A Glimpse into the Future: The Cryptocurrency Market on May 6, 2025

Imagine stepping into a world where digital currencies are as common as cash in your wallet. The cryptocurrency market on May 6, 2025, offers a fascinating glimpse into this future. With a mix of bullish and bearish signals, the market is a playground of opportunities and challenges. Let’s explore the current state, focusing on recent performance, technical analysis, and future outlook.

Yesterday’s Top Performers

In the cryptocurrency world, yesterday’s gains often set the stage for today’s trading. On May 5, 2025, several tokens made headlines with their impressive performance.

Daily Standouts

– DARK: This token surged by 17.6%, making it the day’s top performer. Such a significant increase indicates strong market interest and potential for further growth.

– PUNDIX: Following closely, PUNDIX recorded a 9.27% gain, demonstrating its resilience and appeal to investors.

– STO: With a 9.07% increase, STO also made a notable impact, reflecting positive market sentiment.

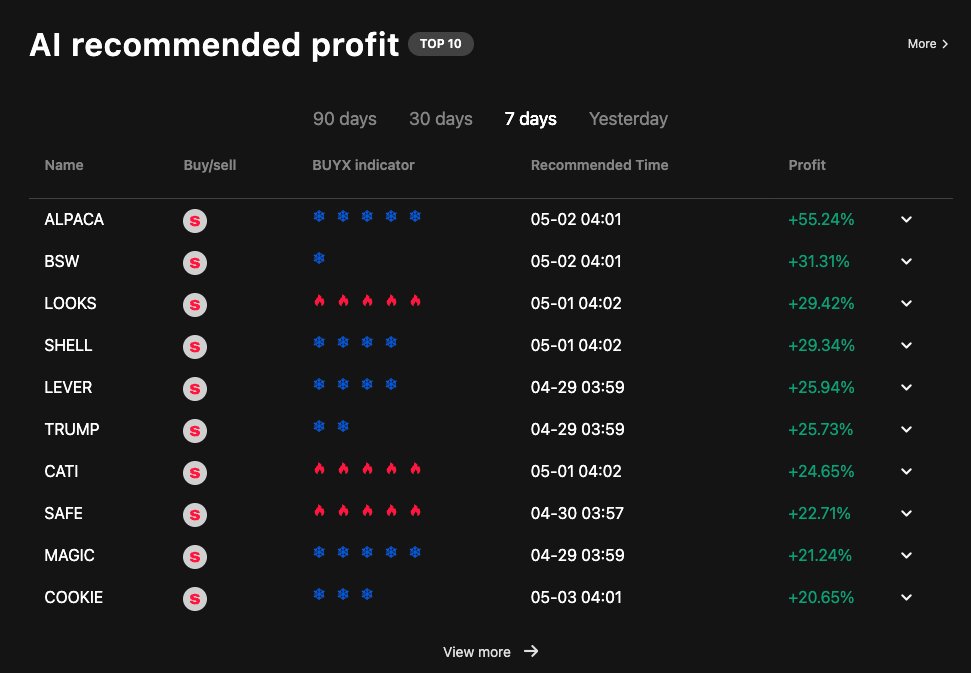

Weekly Winners

Looking at the broader week, some tokens have shown exceptional growth, highlighting their long-term potential.

– ALPACA: Leading the pack with a 55.24% increase, ALPACA indicates a strong upward trend.

– BSW: With a 31.31% gain, BSW demonstrated robust performance, attracting investor attention.

– LOOKS: Rounding out the top three, LOOKS saw a 29.47% increase, showcasing its potential for further growth.

Technical Analysis: The Market’s Pulse

Technical analysis provides valuable insights into the market’s direction and potential price movements. Let’s examine some key cryptocurrencies and their current technical setups.

Bitcoin (BTC)

Bitcoin, the flagship cryptocurrency, is currently in a bullish phase. Analysts suggest that Bitcoin is ultra-bullish above $90,000 and remains a strong buy below $95,000. The entire cryptocurrency market is expected to be super bullish late May, pending the Federal Reserve’s decision on interest rates[REF]Master Ananda[/REF].

Cardano (ADA)

ADA/USD is trading within a descending channel on the H4 chart, currently at 0.6591. The cryptocurrency is below the significant 0.6874 resistance level and the 200 MA on the 4-hour timeframe. This indicates a potential for a breakout if the resistance is overcome[REF]Thomas Anderson[/REF].

Chainlink (LINK)

LINK/USDT has approached the Fair Value Gap (FVG) 4-hour zone between $13.700 and $13.500 during its decline. If the price reacts positively to this zone, the main target is to break through and consolidate above the $14.200 level, indicating a bullish outlook[REF]WorldWide Futures Crypto[/REF].

Market Sentiment and Future Outlook

The cryptocurrency market is influenced by a multitude of factors, including regulatory decisions, technological advancements, and global economic conditions. As we approach late May 2025, several key events and trends are shaping market sentiment.

Regulatory Environment

The Federal Reserve’s decision on interest rates is a critical factor influencing market sentiment. A pause in rate hikes could boost the cryptocurrency market, as lower interest rates typically make riskier assets more attractive. Investors are eagerly awaiting this decision, which could set the tone for the market in the coming months.

Technological Advancements

The cryptocurrency market is continuously evolving, with new technologies and platforms emerging. Tools like DexCheck, an AI-driven analytics platform, provide real-time insights and market analysis to enhance trading experiences. Such innovations are crucial for traders looking to navigate the complex cryptocurrency landscape[REF]Tonoy[/REF].

Investor Sentiment

Investor sentiment plays a significant role in market movements. Positive sentiment can drive prices higher, while negative sentiment can lead to sell-offs. Currently, there is a mix of optimism and caution, with some investors bullish on the market’s potential and others wary of potential risks.

Conclusion: Navigating the Cryptocurrency Market

The cryptocurrency market on May 6, 2025, presents a mix of opportunities and challenges. With top performers like DARK, ALPACA, and LINK showcasing significant gains, investors have plenty of options to explore. However, it’s crucial to stay informed about technical analysis, market sentiment, and regulatory developments to make informed decisions. As we move into late May, the market’s direction will be heavily influenced by the Federal Reserve’s decision and ongoing technological advancements. Whether you’re a seasoned trader or a newcomer, staying vigilant and adaptable is key to navigating this dynamic market.