Bolivia & El Salvador Forge Crypto Framework

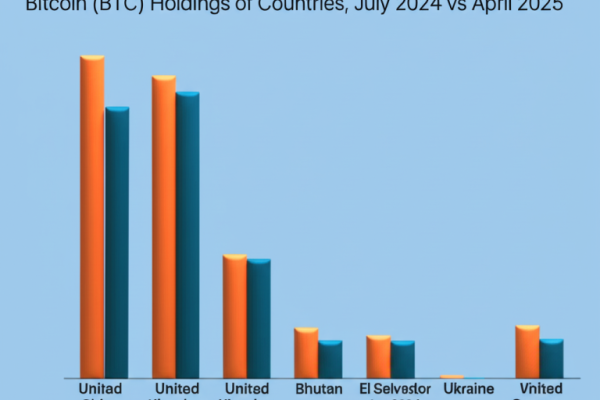

Bolivia and El Salvador: A Crypto-Fueled Alliance Shaping Latin America’s Financial Future A Paradigm Shift in Economic Strategy Latin America is witnessing a transformative shift in economic strategy, with Bolivia and El Salvador at the forefront of a crypto-driven financial revolution. Bolivia, once a staunch opponent of cryptocurrencies, has dramatically reversed its stance, partnering with…