A Legislative Turning Point and Its Implications

The Dawn of Regulatory Clarity?

The cryptocurrency landscape has long been characterized by uncertainty and ambiguity, with regulators struggling to keep pace with the rapid evolution of digital assets. However, recent developments in the United States have sparked a sense of optimism among industry participants. The term “Crypto Week” has emerged as a significant marker in the timeline of digital assets, representing a concentrated period of legislative activity aimed at providing a clearer framework for the cryptocurrency industry. This report delves into the key events of “Crypto Week,” analyzing the legislative milestones achieved, the potential impact on the cryptocurrency market, and the broader implications for the future of digital assets.

Legislative Firepower: Key Bills and Their Significance

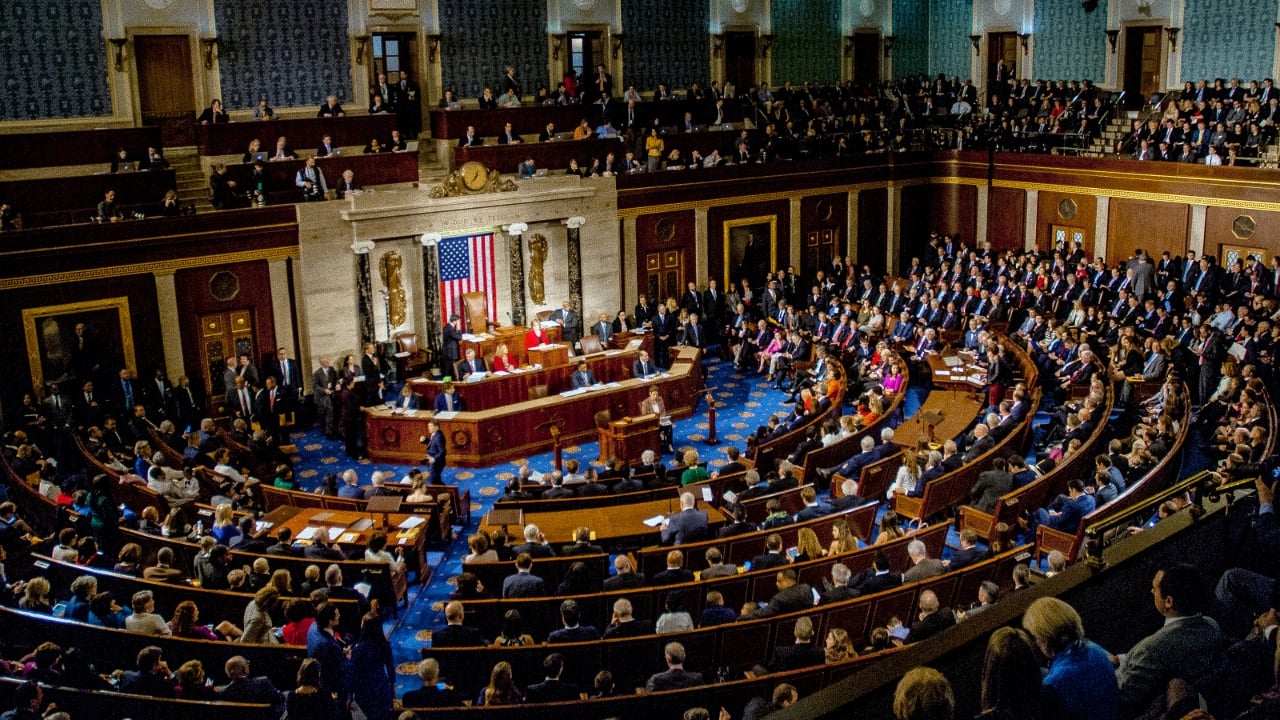

“Crypto Week” was characterized by the U.S. House of Representatives’ consideration and passage of several key bills designed to address various aspects of the digital asset landscape. While the exact bills debated and their specific provisions may vary, the core objective was to provide regulatory clarity and establish a legal framework for cryptocurrencies.

The GENIUS Act: Promoting Innovation and Understanding

One notable piece of legislation that gained traction during “Crypto Week” is the GENIUS Act. While the specific details of the Act might evolve, its general purpose is to promote innovation and understanding of blockchain technology and digital assets. This Act potentially focuses on fostering a more conducive environment for the development and deployment of blockchain-based solutions. Its passage signals a commitment to encouraging technological advancement within the cryptocurrency space.

The GENIUS Act could include provisions for research and development grants, educational initiatives, and public-private partnerships aimed at accelerating the adoption of blockchain technology. By providing a supportive regulatory environment, the Act could help attract more talent and investment to the cryptocurrency industry, fostering a culture of innovation and entrepreneurship.

The CLARITY Act: Bringing Clarity to Regulatory Ambiguities

Another crucial bill under consideration was the CLARITY Act. The primary goal of this act is to bring clarity to the existing regulatory ambiguities surrounding digital assets. The act might seek to define which cryptocurrencies should be classified as securities and which should be treated as commodities, bringing them under the purview of different regulatory bodies, like the Securities and Exchange Commission (SEC) or the Commodity Futures Trading Commission (CFTC). Clearer classifications would enable businesses operating in the crypto space to better understand and comply with existing regulations.

The CLARITY Act could also address issues related to tax treatment, anti-money laundering (AML) compliance, and consumer protection. By providing a clear and consistent regulatory framework, the Act could help reduce the legal and operational risks associated with operating in the cryptocurrency market.

The Anti-CBDC Surveillance State Act: Protecting Privacy and Preventing Government Overreach

The Anti-CBDC Surveillance State Act might have been brought up for debate, as well. The Act is likely aimed at preventing the creation of a central bank digital currency (CBDC) that could potentially be used for surveillance or control of citizens’ financial transactions. This Act could reflect concerns about privacy and government overreach within the digital currency space.

The Anti-CBDC Surveillance State Act could include provisions that limit the government’s ability to track and monitor financial transactions, as well as restrictions on the use of CBDCs for purposes other than facilitating payments. By protecting the privacy and financial freedom of citizens, the Act could help ensure that the benefits of digital currencies are not undermined by excessive government control.

The passage of these bills through the House of Representatives represents a significant victory for the cryptocurrency industry. It demonstrates a growing recognition among lawmakers of the importance of digital assets and the need for a clear and consistent regulatory framework.

Ethereum’s Rise: The Market’s Narrative Driver

While legislative developments dominated the headlines, Ethereum also played a pivotal role during “Crypto Week.” Ethereum, the second-largest cryptocurrency by market capitalization, has increasingly become a focal point for innovation and development within the blockchain space. Its transition to a Proof-of-Stake (PoS) consensus mechanism, known as “The Merge,” captured the attention of investors and developers alike.

Ethereum’s enhanced scalability, security, and energy efficiency, post-Merge, have positioned it as a leading platform for decentralized applications (dApps), decentralized finance (DeFi), and non-fungible tokens (NFTs). As such, Ethereum has emerged as a primary driver of market sentiment and narrative. Positive developments on the Ethereum platform often lead to increased investor confidence and broader market optimism.

The success of Ethereum’s transition to PoS has also highlighted the potential of blockchain technology to address some of the most pressing challenges facing the cryptocurrency industry, such as scalability, energy consumption, and security. By demonstrating the viability of PoS as a consensus mechanism, Ethereum has paved the way for other blockchain projects to explore similar solutions, fostering a more sustainable and efficient cryptocurrency ecosystem.

Potential Impacts on the Cryptocurrency Market

“Crypto Week” and its legislative outcomes have the potential to significantly impact the cryptocurrency market in several ways:

Increased Institutional Investment

Regulatory clarity can attract more institutional investors to the cryptocurrency market. Many institutional investors have been hesitant to enter the market due to regulatory uncertainty. With clearer rules and guidelines, they may feel more comfortable allocating capital to digital assets, which could lead to a surge in market liquidity and prices.

The influx of institutional investment could also bring greater stability and maturity to the cryptocurrency market, reducing volatility and enhancing price discovery. By providing a more predictable and transparent regulatory environment, the market could attract a broader range of investors, including hedge funds, asset managers, and pension funds, further diversifying the investor base and reducing systemic risks.

Enhanced Investor Protection

Clearer regulations can also provide enhanced protection for retail investors. By establishing guidelines for cryptocurrency exchanges, custodians, and other service providers, regulators can help prevent fraud and manipulation, protecting investors from potential losses.

The implementation of robust investor protection measures could also help build trust and confidence in the cryptocurrency market, encouraging more retail investors to participate. By providing a safe and secure environment for investing in digital assets, regulators can help foster a more inclusive and accessible market, empowering individuals to take control of their financial futures.

Fostered Innovation

A well-defined regulatory framework can foster innovation in the cryptocurrency space. By providing clear rules of the road, regulators can encourage entrepreneurs and developers to build new and innovative products and services without fear of running afoul of the law.

The establishment of a supportive regulatory environment could also help attract more talent and investment to the cryptocurrency industry, accelerating the development of cutting-edge technologies and solutions. By fostering a culture of innovation and experimentation, the market could unlock new use cases and applications for blockchain technology, driving growth and adoption.

Job Creation

As the cryptocurrency industry matures and becomes more regulated, it is likely to create new jobs in areas such as compliance, legal, and technology. The increasing number of job postings related to crypto and blockchain technology on platforms like Indeed.com suggests a growing demand for skilled professionals in this field.

The expansion of the cryptocurrency job market could also help address some of the most pressing economic challenges facing the global economy, such as unemployment and income inequality. By creating new opportunities for individuals to participate in the digital economy, the industry could help promote financial inclusion and economic empowerment, fostering a more prosperous and equitable society.

Challenges and Concerns

Despite the positive developments during “Crypto Week,” several challenges and concerns remain.

Senate Approval

The bills passed by the House of Representatives still need to be approved by the Senate. The Senate is often more deliberative and less likely to pass legislation quickly, so it is uncertain whether these bills will ultimately become law.

The Senate’s approval process could also be influenced by a range of political and ideological factors, making it difficult to predict the outcome. Moreover, the Senate’s consideration of the bills could be subject to amendments and revisions, potentially altering the original intent and scope of the legislation.

Implementation

Even if the bills are passed into law, the implementation of the regulations could be challenging. Regulators will need to develop clear and consistent guidelines and enforcement mechanisms to ensure that the regulations are effectively implemented.

The implementation process could also be hindered by a lack of resources, expertise, and coordination among regulatory agencies, as well as resistance from industry participants and other stakeholders. Moreover, the evolving nature of the cryptocurrency market could make it difficult for regulators to keep pace with technological and market developments, potentially leading to regulatory gaps and inconsistencies.

Potential for Overregulation

There is also a risk that regulators could overregulate the cryptocurrency industry, stifling innovation and driving businesses overseas. It is important for regulators to strike a balance between protecting investors and fostering innovation.

The risk of overregulation could be exacerbated by the complexity and novelty of the cryptocurrency market, as well as the lack of consensus among regulators and policymakers regarding the appropriate regulatory approach. Moreover, the global nature of the cryptocurrency market could make it difficult for regulators to coordinate their efforts and avoid regulatory arbitrage, potentially leading to a fragmented and inconsistent regulatory landscape.

Conclusion: A Cautiously Optimistic Future

“Crypto Week” represents a potentially landmark moment for the cryptocurrency industry. The passage of key bills by the House of Representatives signals a growing recognition among lawmakers of the importance of digital assets and the need for a clear regulatory framework. This legislative progress, coupled with Ethereum’s continued innovation and market dominance, suggests a potentially bright future for the cryptocurrency industry.

However, it is important to remain cautiously optimistic. The bills still need to be approved by the Senate, and the implementation of the regulations could be challenging. Moreover, there is a risk of overregulation that could stifle innovation.

The Road Ahead: Continued Engagement and Vigilance

The cryptocurrency community must remain engaged in the legislative process and advocate for regulations that are both protective of investors and supportive of innovation. Continued dialogue between industry participants, regulators, and lawmakers is essential to ensure that the future of digital assets is one of responsible growth and widespread adoption. Only through vigilance and proactive engagement can the industry capitalize on the momentum of “Crypto Week” and build a sustainable and thriving ecosystem for digital assets.