Navigating the Cryptocurrency Market: A Deep Dive into Recent Trends and Insights

Introduction: The Volatile Nature of Cryptocurrency

The cryptocurrency market is renowned for its rapid price fluctuations, making it both an exciting and challenging space for investors. Recent data from Sentora, a leading DeFi analytics platform, suggests that Bitcoin (BTC) may be heading for a price correction. This analysis explores the factors driving these movements, the potential implications, and whether investors should consider buying or waiting.

Understanding the Recent Bitcoin Price Drop

Why Is Crypto Dropping Today?

Several factors contribute to the recent downturn in cryptocurrency prices:

Correction or Start of a Downtrend?

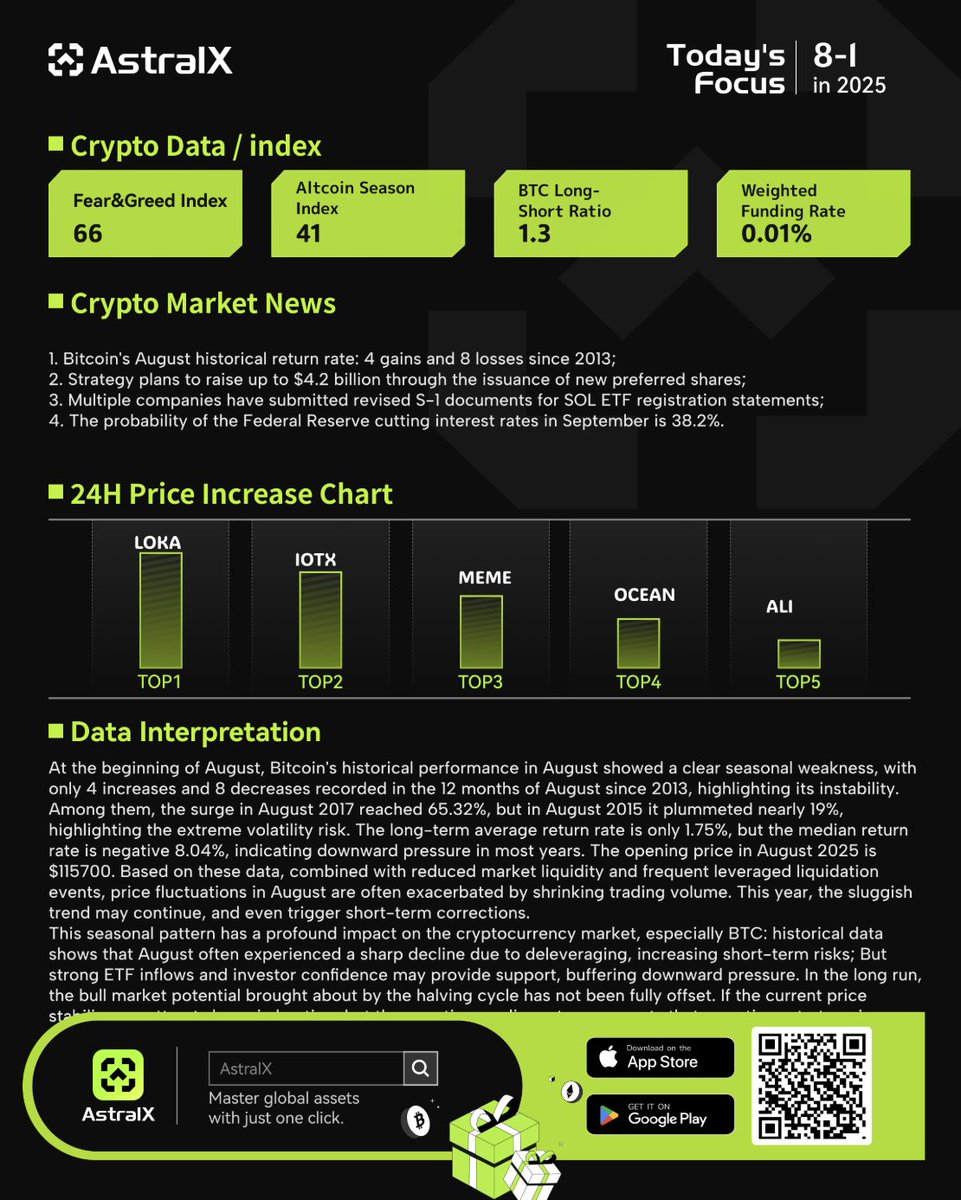

The question on every investor’s mind is whether this dip is a temporary correction or the beginning of a prolonged downtrend. Historical data shows that Bitcoin has experienced more losses than gains in August since 2013, with a 4:8 win-loss ratio. However, past performance does not guarantee future results, and external factors such as regulatory developments and institutional adoption could alter this trend.

Key Trader Signals and Market Sentiment

Technical Indicators and Trading Strategies

– Lista DAO (LISTA): Despite a strong 60-day and 90-day uptrend, LISTA has seen volatility, with price changes of +41.05% and +62.63%, respectively. Traders should monitor resistance levels to gauge future movements.

– Bitcoin’s Historical Performance: Bitcoin’s August performance has been mixed, with more losses than gains. However, strategic investors may see this as a buying opportunity before a potential rebound.

Should You Buy Now or Wait?

The decision to buy or hold depends on individual risk tolerance and investment strategy:

– Buy the Dip: Some traders believe that corrections present buying opportunities, especially if fundamental factors remain strong.

– Wait for Confirmation: Others prefer waiting for clearer market signals, such as a reversal in on-chain metrics or a shift in macroeconomic conditions.

Beyond Bitcoin: Other Cryptocurrencies in Focus

Pepe Coin ($PEPE) Analysis

Pepe Coin, a meme-inspired cryptocurrency, has gained popularity due to its community-driven nature. Unlike utility-focused tokens, PEPE thrives on hype and speculative trading. While it lacks intrinsic value, its strong social media presence and meme culture make it a unique player in the market.

Virtuals Protocol (VIRTUALS Coin) and AI Integration

Virtuals Protocol is an emerging cryptocurrency that combines artificial intelligence (AI) with Metaverse technologies. Its innovative approach positions it as a potential disruptor in the blockchain space, though its long-term success will depend on adoption and technological advancements.

Conclusion: Navigating the Cryptocurrency Landscape

The cryptocurrency market remains highly dynamic, influenced by technical, fundamental, and macroeconomic factors. While Bitcoin’s recent dip has raised concerns, it also presents opportunities for strategic investors. Whether you choose to buy the dip or wait for clearer signals, staying informed and adaptable is key to navigating this volatile yet rewarding market.

Final Thoughts

As the crypto space continues to evolve, investors must balance risk and opportunity. By leveraging data-driven insights, monitoring market trends, and staying updated on regulatory developments, traders can make more informed decisions in this ever-changing landscape.

—

Sources: