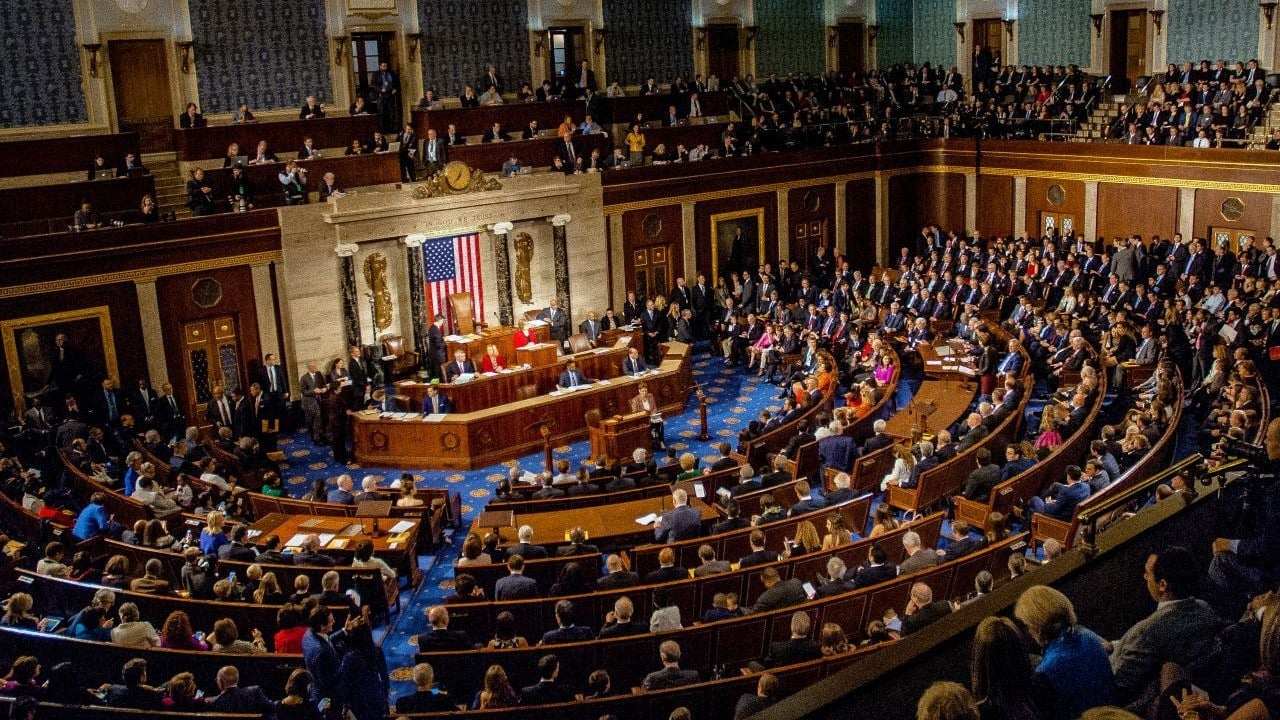

The digital asset landscape in the United States is on the brink of a transformative period. The US House of Representatives has designated the week of July 14th as “Crypto Week,” signaling an unprecedented legislative push to address the regulatory ambiguities surrounding cryptocurrencies and blockchain technologies. This initiative, led by Republican House leaders, aims to establish a clear framework for digital assets, protect against potential government overreach, and foster innovation. However, the journey toward legislative success is fraught with challenges, including partisan divides, jurisdictional conflicts, and technical complexities.

At the core of “Crypto Week” are three pivotal bills, each targeting a distinct yet interconnected aspect of the crypto ecosystem. The CLARITY Act seeks to resolve the long-standing debate over whether digital assets should be classified as securities or commodities. By establishing a clear framework for regulatory treatment, this legislation could alleviate uncertainty for businesses, attract investment, and stimulate innovation. The Anti-CBDC Surveillance State Act, on the other hand, focuses on preventing government overreach through central bank digital currencies (CBDCs). This bill aims to safeguard financial privacy and limit the Federal Reserve’s ability to issue a CBDC without congressional approval. Lastly, the GENIUS Act, though details are scarce, is expected to promote technological innovation by addressing regulatory sandboxes, tax treatment, and blockchain development.

The political landscape surrounding “Crypto Week” is complex and evolving. While House Republicans are driving the legislative effort, some Democrats have expressed concerns about the risks associated with cryptocurrencies, particularly regarding consumer protection and financial stability. These concerns could lead to opposition, especially if Democrats believe the bills do not adequately address these issues. Additionally, former President Trump’s growing interest in crypto adds another layer of complexity. His embrace of digital assets could galvanize support among his followers but may also alienate Democrats wary of aligning with him. Furthermore, allegations of Trump’s financial ties to crypto ventures could raise concerns about potential conflicts of interest, further polarizing the debate.

Another significant challenge lies in the ongoing turf war between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) over regulatory jurisdiction. Both agencies claim authority over different aspects of the crypto market, leading to confusion and uncertainty for businesses. Resolving this jurisdictional ambiguity is crucial for creating a clear and consistent regulatory framework. The outcome of “Crypto Week” will have far-reaching implications for the entire crypto ecosystem. A clear and predictable regulatory framework could unlock significant investment and innovation, encouraging the development of new products and services. Conversely, a failure to provide clarity could stifle innovation and drive businesses to more favorable jurisdictions.

Consumer protection is another key concern for policymakers, particularly in light of recent high-profile collapses of crypto companies. The legislation considered during “Crypto Week” could include provisions aimed at protecting consumers from fraud, scams, and other risks associated with cryptocurrencies. However, striking the right balance between consumer protection and fostering innovation will be a crucial challenge. The Anti-CBDC Surveillance State Act reflects growing concerns about the potential for government overreach through central bank digital currencies. The outcome of this legislation could significantly impact the future of CBDCs in the US, potentially preventing the Federal Reserve from issuing a CBDC without explicit authorization from Congress.

The CLARITY Act’s definitions will also affect Bitcoin and altcoins. More regulatory clarity could encourage innovation within the crypto ecosystem, as developers and entrepreneurs will have a better understanding of the legal landscape. This innovation may lead to the development of new applications and technologies that utilize blockchain and cryptocurrencies, potentially driving further adoption. In conclusion, “Crypto Week” represents a pivotal moment for the US crypto landscape. The legislation under consideration has the potential to reshape the regulatory framework governing digital assets, impacting innovation, investment, and consumer protection. However, the path forward is fraught with challenges, as partisan divides, regulatory complexities, and evolving political dynamics threaten to complicate the process. Whether “Crypto Week” will usher in an era of clarity and growth or further uncertainty remains to be seen, but one thing is certain: the decisions made in the coming weeks will have a lasting impact on the future of crypto in the United States.