As we step deeper into 2025, the fusion of artificial intelligence (AI) and cryptocurrency is reshaping the digital asset landscape in ways both fascinating and complex. AI is no longer a futuristic concept dangling on the horizon—it has become a crucial co-pilot for investors, traders, developers, and regulators navigating an ever-evolving crypto ecosystem. This report delves into how AI is transforming the cryptocurrency market, analyzing its present applications, emerging trends, challenges, and what lies ahead.

—

The Rising Role of AI in Crypto Decision-Making

The cryptocurrency market is famously volatile and driven by a plethora of factors—from on-chain transaction data to shifting regulatory landscapes and investor sentiment. In this maelstrom, AI steps in as an indispensable tool for decoding patterns and synthesizing diverse data streams.

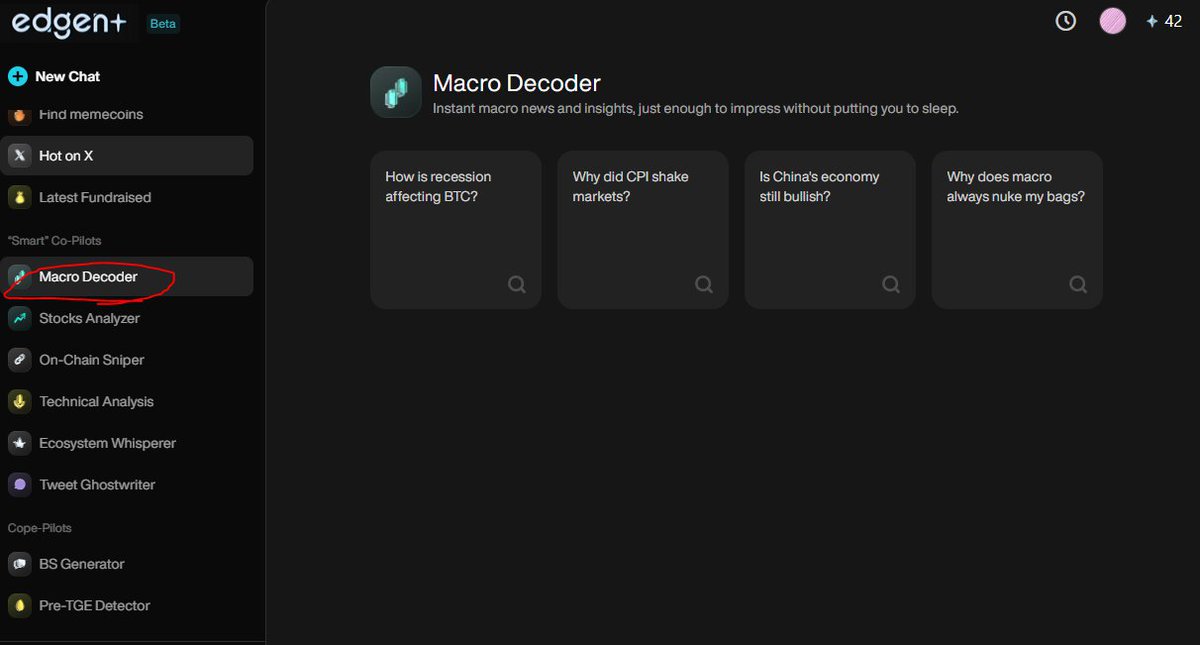

AI-powered platforms today are crafted to digest massive amounts of information—market orders, social media chatter, macroeconomic indicators, and blockchain analytics—at speeds unreachable by human traders. These tools act like “smart co-pilots,” augmenting human intuition with advanced computational power.

– Holistic Analysis: AI models integrate on-chain metrics (such as transaction volumes, wallet activity, and token flow) with off-chain signals (news headlines, Federal Reserve announcements, geopolitical events). This blend offers investors a 360-degree market view that traditional systems lack.

– Predictive Power: Machine learning algorithms can uncover subtle patterns and forecast market movements by continuously retraining on new data. This anticipative ability allows traders to preempt shifts in price momentum or liquidity liquidity crunches before they fully manifest.

– Sentiment Mining: The crypto community’s heartbeat often pulses through social channels like Twitter, Reddit, and Telegram. Natural language processing (NLP) techniques parse these discussions to gauge optimism, fear, or hype, feeding into more nuanced sentiment indices that influence trade strategies.

Collectively, these facets position AI-driven tools as essential in both long-term strategic investing and short-term trading maneuvers.

—

AI and Cross-Chain Analytics: A New Frontier

Cryptocurrency’s multi-chain reality introduces complexity that can frustrate even seasoned analysts. Different blockchain protocols—Ethereum, Solana, Binance Smart Chain, and newer entrants—each operate with unique characteristics, tokenomics, and user behavior.

AI-powered agents now specialize in cross-chain analysis, evaluating interactions across networks to identify arbitrage opportunities and liquidity movements with unprecedented clarity. These cross-chain insights are particularly useful because:

– Portfolio Diversification: Investors spread risk by holding assets on multiple chains. AI tools can monitor and balance portfolio exposure dynamically.

– Interoperability Monitoring: As bridges and swaps become commonplace, AI tracks cross-chain transactions to detect anomalies or emerging hot spots.

– Emerging Project Detection: Early-stage tokens or protocols often make ripples first on less dominant chains. AI alerts can spotlight these innovations before wider market awareness kicks in.

This multi-chain intelligence empowers crypto participants to unlock value beyond siloed ecosystems, which is increasingly vital as the industry moves toward interoperability.

—

The Ethical and Technical Challenges of AI in Crypto

While AI’s promise in cryptocurrency is substantial, challenges abound. Noteworthy among them are:

– Data Quality and Bias: AI models are only as good as the data they ingest. In crypto, data fragmentation and the presence of manipulative actors (bots pumping or dumping coins) can skew results, requiring constant vigilance and model refinement.

– Transparency and Explainability: Many AI algorithms, especially deep learning models, work as “black boxes,” making it difficult for users to understand why specific recommendations are made. This opacity challenges trust and hinders regulatory acceptance.

– Security Concerns: With great computational power comes risk. Malicious actors may attempt to exploit AI vulnerabilities or feed systems false inputs (data poisoning) to manipulate markets or trading decisions.

– Regulatory Landscape: As AI integration grows, regulators worldwide are grappling with questions around accountability, fairness, and potential market manipulation powered by algorithmic trading.

The industry’s responsibility lies in developing robust, transparent, and secure AI tools that complement human judgment rather than replace it.

—

Looking Ahead: AI’s Expanding Horizons in Crypto

Several trends suggest AI’s role in cryptocurrency will deepen and diversify:

– Automated Market Making & Liquidity Provision: AI algorithms already optimize decentralized exchange order books and minimize slippage for large trades. Next-gen models will continually learn to adapt to evolving network conditions to improve efficiency.

– Personalized Investment Advice: AI chatbots and robo-advisors could democratize access to tailored crypto portfolio management, lowering barriers for retail investors.

– Enhanced Fraud Detection & Compliance: Regulators and exchanges increasingly leverage AI-powered tools to flag suspicious transactions, AML (Anti-Money Laundering) violations, and cyber threats—enhancing market integrity.

– Smart Contract Auditing & Vulnerability Identification: AI tools designed to audit code will continue improving, reducing smart contract failures and associated financial losses.

– NFT and Metaverse Analytics: AI will become instrumental in appraising digital art, collectibles, and virtual assets, helping investors navigate speculative bubbles and real value.

—

Conclusion: Embracing AI With Eyes Wide Open

The marriage of AI and cryptocurrency is redefining how markets operate, democratizing data access, fostering innovation, and inviting new efficiencies. However, the path forward demands a balanced approach—capitalizing on AI’s analytical strengths while acknowledging its current limitations and risks.

In 2025 and beyond, successful crypto participants will be those who integrate AI insights with human experience and skepticism—recognizing that behind every line of code and algorithm lies an unpredictable human narrative.

The journey ahead promises to be as exhilarating as it is intricate, where AI doesn’t just analyze the market but becomes an active partner in charting the uncharted territories of digital finance.

—

Additional Reading

– How AI Is Transforming Cryptocurrency Trading

– Cross-Chain Analytics and AI: Unlocking New Opportunities

– Ethics and Challenges of AI in Financial Markets

– The Role of AI in Smart Contract Security

– AI-Driven Sentiment Analysis in Cryptocurrency Markets