—

Understanding AI’s Transformative Role in Cryptocurrency: A Detailed Exploration

Introduction: Why AI and Cryptocurrency Are an Inevitable Pair

Artificial Intelligence (AI) has steadily woven itself into the fabric of numerous industries, and cryptocurrency is no exception. At first glance, the worlds of decentralized finance and machine learning might seem distant, but the blend of these technologies is reshaping how people trade, analyze, and even conceptualize digital assets. The cryptocurrency market’s notorious volatility and vast data streams make it fertile ground for AI applications that offer speed, precision, and predictive insights. This article dissects the emerging trends and groundbreaking tools at the intersection of AI and crypto, revealing a future where intelligent algorithms empower investors and developers alike.

—

Decoding AI’s Influence in Crypto Trading and Analysis

Trading cryptocurrencies like Bitcoin or Ethereum involves digesting enormous amounts of real-time data—price movements, transaction volumes, order books, social sentiment, and macroeconomic events—all far too complex for human traders to monitor exhaustively.

1. Advanced Technical Analysis Through AI

Traditional technical analysis relies on human interpretation of charts and patterns, prone to bias and limited by cognitive load. AI-powered algorithms, however, can swiftly comb through multiple blockchains’ price histories, detect subtle patterns, and generate actionable alerts. Platforms such as Wickr exemplify this integration; its AI agent processes contract addresses and returns high-level technical analyses, helping users identify market trends, momentum shifts, and potential entry or exit points.

This automation reduces guesswork, elevates efficiency, and makes sophisticated trading tactics accessible to retail investors who previously depended heavily on expert advice or trial and error.

2. Sentiment Analysis: Mining the Social Web for Crypto Signals

Cryptocurrency markets are uniquely sensitive to public sentiment, often reacting sharply to news, influencers’ opinions, and collective moods expressed on platforms like Twitter, Reddit, and specialized forums. AI models trained in natural language processing (NLP) can parse vast amounts of text data, quantifying sentiment and detecting emerging buzz or fear in the community.

Research such as the study “Pump It: Twitter Sentiment Analysis for Cryptocurrency Price Prediction” demonstrates how merging sentiment scores with price forecasting models can enhance predictive accuracy, allowing traders to anticipate rallies or dumps triggered by social dynamics.

—

AI-Powered Innovation Beyond Trading: Governance and Smart Contracts

While AI most obviously impacts trading, it’s also transforming other blockchain areas.

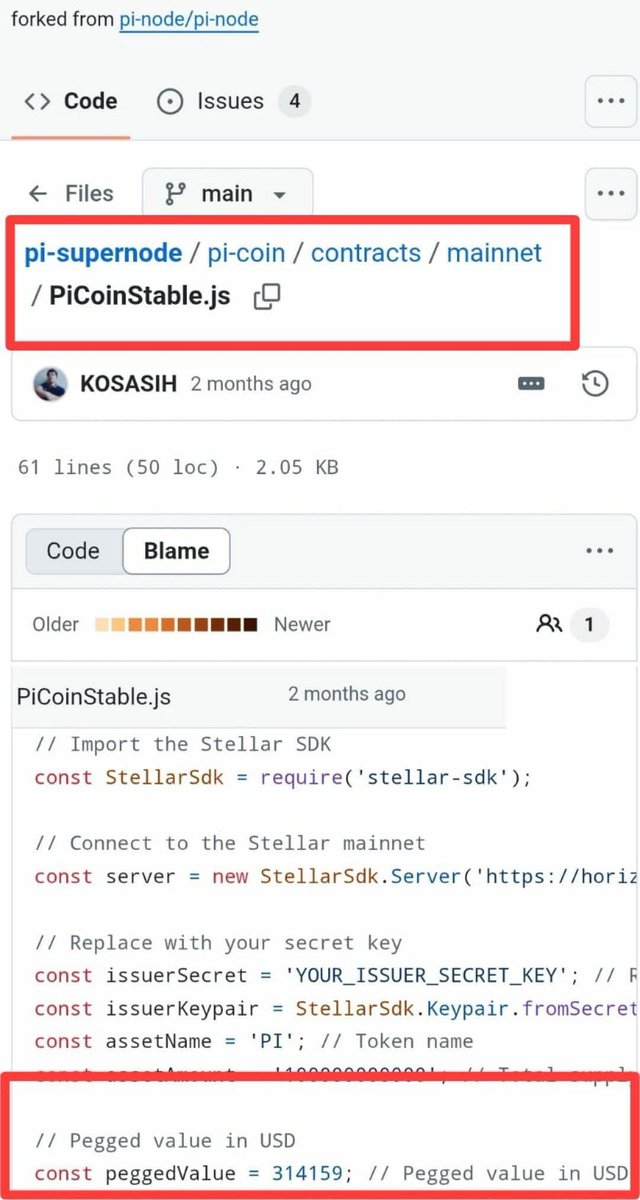

1. Smart Contract Audits and Optimization

Smart contracts—self-executing agreements coded on blockchains—can benefit greatly from AI scrutiny. Machine learning tools now exist that analyze contract code for vulnerabilities, inefficiencies, or compliance issues. This lowers the risk of costly bugs and exploits, making decentralized applications more robust.

2. AI in Decentralized Autonomous Organizations (DAOs)

DAOs represent a new form of organizational governance without centralized control. Incorporating AI into DAOs can automate proposal evaluations, voting mechanisms, and resource allocations. By learning community preferences over time, AI agents can suggest decisions that align with collective goals or flag proposals that might harm the ecosystem’s health.

—

Navigating Challenges: The Tradeoffs and Risks of AI Integration

No transformational technology comes without caveats, and AI in cryptocurrency is no exception.

– Algorithmic Bias and Market Homogenization: AI models may inadvertently amplify certain market behaviors. If many traders adopt the same AI signals, this could create feedback loops, increasing volatility or risk herding.

– Transparency Concerns: AI-driven decisions are sometimes “black boxes,” making it hard for users to understand why a specific trade or recommendation was made. This opacity can undermine trust, especially within the decentralized ethos.

– Security Risks: Malicious actors might weaponize AI for market manipulation or automated phishing attacks, so robust safeguards and ethical guidelines become critical components.

—

The Future: Toward Hybrid Intelligence and Responsive Ecosystems

Looking ahead, the synergy between AI and crypto suggests a landscape where machines and humans collaborate closely. Rather than AI replacing human intuition, it will serve as a powerful co-pilot, providing real-time insights, risk assessments, and scenario simulations.

Emerging projects like Macro Decoder illustrate multi-layered perspectives by combining micro-level token data analysis with macroeconomic modeling, offering investors holistic views that consider broad economic conditions alongside token-specific factors.

Furthermore, as AI tools become more democratized and user-friendly, they will empower a broader spectrum of participants—from novice investors to institutional players—to engage confidently in crypto markets.

—

Conclusion: Embracing the AI-Crypto Convergence

Artificial intelligence is not just an accessory to the cryptocurrency world; it is gradually becoming an indispensable catalyst that amplifies market efficiency, sharpens decision-making, and fosters innovation across the blockchain ecosystem. While challenges exist, the smart integration of AI promises to unlock new dimensions of understanding and participation, helping to tame the inherent chaos of digital asset markets.

For anyone intrigued by crypto’s future, watching how AI evolves within this space is not merely optional—it’s essential. The journey from speculative frenzy to data-driven maturity hinges on this intricate dance of algorithms and decentralized technology.

—

Sources and Further Reading

– Wickr AI Technical Analysis Platform Overview: https://virtuswap.io

– “Pump It: Twitter Sentiment Analysis for Cryptocurrency Price Prediction”: https://www.mdpi.com/1911-8074/15/5/180

– Macro Decoder AI Tool Introduction: https://somnia-pang.medium.com/macro-decoder-analysis-crypto-2025

– Technical Patterns in Cryptocurrency Trading: https://www.investopedia.com/terms/t/technical-analysis.asp

—

If you want, I can dive deeper into specific AI crypto tools, ethical considerations, or emerging trends!