The Ever-Evolving Narrative of Bitcoin

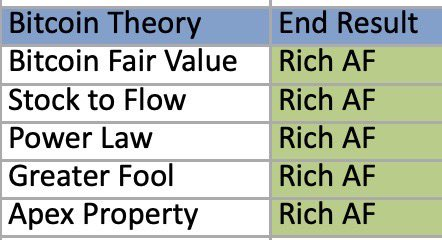

Imagine stepping into a world where digital gold is not just a concept from science fiction but a reality that has captured the imagination of millions. Bitcoin, the pioneer of cryptocurrencies, has been on a rollercoaster ride since its inception, and as we navigate through 2025, the discourse around it continues to evolve. This report delves into the different Bitcoin theories, their implications, and the corresponding end results they foresee. By understanding these perspectives, we can gain a more comprehensive view of Bitcoin’s potential trajectory and the factors influencing its market behavior.

The Bullish Perspective

Corporate Adoption and Institutional Investment

One of the most compelling bullish theories revolves around the increasing corporate adoption and institutional investment in Bitcoin. As Wall Street firms and public companies view Bitcoin as a strategic asset, the sustained buying pressure is expected to drive prices upward in the long term. This trend is backed by the notion that institutional investors bring stability and liquidity to the market, reducing volatility and fostering a more mature investment environment. The influx of capital from these entities is seen as a positive indicator for Bitcoin’s future price performance, with some analysts predicting significant upside potential. For instance, companies like MicroStrategy and Tesla have made substantial investments in Bitcoin, signaling a growing acceptance and confidence in the digital asset.

Technical Indicators and Market Sentiment

Technical analysis provides another layer of bullish optimism. Indicators such as the Relative Strength Index (RSI) and moving averages suggest underlying bullish momentum. For instance, Bitcoin trading within a horizontal supply zone, with the 21-day and 50-day moving averages acting as dynamic support, indicates a strong foundation for further price appreciation. Additionally, the RSI nearing the overbought region of 70 confirms buyer interest and positive investor sentiment, reinforcing the bullish outlook. These technical indicators are crucial for traders and investors who rely on data-driven decisions to navigate the volatile cryptocurrency market.

The Bearish Perspective

Order Flow and Market Dynamics

On the other hand, a distinctly bearish trend is observed in the order flow analysis. The significant influx of sell orders, coupled with large market participants exerting downward pressure, paints a cautious picture. This bearish sentiment is further supported by the rejection from the horizontal supply zone, where the Ichimoku Cloud provides strong support below the price action. This setup suggests the possibility of a short-term correction, aligning with the bearish narrative. The bearish trend is further reinforced by the accumulation under the 106k and the point of control (POC) of the last consolidation, indicating a potential downward movement.

Market Volatility and Technical Patterns

The bearish perspective is also bolstered by the recent breakdown of the local maximum for Bitcoin, as noted by various analysts. The market’s volatility and the potential for a correction are highlighted by the overbought risk indicated by the daily RSI. Despite the bull flag pattern on the weekly chart, which is typically a bullish continuation signal, the current market conditions warrant a cautious approach. The bearish trend is further reinforced by the accumulation under the 106k and the point of control (POC) of the last consolidation, indicating a potential downward movement. This volatility is a double-edged sword, offering opportunities for short-term gains but also posing risks for long-term investors.

The Neutral Perspective

Balancing Act

A neutral perspective acknowledges the duality of the market, where both bullish and bearish forces are at play. This view emphasizes the importance of staying informed and adaptable, recognizing that market conditions can change rapidly. The neutral stance is supported by the observation that Bitcoin is currently trading within a consolidation phase, with buyers and sellers engaged in a balancing act. This phase is characterized by a horizontal supply zone, where price action shows signs of consolidation, and dynamic support levels are in place. This neutral stance is crucial for investors who prefer a more balanced approach, avoiding the extremes of both bullish optimism and bearish pessimism.

Long-Term vs. Short-Term Outlook

The neutral perspective also considers the long-term vs. short-term outlook. While the long-term prospects for Bitcoin remain bullish, driven by corporate adoption and institutional investment, the short-term outlook is more uncertain. The market’s volatility and the potential for corrections necessitate a balanced approach, where investors remain vigilant and adapt their strategies accordingly. This perspective underscores the importance of staying informed and being prepared for various market scenarios. For example, while long-term investors may hold onto their Bitcoin despite short-term fluctuations, short-term traders may capitalize on these fluctuations to make quick gains.

The Cultural and Societal Impact

The Spirit of Freedom

Beyond the financial aspects, Bitcoin’s cultural and societal impact cannot be overlooked. Often associated with the spirit of freedom and decentralization, Bitcoin has become a symbol of resistance against traditional financial systems. This cultural narrative adds a layer of resilience to Bitcoin’s market behavior, as it continues to attract individuals and communities who value its decentralized nature and potential for financial sovereignty. The idea of a decentralized currency that is not controlled by any single entity resonates with many who seek financial independence and autonomy.

The Role of Memes and Community

The influence of memes and community-driven initiatives, such as those originating from platforms like 4chan, further underscores Bitcoin’s cultural significance. Memes like $Doge, $Shib, and $Pepe have gained popularity, reflecting the community’s creativity and engagement. This cultural phenomenon adds a unique dimension to Bitcoin’s market dynamics, where community sentiment and collective action play a crucial role in shaping its trajectory. The power of memes in driving market trends is a testament to the influence of social media and online communities in the modern financial landscape.

Conclusion

The Future of Bitcoin

As we look ahead, the future of Bitcoin remains a tapestry woven with threads of bullish optimism, bearish caution, and neutral adaptability. The increasing corporate adoption and institutional investment paint a bullish picture, while the order flow and market volatility present a bearish outlook. The neutral perspective, meanwhile, emphasizes the importance of staying informed and adaptable, recognizing the duality of the market. In this ever-evolving narrative, one thing is clear: Bitcoin’s journey is far from over. As we navigate through 2025 and beyond, the theories and analyses surrounding Bitcoin will continue to shape its trajectory, reflecting the dynamic and unpredictable nature of the cryptocurrency market. Whether you are a bullish optimist, a bearish skeptic, or a neutral observer, the story of Bitcoin is one that captivates and challenges us to think critically about the future of finance and technology.

References

The following links provide further insights and analyses on Bitcoin’s market dynamics and theories: