Cryptocurrency Market Dynamics: A Comprehensive Analysis

Introduction: The Ever-Evolving Crypto Landscape

The cryptocurrency market is a realm of constant flux, where digital assets oscillate between bullish surges and bearish downturns. Recent movements have sparked a wave of analysis and speculation, with Bitcoin’s price dipping below the $115,000 mark and Ethereum (ETH) making a notable rebound. This report delves into the latest trends, strategic maneuvers, and technical analyses shaping the crypto sphere.

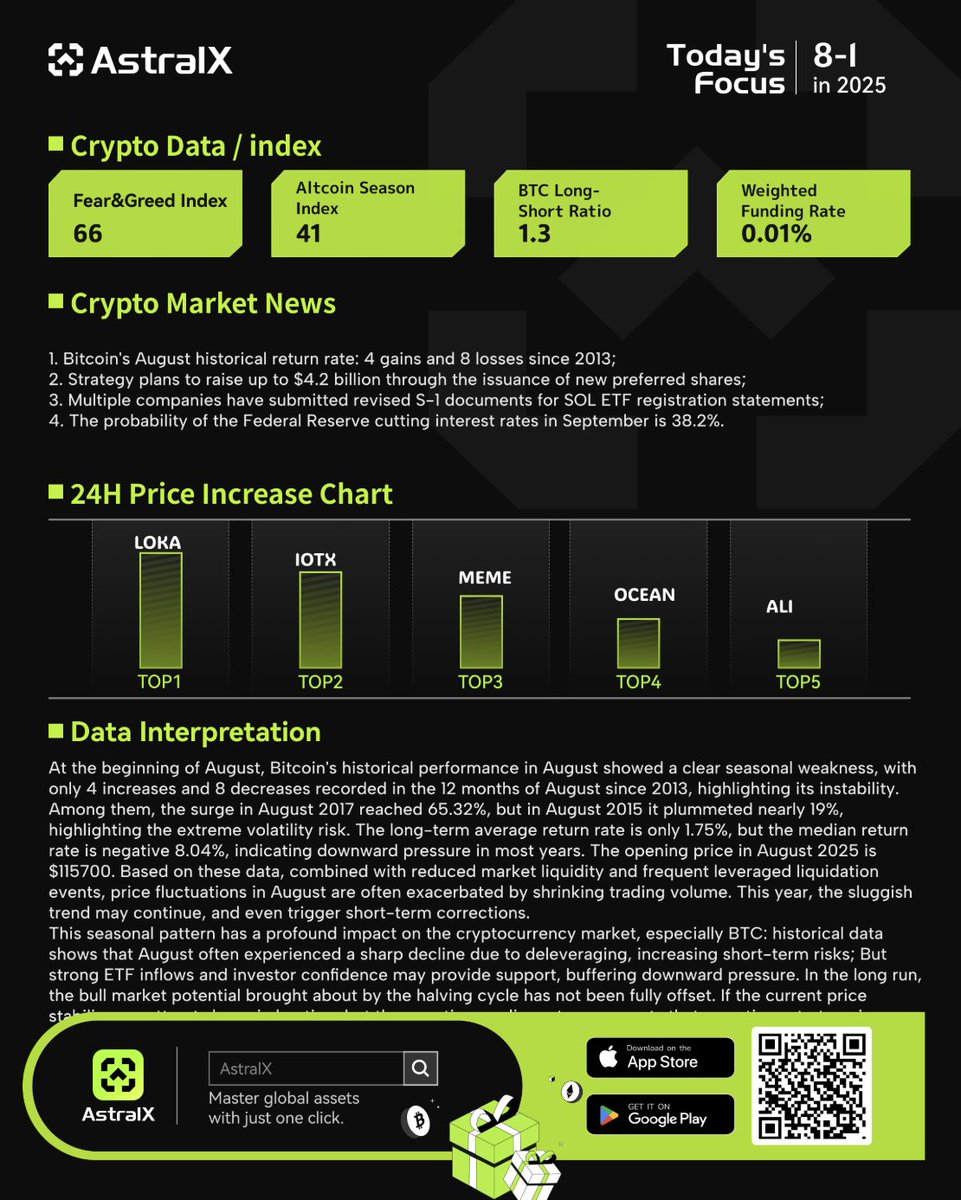

Bitcoin’s Historical Performance: A Mixed Bag

Bitcoin’s performance in August has historically been a rollercoaster. Since 2013, August has seen Bitcoin experience four gains and eight losses. This mixed performance underscores the volatility inherent in the cryptocurrency market. Despite this, Bitcoin remains a cornerstone of the digital asset ecosystem, with its price movements often setting the tone for the broader market.

Strategic Moves: Raising Capital and Expanding Horizons

In a significant development, a major player in the crypto space has announced plans to raise up to $4.2 billion through the issuance of new preferred shares. This strategic move highlights the growing maturity of the cryptocurrency market, where large-scale fundraising is becoming increasingly common. Such initiatives not only inject liquidity into the market but also signal confidence in the long-term viability of digital assets.

Technical Analysis: Spotlight on Lista DAO and Polymesh

Lista DAO (LISTA)

Lista DAO (LISTA) has been on an impressive uptrend, with price changes of +41.05% over the past 60 days and +62.63% over the past 90 days. Currently trading at approximately $0.2757, Lista DAO’s performance is a testament to the potential of decentralized autonomous organizations (DAOs) in the crypto space.

Polymesh (POLYX)

Polymesh (POLYX), on the other hand, has experienced significant volatility, with a year-to-date (YTD) price change of -47.02%. However, over the past 60 days, it has shown a positive trend, indicating a potential rebound. Currently trading at approximately $0.1464, Polymesh’s performance highlights the importance of long-term perspective in cryptocurrency investment.

Ethereum’s Resurgence: A Bullish Turn

Ethereum (ETH) has once again taken center stage, with a notable rebound that has brought it back to levels near its March 2024 high of $3,980. This resurgence is a positive sign for the broader altcoin market, as Ethereum’s performance often influences the trajectory of other digital assets.

The Federal Reserve’s Impact: Stability Amidst Volatility

The Federal Reserve’s decision to maintain interest rates for the fifth consecutive time has provided a sense of stability amidst the market’s volatility. This stability is crucial for cryptocurrency markets, which are highly sensitive to macroeconomic factors. The unchanged interest rates have likely contributed to the increased trading activity in Ethereum and altcoins.

Virtuals Protocol: Integrating AI with the Metaverse

Virtuals Protocol, or VIRTUALS Coin, has garnered attention for its innovative approach to integrating artificial intelligence (AI) with Metaverse technologies. This fusion of cutting-edge technologies underscores the potential of cryptocurrencies to drive innovation across various sectors.

Trading Tools and Resources: Empowering Investors

The cryptocurrency market is replete with tools and resources designed to empower investors. From podcasts offering in-depth analysis to trading tools that streamline analysis and automate trades, these resources are invaluable for navigating the complex world of digital assets. Notable mentions include #CoinDesk, #ThePompPodcast, and #Unchained, which provide expert insights and analysis on the latest trends.

Conclusion: Navigating the Crypto Landscape

The cryptocurrency market is a dynamic and ever-evolving landscape, where strategic maneuvers, technical analyses, and macroeconomic factors all play crucial roles. As Bitcoin and Ethereum continue to set the pace, investors must remain vigilant and informed, leveraging the wealth of resources available to navigate this exciting but volatile terrain.