The past year has been a testament to the dynamic interplay between finance and technology, with Bitcoin and Nvidia emerging as two of the most influential players in their respective domains. Bitcoin, the pioneering cryptocurrency, has continued its relentless climb, defying market volatility and regulatory challenges to solidify its position as the leading digital asset. Meanwhile, Nvidia, the chipmaking titan, has surged into the spotlight, driven by the explosive growth of artificial intelligence (AI) and its pivotal role in powering AI applications. This report explores the intricate dance between these two titans, examining their recent performance, market dynamics, and the factors contributing to their respective ascensions.

Bitcoin has consistently demonstrated remarkable resilience, navigating regulatory hurdles, market volatility, and macroeconomic uncertainties. Despite these challenges, the cryptocurrency has not only maintained its position as the leading digital asset but has also achieved significant milestones. Price surges have been driven by factors such as institutional adoption, increased retail interest, and its perceived role as a hedge against inflation. Recent reports indicate that Bitcoin has surpassed $90,000 and is approaching $100,000, with some analysts predicting further upside potential. This surge has propelled Bitcoin’s market capitalization to over $2 trillion, solidifying its dominance in the crypto market.

The increase in large-volume transactions, often referred to as “whale” transactions, suggests growing confidence among institutional investors and high-net-worth individuals. These transactions can have a significant impact on market dynamics, influencing price movements and overall sentiment. However, the impact on mining companies has been mixed. The increasing difficulty of mining, coupled with energy consumption concerns, has led to challenges for some players in the sector. Innovative solutions, such as renewable energy-powered mining operations, are emerging to address these concerns.

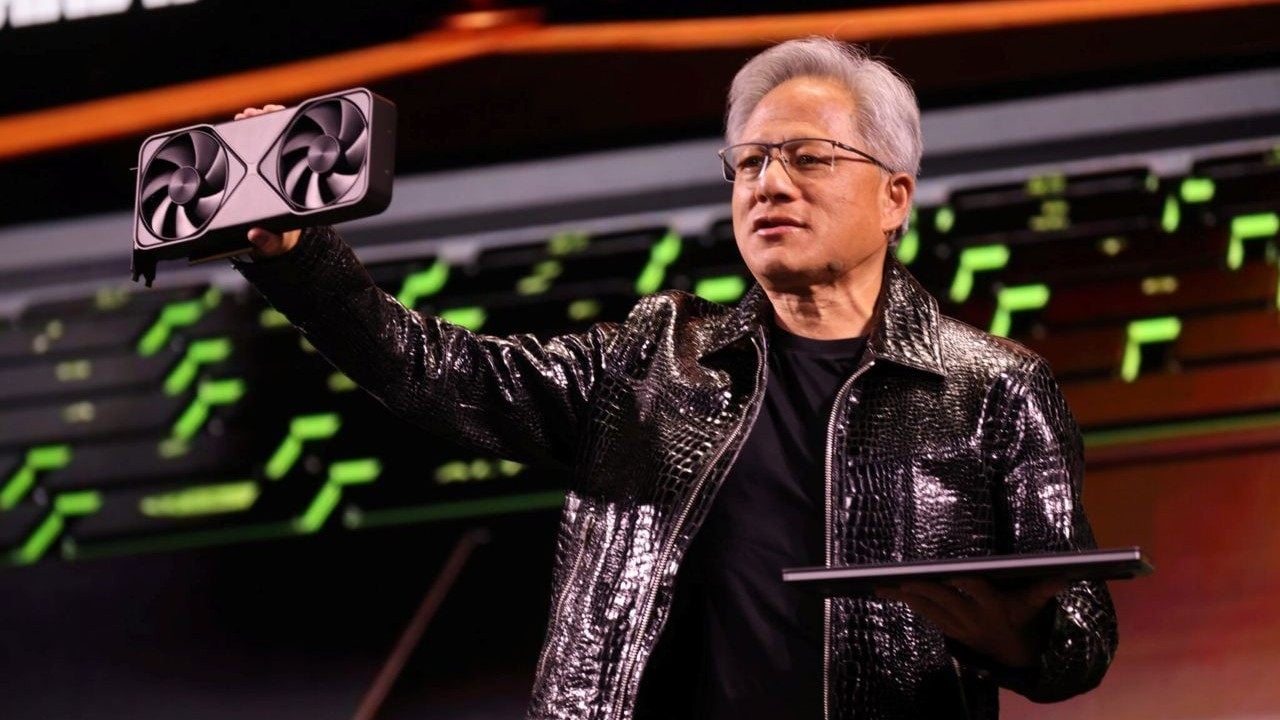

While Bitcoin might be making headlines for hitting an all-time high after the U.S. presidential election, Nvidia has quietly outperformed it by a massive margin. Closing at $146.27 on Nov. 14, Nvidia’s stock price has surged 2,768% over the past five years. Nvidia’s rise to prominence has been nothing short of meteoric, fueled by the explosive growth of artificial intelligence and its crucial role in powering AI applications. The company’s graphics processing units (GPUs) have become indispensable for training complex AI models, driving demand and propelling its market value to unprecedented heights.

Nvidia has achieved a historic milestone by becoming the first company to reach a $4 trillion market capitalization. This achievement underscores its dominance in the AI chip market and reflects the immense value investors place on its future growth potential. The company is also taking on an added role amid the AI craze: Data-Center Designer. Nvidia is seeking to gain ground on competitors by leveraging its technological advantages and strategic partnerships to stay ahead of the curve. The company’s ability to innovate and adapt to evolving market demands has been key to its success.

While Nvidia has traditionally been known for its gaming GPUs, the company has successfully diversified its business, with AI and data center applications now representing a significant portion of its revenue. This diversification has reduced its reliance on the cyclical gaming market and positioned it for long-term growth. Despite Nvidia’s explosive growth, there are reports that some billionaires are shifting their investments away from the company, raising questions about its future prospects. However, analysts remain largely bullish on Nvidia, citing its strong fundamentals and growth potential.

The relationship between Bitcoin and Nvidia is complex and multifaceted, characterized by both symbiotic elements and competitive dynamics. Both Bitcoin and Nvidia operate in the realm of cutting-edge technology, albeit in different domains. Bitcoin relies on advanced cryptography and distributed ledger technology, while Nvidia specializes in high-performance computing and AI. The convergence of these technologies could lead to new innovations and opportunities, such as AI-powered crypto trading platforms or blockchain-based data marketplaces for AI training.

Market sentiment can play a significant role in influencing the performance of both Bitcoin and Nvidia. Positive news or developments in one sector can often spill over into the other, driving investor interest and capital flows. Conversely, negative news or regulatory concerns can have a dampening effect on both markets. While Bitcoin and Nvidia operate in different industries, they both compete for investor capital. Investors may choose to allocate funds to either Bitcoin or Nvidia based on their risk tolerance, investment objectives, and perceived growth potential. This competition can lead to shifts in market dominance and relative performance.

Looking ahead, the future performance of Bitcoin and Nvidia will be influenced by a variety of factors. Continued innovation in both the cryptocurrency and AI sectors will be critical for driving growth and maintaining competitiveness. Bitcoin developers are working on scaling solutions and privacy enhancements, while Nvidia is investing heavily in next-generation GPUs and AI software platforms. Regulatory developments will continue to play a significant role in shaping the trajectory of Bitcoin and other cryptocurrencies. Clarity on issues such as taxation, security classification, and anti-money laundering compliance will be essential for fostering mainstream adoption.

Macroeconomic factors, such as inflation, interest rates, and economic growth, can impact investor sentiment and risk appetite, influencing the performance of both Bitcoin and Nvidia. The broader adoption of Bitcoin as a medium of exchange and store of value will be crucial for its long-term success. Similarly, the expansion of AI applications across various industries will drive demand for Nvidia’s products and services. The competitive landscape in both the crypturrency and AI sectors is becoming increasingly crowded. New entrants and established players are vying for market share, which could put pressure on profit margins and growth rates.

The contrasting but intertwined narratives of Bitcoin and Nvidia highlight the dynamic and ever-changing nature of the financial and technological landscapes. While Bitcoin continues its journey toward mainstream acceptance and higher valuations, Nvidia has emerged as a dominant force in the AI revolution, captivating investors with its growth potential. As both titans navigate the complexities of their respective markets, their success will depend on their ability to innovate, adapt, and capitalize on emerging opportunities. The future promises to be an exciting chapter in the ongoing saga of Bitcoin and Nvidia, with profound implications for the global economy and the future of technology.