Cryptocurrency markets remain a thrilling playground where innovation and volatility coalesce, and artificial intelligence (AI) is steadily redefining this space in profound ways. As we step into mid-2025, the integration of AI-powered tools and agents within cryptocurrency analysis and trading is transforming how decisions are made, risks are managed, and opportunities are captured. This report delves into the multifaceted impact of AI on the crypto landscape, weaving together insights from prominent analysts, real-time AI applications, market reactions, and the social dynamics shaping investor behavior.

The Spark of AI in Crypto: Bridging Complexity with Clarity

Cryptocurrency, by its nature, is complex — a swirling mix of cutting-edge technology, catastrophic dips, euphoric rallies, and a social media-fueled ethos that defies traditional markets. Into this chaos steps AI, serving as both a beacon and a mediator. It bridges gaps where human limits in data processing, speed, and emotional bias often falter.

Algorithms powered by machine learning digest vast streams of information: price action across blockchains, social sentiment from Twitter and Reddit, macroeconomic indicators, and even news headlines. AI agents then synthesize this into actionable insights, enabling traders to make faster and more informed decisions with an edge that closely mimics professional hedge funds.

Voices Leading the AI and Crypto Conversation

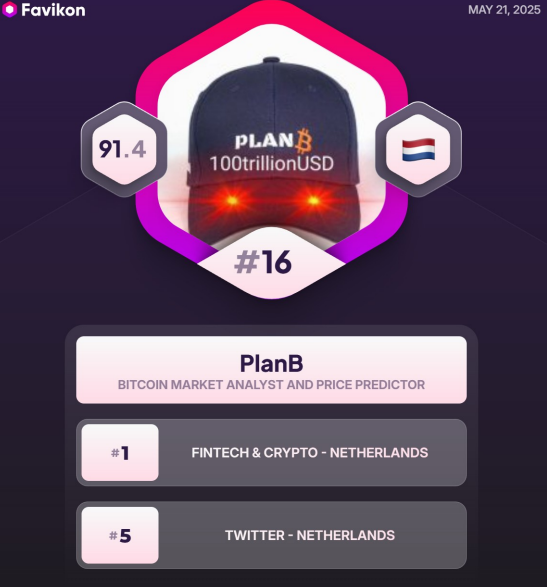

Two influential figures exemplify the blend of systematic, data-driven methodologies and community education:

– PlanB (@100trillionUSD) has evolved Bitcoin price modeling by integrating technical indicators like RSI with his original Stock-to-Flow framework, allowing followers to eschew noise for pattern recognition and probabilistic outcomes.

– Benjamin Cowen (@IntoCryptoSpace) brings intellectual rigor to what might otherwise be an opaque world. His engineering and academic background shine through in how he decodes complex crypto metrics and educates traders about the nuanced behavior of assets like Bitcoin and Ethereum.

Their work provides a foundation for AI initiatives, reflecting the importance of blending human understanding with algorithmic power when navigating volatile crypto waters.

AI Agents: Real-Time Navigators of Crypto Seas

The emergence of AI-driven platforms like Cookiedotfun and Wickr $WICKR marks an evolution from static chart reading to dynamic and comprehensive analysis across multiple blockchain ecosystems:

– Cookiedotfun acts as a sentinel monitoring AI agents themselves, revealing a meta-layer of market activity where artificial intelligences “watch” and react to blockchain and token movements in real-time. This permits traders not just to follow price but to anticipate shifts prompted by automated behaviors, such as “Snaps” accumulation ahead of airdrops.

– Wickr $WICKR, by contrast, is a Swiss Army knife for AI analytical power. By processing contract addresses across varied blockchains, it applies pattern recognition techniques to generate advanced technical insights that can highlight breakout potentials, identify false signals, and adapt to the rapidly changing narratives unique to decentralized finance (DeFi) environments.

Together, these AI tools underscore a pivotal shift: trading is becoming less reactive and more predictive, driven by algorithmic foresight capable of addressing multi-chain intricacies and accelerating market rhythms.

Market Movements: Where AI Meets Traditional Signals

Bitcoin’s recent flirtations with resistance around the $107,200 threshold show how traditional supply-demand dynamics remain a cornerstone of market interpretation, even as AI models enhance understanding. Analysts predict that this price zone could trigger a breakout toward $109,900 or force pullbacks to the $103,300–$104,900 range. These scenarios are not guesses but educated probabilities informed by historic data trends bolstered by real-time AI feeds.

Dogecoin’s 10% dip highlights altcoins’ notorious sensitivity, but also the impact of external factors like political affiliations and celebrity endorsements. Elon Musk’s continued influence exemplifies how meme-driven coins defy pure technical logic and become social phenomena. Here, AI’s role shifts to parsing behavioral patterns: sentiment analytics can detect shifts in public mood that precede price moves, offering traders early warning signals.

Other tokens such as Solana (SOL) and newly introduced stablecoins around unconventional peg values (e.g., a $314,159 stablecoin related to Pi Network) suggest a crypto ecosystem experimenting with new value propositions. AI tools are crucial in this landscape for identifying genuine projects versus speculative bubbles by analyzing on-chain data, developer activity, and market sentiment—all at speeds unattainable by human traders.

Sentiment and Social Media: The Invisible Hand Influencing Crypto Markets

Crypto is as much about psychology as technology. The community’s emotional tide — reflected in tweets, memes, and influencer statements — often moves markets more than any technical chart. AI-powered sentiment analysis models quantify these mood swings, turning qualitative chatter into measurable indicators.

Such models contribute to risk management, offering traders probabilistic forecasts that incorporate social velocity. This fusion of behavioral finance with algorithmic power is pioneering new avenues in crypto strategy. Traders equipped with these insights can balance hype and realism, improving timing and positioning.

Essential Tools and Skills: Human-AI Synergy

AI’s rise doesn’t diminish the necessity for fundamental trading skills. Capital management, emotional discipline, and strategic planning are still paramount. Instead, AI acts as a powerful extension of a trader’s capabilities, enabling faster decision cycles, reducing cognitive biases, and providing comprehensive data views.

Mastery happens at this intersection — using AI to enhance technical analysis skills and applying human judgement to contextualize AI output amidst broader market narratives. Those who excel in this synergy will better manage volatility and seize opportunities across an increasingly complex crypto ecosystem.

Looking Ahead: AI and Crypto’s Expanding Horizon

The confluence of AI and cryptocurrency in 2025 is redefining what’s possible. As the space evolves, the integration of AI agents, real-time tracking, sentiment analytics, and advanced pattern recognition promises even more sophisticated tools. These will not just assist traders but could eventually automate substantial parts of portfolio management and risk assessment.

Crucially, the journey underscores one truth: the future of crypto success is not merely human or artificial intelligence alone — but the seamless fusion of both, navigating the unpredictable waves with clarity, speed, and insight.

—

Sources

– PlanB on Bitcoin Stock-to-Flow and RSI

– Benjamin Cowen’s Educational Analysis

– Cookiedotfun AI Agent Tracking

– Wickr $WICKR AI Trading Insights

– Dogecoin Price Support Analysis

– Bitcoin Technical Analysis May 2025

– Pi Network Stablecoin Speculation

– Sentiment Analysis Research on Crypto Price Prediction

—

Navigate the 2025 crypto waves with AI-driven insights from Cookiedotfun and expert analysis by PlanB for smarter trading moves.