The Crypto Landscape in 2025: A Snapshot of Market Dynamics

Introduction

Imagine standing at the edge of a vast, digital frontier. This is the world of cryptocurrency in 2025, a landscape teeming with opportunities, challenges, and rapid changes. As we delve into the current state of the crypto market, we’ll explore the trends, innovations, and regulatory developments shaping this dynamic space.

Market Overview

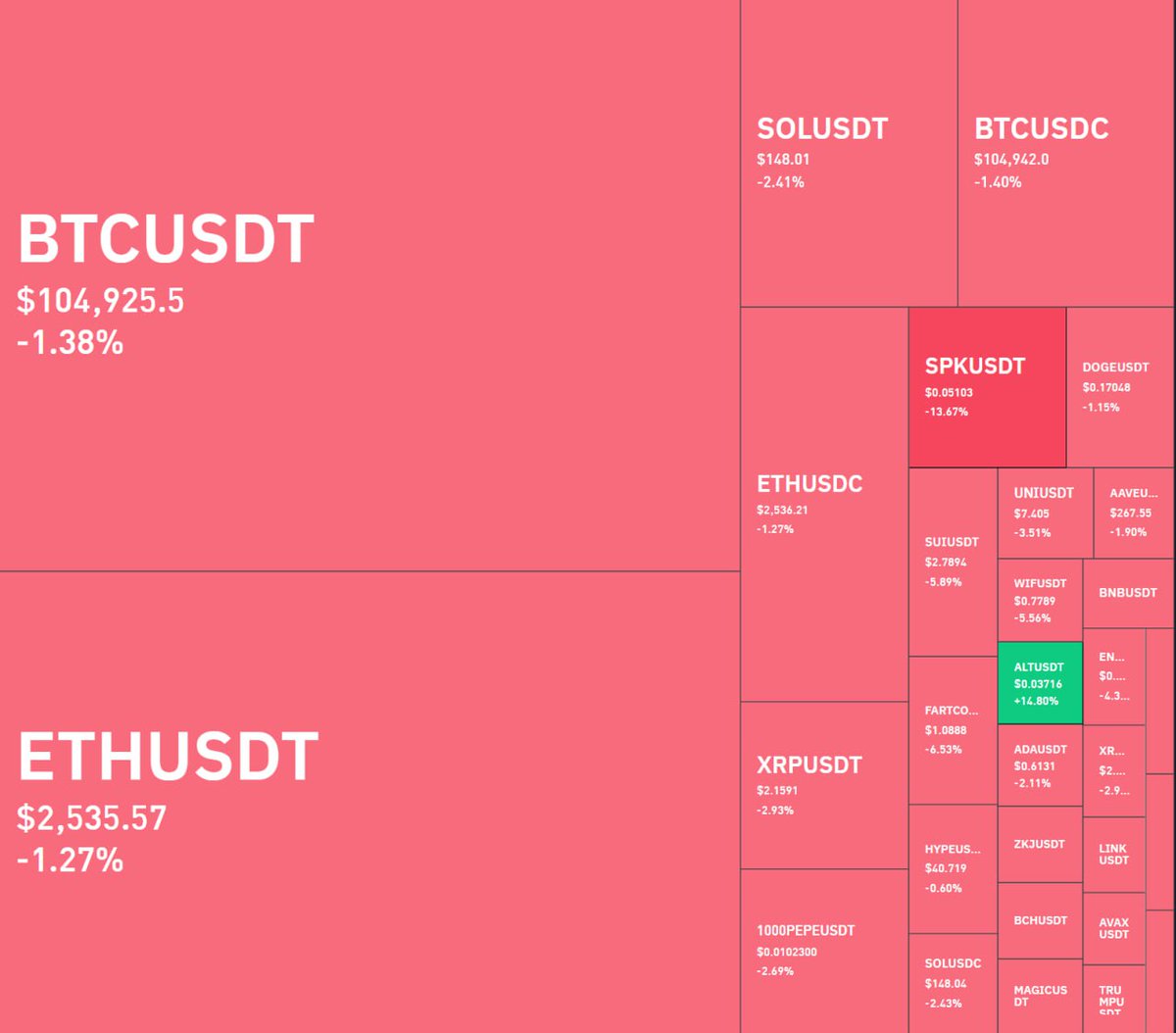

The crypto market is experiencing a mix of bullish and bearish sentiments. Major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) have seen slight dips, with BTC hovering around $104,925 and $106,426 and ETH around $2,535 and $2,569 within the same day, reflecting a volatile yet intriguing market [1][2]. These fluctuations are typical in the crypto world, where prices can swing dramatically based on various factors, including market sentiment, regulatory news, and technological advancements.

Key Cryptocurrencies

##

Bitcoin (BTC)

Bitcoin, the original cryptocurrency, continues to be the gold standard in the digital asset space. Its market dominance and liquidity make it a favorite among institutional and retail investors alike. Despite recent dips, Bitcoin’s long-term outlook remains robust, with significant interest from both traditional financial institutions and crypto-native firms.

##

Ethereum (ETH)

Ethereum, the second-largest cryptocurrency by market capitalization, is more than just a digital currency. It’s a platform for decentralized applications (dApps) and smart contracts, making it a cornerstone of the blockchain ecosystem. Recent data shows substantial inflows into Ethereum, indicating strong institutional interest [8].

##

Solana (SOL)

Solana, known for its high-speed and low-cost transactions, has been gaining traction. The likelihood of a Solana ETF approval by July 31 has increased, which could further boost its market standing [4].

Regulatory and Geopolitical Developments

Regulatory clarity is crucial for the crypto market’s growth. Recent developments include:

Global Regulatory Landscape

##

United States

The US Senate has passed the GENIUS Act, which aims to regulate stablecoins, a significant step towards providing a legal framework for these digital assets [9]. Additionally, the Federal Reserve is expected to leave interest rates unchanged, which could have implications for crypto investments [13].

##

Thailand

Thailand has approved a tax exemption on crypto capital gains until 2029, a move that could attract more investors to the crypto market in the country [5].

##

Ukraine

Ukraine has introduced a bill for a Bitcoin Reserve in Parliament, signaling a growing acceptance of cryptocurrencies in the country [6].

Geopolitical Influences

Geopolitical events, such as pharma tariffs and international trade policies, can indirectly affect the crypto market. For instance, pharma tariffs announced by former US President Donald Trump could impact market sentiment and investor behavior [3].

Institutional and Technological Innovations

Institutional Investments

Institutional interest in crypto continues to grow. Ark Invest, led by Cathie Wood, has been actively managing its crypto holdings, selling nearly $100 million worth of Circle shares in recent days [10]. This activity reflects the ongoing strategic adjustments by major players in the market.

Technological Advancements

Technological innovations are driving the crypto market forward. For example, the listing of Van Eck’s spot Solana ETF on the DTCC platform with the ticker $VSOL is a significant milestone [14]. This move could pave the way for more institutional investments in Solana and other cryptocurrencies.

Emerging Trends

##

Stablecoins

Stablecoins, which are pegged to the value of traditional currencies, are gaining popularity. JPMorgan Bank’s filing of a crypto trademark “JPMD” hints at a potential stablecoin launch, which could further legitimize the use of digital assets in mainstream finance [15].

##

Decentralized Finance (DeFi)

DeFi continues to disrupt traditional financial services by offering decentralized lending, borrowing, and trading platforms. The growth of DeFi is closely tied to the adoption of smart contracts and blockchain technology.

The Future of Crypto

Opportunities and Challenges

The crypto market is rife with opportunities, from investing in emerging cryptocurrencies to participating in the DeFi revolution. However, it also faces challenges, including regulatory uncertainties, market volatility, and technological risks.

Staying Informed

For those looking to stay ahead in the crypto space, staying informed is key. Podcasts and resources that provide expert insights and analysis can be invaluable [16]. Whether you’re a seasoned investor or a curious newcomer, continuous learning is essential in this fast-evolving field.

Conclusion: Embracing the Crypto Revolution

The Path Forward

The crypto landscape in 2025 is a testament to the rapid evolution of digital assets. From regulatory developments to technological innovations, the market is shaping up to be more inclusive and dynamic. As we navigate this digital frontier, it’s crucial to stay informed, adapt to changes, and embrace the opportunities that lie ahead.

The future of crypto is bright, but it’s also complex and ever-changing. By understanding the current market dynamics, regulatory environment, and technological advancements, we can better prepare for the challenges and opportunities that lie ahead. So, whether you’re a seasoned crypto enthusiast or a curious newcomer, there’s never been a more exciting time to be part of the crypto revolution.

References

[1] Crypto Bulletin (2025) [Tweet]. Retrieved from here on June 18, 2025

[2] Crypto Bulletin (2025) [Tweet]. Retrieved from here on June 18, 2025

[3] Crypto Bulletin (2025) [Tweet]. Retrieved from here on June 18, 2025

[4] Crypto Bulletin (2025) [Tweet]. Retrieved from here on June 18, 2025

[5] Crypto Bulletin (2025) [Tweet]. Retrieved from here on June 18, 2025

[6] Crypto Bulletin (2025) [Tweet]. Retrieved from here on June 18, 2025

[8] Crypto Bulletin (2025) [Tweet]. Retrieved from here on June 18, 2025

[9] Crypto Bulletin (2025) [Tweet]. Retrieved from here on June 18, 2025

[10] AstralX (2025) [Tweet]. Retrieved from here on June 18, 2025

[13] Crypto Bulletin (2025) [Tweet]. Retrieved from here on June 18, 2025

[14] Crypto Bulletin (2025) [Tweet]. Retrieved from here on June 18, 2025

[15] Crypto Bulletin (2025) [Tweet]. Retrieved from here on June 18, 2025

[16] Cora Montoya (2025) [Tweet]. Retrieved from here on June 18, 2025