empowering individuals to participate in a market that was once reserved for the wealthy elite. As these technologies continue to evolve, we can expect to see even greater innovation and disruption in the real estate industry. The future of property ownership is here, and it’s tokenized, intelligent, and decentralized.

Sources: