Navigating the Cryptocurrency Market: A Deep Dive into Recent Trends and Insights

Introduction: The Ever-Changing Crypto Landscape

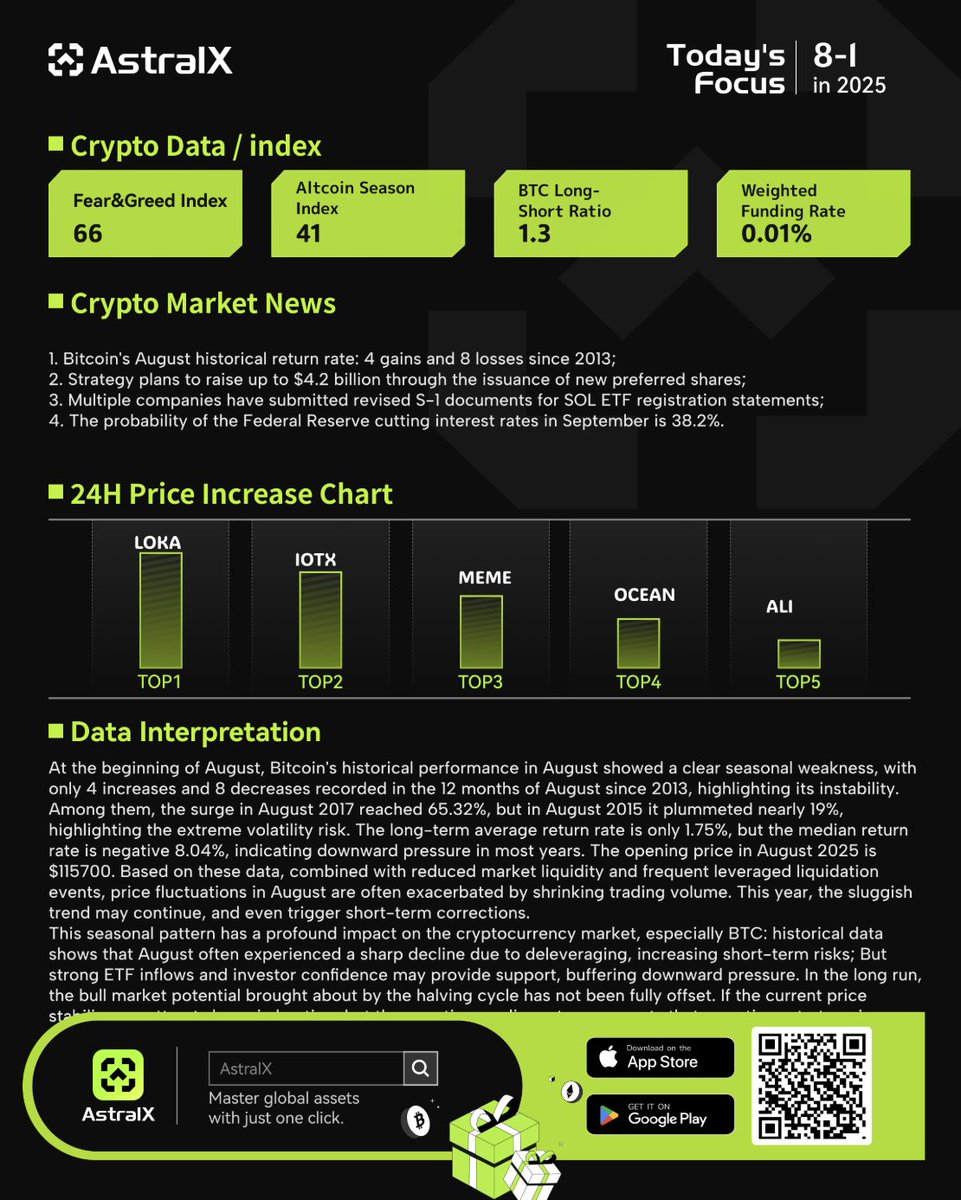

The cryptocurrency market is renowned for its volatility, where fortunes can shift in an instant. Recent events have highlighted this unpredictability, with Bitcoin (BTC) experiencing significant fluctuations, meme coins gaining traction, and altcoins showing mixed performance. This report explores the latest trends, technical analyses, and market dynamics shaping the crypto space in early August 2025.

—

Bitcoin’s Rollercoaster: A Closer Look at Recent Movements

The $114,000 Drop and Its Implications

Bitcoin, the flagship cryptocurrency, recently dipped below the $114,000 mark, sparking concerns among investors. This decline followed a period of bullish momentum, where BTC had surged past $116,000, only to face a correction. Market analysts attribute this volatility to several factors, including macroeconomic conditions, institutional selling pressure, and on-chain data suggesting potential downward trends [1, 2].

Historical Performance and Future Outlook

Historical data reveals that Bitcoin’s August performance has been mixed, with more losses than gains since 2013. However, the market remains optimistic about long-term growth, especially with Bitcoin’s halving event approaching, which historically precedes bullish cycles [3].

—

Meme Coins and Altcoins: The Rise of Speculative Assets

Janicetoken: A Meme Coin with Uncertain Potential

Janicetoken, a meme coin operating on the Solana blockchain, has garnered attention due to its speculative nature. While meme coins often lack intrinsic utility, they thrive on community hype and social media trends. Analysts warn investors to approach such assets with caution, as their value is highly volatile and driven by market sentiment rather than fundamentals [4].

Pepe Coin ($PEPE): The Meme That Keeps Growing

Pepe Coin, inspired by the infamous “Pepe the Frog” meme, has become a notable player in the meme coin space. Unlike utility-focused tokens, PEPE relies purely on community-driven momentum. Despite its lack of real-world applications, it has seen significant price surges, demonstrating the power of internet culture in shaping crypto markets [5].

Moonriver (MOVR) and Lista DAO (LISTA): Altcoins in Focus

Moonriver (MOVR), an Ethereum-compatible blockchain on Polkadot, has faced a challenging year with a 54.75% year-to-date loss. However, some analysts believe it could recover if broader market conditions improve [6].

Lista DAO (LISTA), on the other hand, has shown impressive gains, with a 62.63% increase over 90 days. This uptrend suggests growing interest in decentralized autonomous organizations (DAOs) and community-driven projects [7].

—

Market Dynamics: Whales, Dollars, and On-Chain Data

Whale Activity and Institutional Influence

Recent on-chain data indicates that large holders (whales) are increasing their selling pressure on Bitcoin and Ethereum. This movement often precedes market corrections, as institutional players adjust their portfolios in response to economic signals [8].

The Strong Dollar Effect

A stronger U.S. dollar has historically weighed on cryptocurrency prices, as investors seek safer assets during economic uncertainty. The Federal Reserve’s recent interest rate decisions have further influenced market sentiment, contributing to the recent downturn [9].

—

Strategies for Navigating the Crypto Market

Technical Analysis: Key Levels and Patterns

Traders are advised to monitor critical support and resistance levels, as these often dictate short-term price movements. For Bitcoin, the $114,000 mark is now a key psychological level, with further declines potentially leading to a deeper correction [10].

Smart Money Signals and Market Sentiment

Smart money, or institutional investors, often provides early signals of market shifts. Recent buying activity in niche tokens like $PENGU on the BNB Chain suggests that some traders are positioning for potential gains in undervalued assets [11].

The Telegram Gift Index: A Unique Market Indicator

Unlike traditional trading metrics, the Telegram Gift Index tracks transactions from key marketplaces, offering insights into retail investor behavior. This unconventional indicator has shown promise in predicting short-term trends [12].

—

Conclusion: Staying Informed in a Volatile Market

The cryptocurrency market remains a high-risk, high-reward environment where rapid shifts can redefine trends overnight. While Bitcoin’s recent dip has raised concerns, historical patterns suggest potential recovery. Meanwhile, meme coins and altcoins continue to captivate investors with their speculative appeal.

For traders and investors, staying informed through technical analysis, on-chain data, and market sentiment is crucial. Whether you’re a long-term HODLer or a short-term trader, understanding these dynamics will help navigate the ever-evolving crypto landscape.

—

Sources