Dollar Rises Before US Inflation Talk

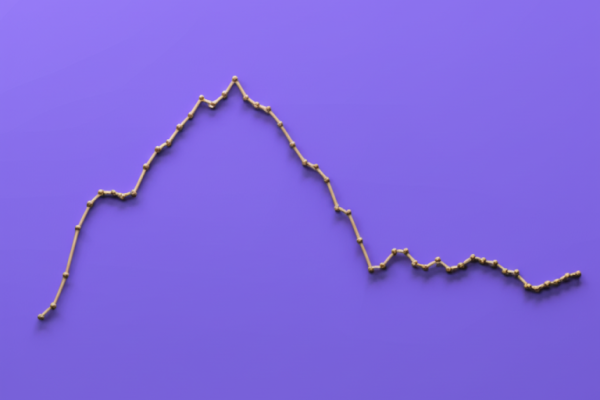

美国美元走强的背后,是一场关于通胀、贸易和政策的复杂棋局。从2025年初开始,美元在市场中的表现变得愈发敏感,特别是在美国即将公布的7月消费者价格指数(CPI)数据和中美贸易关系不断变动的背景下。这一切不仅反映了市场对短期经济数据的关注,更折射出深层次的经济结构变化和未来政策路径的多重不确定性。 通胀的“新常态”:连续攀升的背后 从2025年6月开始,美国的整体通胀率从5月的2.4%升至2.7%,而7月的预期值达到2.8%,这已是连续第三个月的升高。核心CPI(剔除波动较大的食品和能源价格)也在不断攀升,从6月的2.9%跃升至3.0%。这样的数据走势,无一不让市场焦虑:通胀压力似乎变得“粘性”——即使能源价格有所回落,但受关税影响的商品价格不断走高,终端消费者感受到的价格粘性增强。 实际上,2025年的美国通胀从表面上看还是温和的,但其背后隐藏的压力却在逐步累积。尤其是加征关税带来的成本传导效应持续发酵,使得家居用品、娱乐用品、二手车、航空票务等多项商品价格上涨。更令人担忧的是,消除这些压力需要的时间可能比预期更长,物价的“粘性”使得物价调控变得更加复杂。 关税、贸易关系:推动动力还是阻力? 中美贸易关系的剧烈变动,成为推动美国通胀的重要因素之一。当贸易紧张局势升级,关税成为了最直观的“武器”。此次加征的关税,已经开始在家具、休闲用品乃至某些日常用品上显现作用。企业为了应对成本上涨,不得不提高售价,形成传导链条。 高盛、摩根大通等金融机构的分析指出,企业为了应对持续的关税压力,逐步调整定价策略,未来物价水平的升高可能还会持续一段时间。尽管服务行业(如餐饮、住宿)目前受到的影响还较有限,但随着时间推移,成本传导会逐步扩散到更广泛的服务领域。 从长远来看,这种贸易摩擦和关税压力形成的输入性通货膨胀,将给美国经济带来两种潜在风险。一是通胀持续高企,二是经济增长受到抑制。不少分析师提出,短期内贸促品价格上涨难以逆转,中期可能出现“滞涨”——即经济增长放缓,物价仍旧坚挺。 消费者行为的变化:应对“新常态” 面对持续上扬的生活成本,美国消费者的反应表现出两极分化。一方面,部分家庭因物价上涨不得不减少支出,从日用品到娱乐领域都在精打细算。另一方面,促销、优惠活动带来的购买热潮依然存在,尤其是在汽车和电子产品等大宗商品市场。 这种双重态势令宏观经济政策制定者陷入两难:一方面,要防止通胀失控,可能不得不收紧货币政策;另一方面,又需要避免过度紧缩导致经济陷入疲软甚至衰退。联邦储备在调整利率和未来货币政策节奏时,不得不兼顾抑制通胀和呵护经济增长双重目标。 此外,企业也在权衡成本传导策略。一些企业选择暂时控制价格上涨,以维护市场份额,但这难以从根本上减缓输入性通胀的压力。一旦货币政策收紧,市场信心或许会受到影响,但不断累积的成本压力可能让通胀“难以抑制”。 食品价格压力:生活的“刚性需求” 食品是家庭支出中不可或缺的部分,其价格变动直接打击居民的购买力。根据农业部数据,2025年整体食品价格预计年涨幅在2.9%左右,其中家庭自制食品涨幅约为2.2%,而外出就餐价格涨幅甚至达到4%。这意味着,尽管能源价格的波动能影响短期内的整体CPI,但食品的持续上涨已成为“刚性”压力。 如果这个趋势持续,普通家庭日常生活成本将进一步上升,尤其是在低收入和中等收入家庭中,负担加重的压力尤为明显。虽然未来一、两年的增速可能有一定调整,但总体趋势仍指向高位运行。 宏观环境:供应链、政策和未来偏向 全球供应链的调整与中美贸易紧张局势叠加,使得美国当前的输入型通胀具有高度的结构性。供应链的断裂、逆全球化趋势和贸易保护主义都在加剧商品短缺和成本上升。美联储,到2025年,面对这种局面,将不得不权衡货币政策的力度。 若持续加息,可能会短期抑制需求,但也会给经济带来压力,甚至引发资产价格波动。另一方面,政府的贸易政策和谈判进展,将在很大程度上决定未来几季度的物价走势。不管是继续推行关税,还是逐步降低,都会对通胀和供应链稳定产生深远影响。 结语:走在变革的十字路口 美元的走强,既反映市场对未来经济走向的担忧,也折射出政策调控的复杂性。这场关于通胀、贸易和宏观调控的博弈,还在继续。而随着数字的变化,潜藏的结构性风险逐渐展露,挑战与机遇交织。 要应对未来的不确定性,需要不仅借助数据,更要结合市场情绪、政策信号以及全球环境的动态。只有在不断的调整和反应中,才能找到那条通向稳定与增长的平衡之路。在这个复杂局面中,保持敏锐的洞察力和灵活的策略,才是最明智的选择。 資料來源: [1] tradingeconomics.com [2] www.foxbusiness.com [3] www.morningstar.com [4] fortune.com [5] www.ers.usda.gov Powered By YOHO AI