The Rise of Auradine and Its Impact on MARA’s Bitcoin Mining Strategy in 2025

A Strategic Pivot: MARA’s Embrace of Auradine

In the rapidly evolving landscape of Bitcoin mining, adaptability and strategic foresight are paramount. The first half of 2025 marked a significant turning point for MARA, as the company made a bold move by investing heavily in Auradine, a Silicon Valley-based chip startup. This strategic pivot is not merely a vendor diversification but a calculated effort to navigate geopolitical tensions, secure cutting-edge mining technology, and gain a competitive edge in the Bitcoin mining industry. The $73.3 million worth of Teraflux Bitcoin miners shipped by Auradine to MARA in H1 2025 underscores the magnitude of this partnership and its potential impact on MARA’s operations and the broader industry.

Unpacking the $73.3 Million Deal

The $73.3 million investment is more than just a financial transaction; it is a testament to MARA’s confidence in Auradine’s technology and its commitment to bolstering its mining infrastructure. This investment, paid in advance with $22.3 million in Q1 and $51 million in Q2, constituted a substantial portion of MARA’s $108 million cash outflows for vendor advances during the first half of the year. This financial commitment highlights the strategic importance MARA places on this partnership and the expectation of a significant return on investment. Further cementing this relationship, MARA holds $51.4 million in outstanding purchase commitments with Auradine, scheduled for delivery in periodic installments through the remainder of 2025. These commitments show an ongoing and deepening financial tie between both entities.

Trade Tariffs and the Shift to Domestic Suppliers

A key driver behind MARA’s increased reliance on Auradine appears to be the looming threat of trade tariffs. In an increasingly protectionist global environment, sourcing mining hardware from U.S.-based manufacturers like Auradine offers a hedge against potential disruptions to the supply chain and increased costs associated with importing equipment from overseas. This strategic shift allows MARA to mitigate risks associated with international trade policies and ensures a more stable and predictable supply of mining rigs. CEO Fred Thiel’s comments about sourcing around half of MARA’s miner orders this year from Auradine further emphasize this strategic response to geopolitical uncertainties.

Beyond Hardware: Equity Stakes and Board Seats

MARA’s investment in Auradine extends beyond mere procurement. A deeper dive reveals an $85.4 million investment that includes equity stakes and a board seat. This strategic move signals a long-term partnership with shared interests and a vested stake in Auradine’s success. By taking an equity position, MARA gains potential financial upside from Auradine’s growth and innovation. Furthermore, the board seat provides MARA with influence over Auradine’s strategic direction, ensuring alignment with its own mining objectives. This level of integration fosters a collaborative environment and facilitates the exchange of knowledge and expertise between the two companies.

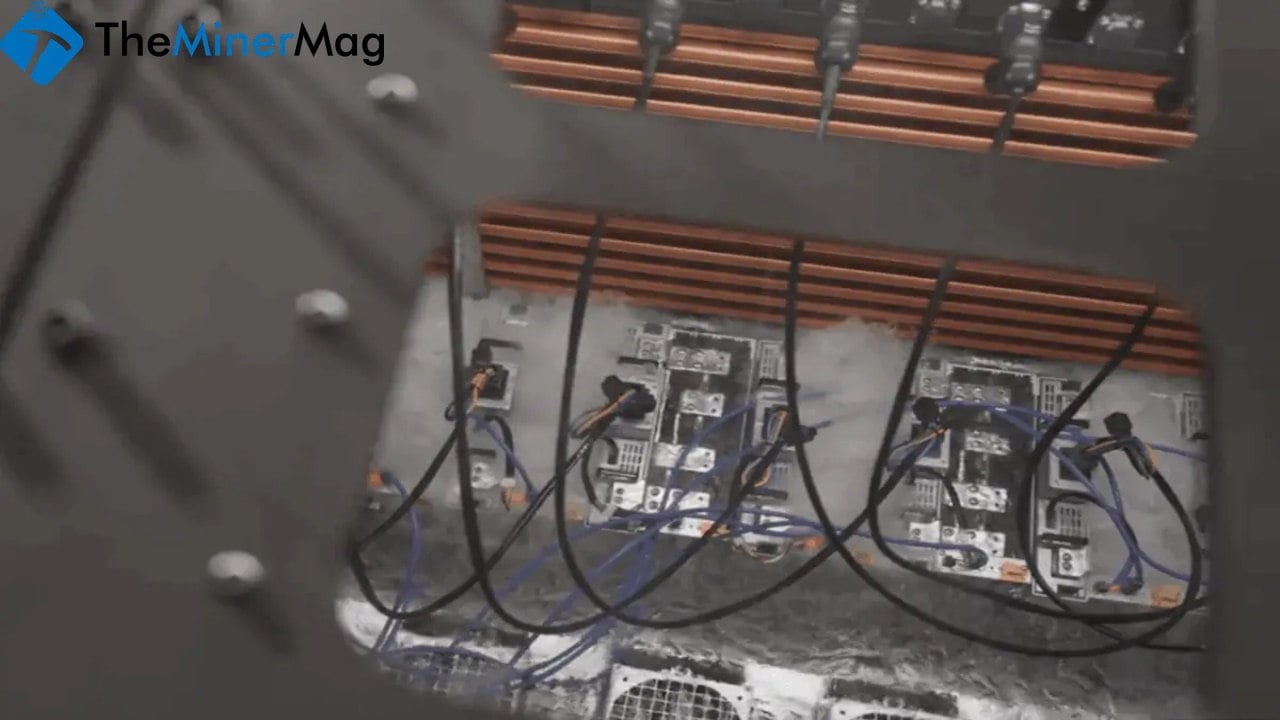

Teraflux Miners: A Technological Advantage?

While the specific technical specifications of Auradine’s Teraflux miners remain somewhat opaque in the available information, the sheer scale of MARA’s investment suggests that these rigs offer a competitive advantage. The mining industry is fiercely competitive, with efficiency and hash rate being critical determinants of profitability. MARA’s willingness to commit significant capital to Auradine implies that the Teraflux miners boast superior performance characteristics compared to other available options, potentially leading to increased bitcoin production and lower operating costs.

MARA’s Record-Breaking May and Expanding Bitcoin Holdings

The timing of MARA’s investment in Auradine coincides with a period of significant growth and operational success. May 2025 marked a record-breaking month for MARA, with 282 blocks won, a 38% increase over April, and a new monthly high. The company’s total bitcoin holdings surpassed 49,000 BTC during May, with 950 bitcoin produced – the most since the halving event in April 2024. This strong performance provides MARA with a solid financial foundation to support its strategic investments in Auradine and other growth initiatives. The influx of new miners from Auradine will further augment MARA’s mining power, increasing its chances of winning blocks and boosting bitcoin production, especially during periods where other mining operations might be facing issues due to less efficient equipment or market fluctuations.

Navigating Post-Halving Dynamics

The bitcoin halving events, which reduce the block reward for miners, have a profound impact on the industry. Miners must adapt to maintain profitability in the face of reduced revenue. MARA’s strategic investment in Auradine appears to be a proactive response to these post-halving dynamics. By deploying more efficient mining hardware, MARA aims to offset the reduction in block rewards and maintain its competitive position. This forward-thinking approach demonstrates MARA’s understanding of the cyclical nature of the Bitcoin market and its commitment to long-term sustainability. The efficiency of the Teraflux miners, if substantially better than older models, can make a considerable difference in profitability during these post-halving periods.

The Broader Implications for the Bitcoin Mining Industry

MARA’s embrace of Auradine has broader implications for the Bitcoin mining industry. It highlights the growing importance of domestic manufacturing and supply chain resilience in an era of geopolitical uncertainty. It also underscores the potential for innovation and competition within the mining hardware sector. Auradine’s emergence as a significant player challenges the dominance of established manufacturers and fosters a more diverse and competitive market. This increased competition can lead to further innovation and efficiency gains, ultimately benefiting the entire Bitcoin ecosystem.

A Glimpse into the Future

The strategic partnership between MARA and Auradine offers a glimpse into the future of Bitcoin mining. It suggests a move towards greater localization, technological innovation, and strategic alliances. As the industry continues to evolve, companies that can adapt to changing market conditions, secure access to cutting-edge technology, and forge strong partnerships will be best positioned to thrive. MARA’s bet on Auradine is a bold move that could potentially reshape its competitive landscape and pave the way for future success.

Mining the Future: A Symbiotic Relationship

The story of MARA and Auradine in the first half of 2025 is more than just a financial transaction; it’s a narrative of strategic foresight, technological innovation, and evolving industry dynamics. The $73.3 million investment marks a pivotal moment, signaling a deliberate shift towards domestic suppliers, advanced mining technology, and a deeper, more integrated partnership. As MARA continues to deploy Auradine’s Teraflux miners and leverage its equity stake in the company, the partnership promises to not only enhance MARA’s mining operations but also contribute to the broader evolution of the Bitcoin mining landscape. This is a perfect example of a company securing its future in a volatile market by investing in strategic partnerships.