The Bitcoin Experiment: El Salvador’s U-Turn and the IMF’s Influence

A Bold but Flawed Vision

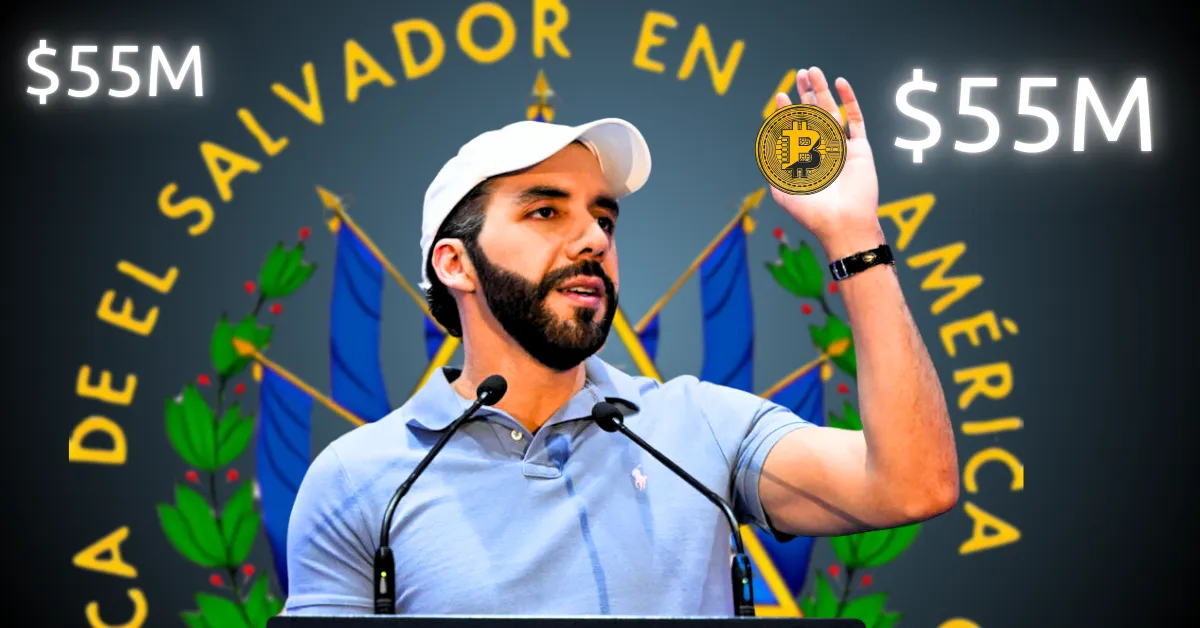

El Salvador’s decision to adopt Bitcoin as legal tender in 2021 was a bold move that captured global attention. President Nayib Bukele, known for his progressive and sometimes controversial policies, positioned Bitcoin as a solution to several economic challenges. The idea was to reduce reliance on the US dollar, lower remittance costs, and attract foreign investment. The government launched the “Chivo Wallet,” a digital wallet to facilitate Bitcoin transactions, and even provided $30 worth of Bitcoin to every citizen who signed up. Additionally, El Salvador began purchasing Bitcoin, adding it to its national reserves. This aggressive adoption strategy turned the country into a test case for cryptocurrency adoption on a national scale.

However, the initial enthusiasm was met with skepticism. Critics raised concerns about Bitcoin’s volatility, its potential for illicit activities, and the lack of financial literacy among the Salvadoran population. These concerns were not unfounded, as the price of Bitcoin proved to be highly volatile, leading to substantial paper losses for the country’s holdings. Moreover, adoption among Salvadorans remained low, with a significant portion of the population lacking access to smartphones or reliable internet, hindering their ability to use the Chivo Wallet.

Economic Realities and Public Apathy

Despite the government’s efforts to promote Bitcoin, the reality on the ground painted a different picture. Surveys indicated a sharp decline in Bitcoin usage among Salvadorans, with many citizens wary of using Bitcoin due to its price fluctuations and a general lack of understanding about cryptocurrency. The government continued to promote Bitcoin, but the public’s indifference became increasingly apparent.

The economic realities of the situation also became clear. The country faced mounting economic pressures, and the need to secure external financing to meet its debt obligations and address other pressing economic needs became urgent. The International Monetary Fund (IMF) emerged as a potential lender, but with conditions. The IMF expressed serious concerns about El Salvador’s Bitcoin policy, citing its risks to financial stability, transparency, and regulatory compliance.

The IMF’s Intervention and the U-Turn

Negotiations between El Salvador and the IMF were intense. The IMF made it clear that any loan agreement would be contingent on El Salvador scaling back its involvement with Bitcoin. While the details of the agreement remain somewhat opaque, it appears that El Salvador agreed to several key concessions.

One of the most significant changes was the cessation of Bitcoin purchases. Despite claims from El Salvador’s Bitcoin Office that the country was buying one Bitcoin per day, an IMF report revealed that El Salvador had not purchased any new Bitcoin since December 2024, coinciding with the loan agreement. This revelation directly contradicted the government’s public pronouncements and raised questions about transparency and accountability.

Beyond halting Bitcoin purchases, El Salvador also took steps to diminish Bitcoin’s role as legal tender. While not completely abandoning Bitcoin, the government rolled back the “Bitcoin mandate,” effectively removing the requirement for businesses to accept it as payment. This move further undermined Bitcoin’s adoption and acceptance within the country.

Broader Implications and Lessons Learned

El Salvador’s experience with Bitcoin has broader implications for other countries considering adopting cryptocurrency as legal tender. It highlights the challenges of implementing such a policy, including the need for widespread financial literacy, robust regulatory frameworks, and careful management of risks. It also underscores the influence of international financial institutions like the IMF, which can exert significant pressure on countries to align their policies with global standards.

Furthermore, El Salvador’s case serves as a cautionary tale about the potential for political motivations to influence economic policy. Bukele’s decision to adopt Bitcoin was arguably driven, at least in part, by a desire to project an image of innovation and progress. However, the lack of careful planning and the failure to address the practical challenges of adoption ultimately undermined the initiative.

Conclusion: A Lesson Learned?

El Salvador’s Bitcoin experiment, once hailed as a revolutionary step towards financial innovation, has largely faltered. The country’s decision to halt Bitcoin purchases and roll back the Bitcoin mandate marks a significant U-turn, driven by economic realities and pressure from the IMF. While Bitcoin may continue to exist in El Salvador, its role as a central pillar of the country’s economic strategy has been significantly diminished.

The experience of El Salvador offers valuable lessons for other countries considering similar initiatives. It demonstrates the importance of thorough planning, realistic expectations, and a clear understanding of the risks and challenges associated with cryptocurrency adoption. It also highlights the critical role of international financial institutions in shaping economic policy, particularly in developing countries. Whether El Salvador’s experiment will ultimately be viewed as a failed gamble or a valuable learning experience remains to be seen, but one thing is clear: the path to widespread cryptocurrency adoption is far more complex than initially imagined.