Crypto Faces ETF Outflows Under Macro Stress

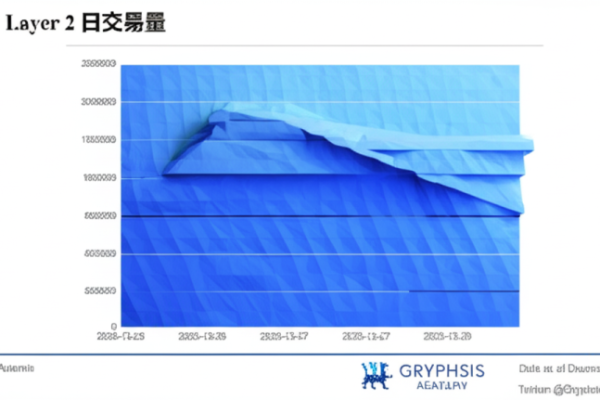

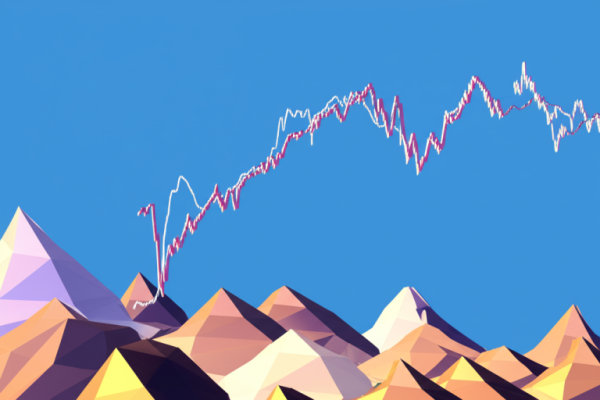

在当今复杂多变的经济环境中,ETF资金流动与加密资产表现成为了市场关注的焦点。宏观经济压力、政策变化以及投资者情绪的波动,深刻影响着各种资产类别的表现。深入分析这些因素背后的逻辑,有助于理解当前市场的动态,以及未来可能的发展趋势。 ETF资金流动:镜中市况的折射 股票ETF的运作轨迹 股票ETF作为资本市场的风向标之一,其资金流动不仅反映投资者的风险偏好,也折射出市场整体的信心程度。最新数据显示,截至2025年8月14日,市场上有1173只股票ETF,总规模逼近3.87万亿元。然而,单日出现146亿元的净流出,尤其是在科创板、创业板和上证50等主要指数ETF的资金撤出,说明投资者在面对短期宏观压力时,偏向了观望甚至减少持仓。 值得注意的是,芯片、半导体等行业ETF依旧承受压力,这反映了投资者对科技行业未来增长前景的谨慎。尽管如此,博时基金的观点强调,国内政策持续发力,资金宽松,经济基本面逐步企稳,为市场提供了底层支撑。这显示出股市的韧性和潜在的复苏动力。 然而,并非所有ETF都出现资金流出。8月19日,部分宽基ETF如中证500和沪深300依然经历资金净流出,但这或多或少是市场调整的正常反应。整体而言,股票ETF的资金流动仍在提示市场处于一种“试探性”状态:投资者在谨慎中观察,等待下一波行情的明确信号。 加密资产ETF的资金动态 加密资产基金的资金流向提供了另类的市场信号。8月4日,以太坊ETF单日流出4.65亿美元,创历史记录。这显示出在市场波动剧烈和监管环境收紧的背景下,投资者对加密资产的态度变得更加谨慎。此前的八个交易日,资金曾大幅流入37亿美元,表现出部分投资者仍然对加密资产抱有期待。 然而,8月21日以太坊现货ETF出现2.88亿美元的净流入,显示出对加密资产的兴趣仍未完全消失。这种“快进快出”的模式,反映市场的高波动性和不确定性,投资者的情绪极易受到价格变动和监管消息的影响。加密资产的投资价值依旧吸引一部分寻求高收益的资本,但风险控制显得尤为关键。 宏观压力的压力锅:风险偏好的转变 全球经济的多重考验 当前全球经济环境充满不确定性。通胀持续高企,利率上升的压力逼得央行频繁调整货币政策,而地缘政治风险又不断升温。这一系列因素共同作用下,市场的风险偏好明显下降。投资者由偏向成长型的资产转向避险品,债券和黄金成为首选。 反观中国市场,政策的持续发力与资金宽松环境,暂时为本地资本市场提供了稳固的底盘。政府调控措施和基础设施投资的推进,为市场提供了必要的支撑。然而,全球不确定因素的存在,使得市场的短期波动依旧难以避免。 投资者行为的心理变化 宏观压力下的投资者,变得更加理性甚至偏向保守。他们在做出投资决策时,更加重视资产的安全性和流动性。ETF作为相对灵活的投资工具,成为资金布局的首要选择。不同行业、不同主题的ETF资金流向,反映出投资者在动荡中追寻相对稳定的增长点。 宽基ETF和行业主题ETF表现出的资金流动,凸显出风险管理与资产配置的策略调整。部分资金由激进投机转向稳健增值,市场氛围趋于理性,但也埋藏着未来潜在的机会。 加密资产的双刃剑:波动中的坚韧 高波动性——市场的“正常现象” 加密资产因其天生的高波动性,而被喻为“市场的盲雷”。宏观经济环境的变化,比如利率上升、政策收紧,直接影响加密市场的价格表现。价格的剧烈波动不仅影响投资者的心理,还加大了投资风险。 房地产和科技行业在传统金融体系中的地位逐步巩固,但加密资产的价值体现更偏向于其创新性。以太坊作为智能合约和去中心化应用的基础,其潜在革命性价值依然吸引着长线投资者。然而,市场波动提醒人们,盈利的同时也要承担相应风险。 持续的价值探索 尽管市场充满波动,投资者对加密资产的热情未减。资金的流入流出,反映出一种“试探性”投资心态:部分人希望抓住转瞬即逝的机会,另一些则警惕突然的挫折。加密资产的潜在价值在于其技术创新和未来应用前景,但也离不开监管环境改善和市场成熟的渐进过程。 未来展望:在动荡中寻觅机遇 市场的演变趋势 尽管近期市场出现较大波动,但中长期来看,估值的基础没有根本性改变。全球宏观经济的调整、政策的持续优化,以及科技创新的步伐,仍为市场提供正向驱动力。股票ETF在政策支持和经济复苏的助推下,仍有成长空间;加密资产将在监管逐步明确的情况下,逐步实现价值的合理体现。 短期市场的波动,也提醒投资者要具备韧性和策略应变能力。保持审慎、理性、分散投资,将是未来市场中的制胜法宝。 投资策略:稳中求进 在不断变化的市场中,寻找平衡点尤为重要。建议投资者采取以下措施: – 组合多元:结合股票、债券、商品及加密资产,打造风险分散的投资组合。 – 关注行业主题:科技、医疗、绿色能源等行业主题ETF,可能带来较好成长性。 – 动态调整:密切关注宏观经济、政策信号,灵活调整投资策略。 未来属于那些善于调整、勇于探索的人。深谙市场节奏,才能在风云变幻中捕捉到持久的价值。 — 结语:穿越风暴,迎接曙光 市场的每一次起伏,都是通向成熟的洗礼。ETF的资金流动和加密资产的波动,或许是短期的风暴,但长远来看,投资的核心逻辑依然坚固。敢于在动荡中寻找机遇,善用理性分析与前瞻视野,终究会在市场的波澜中迎来属于自己的曙光。 資料來源: [1] www.stcn.com [2] www.stcn.com [3] www.cls.cn [4] www.chnfund.com [5] finance.sina.com.cn Powered By YOHO AI