The Current State of Cryptocurrency: Trends, Updates, and Insights

The Allure of Cryptocurrency Promotions

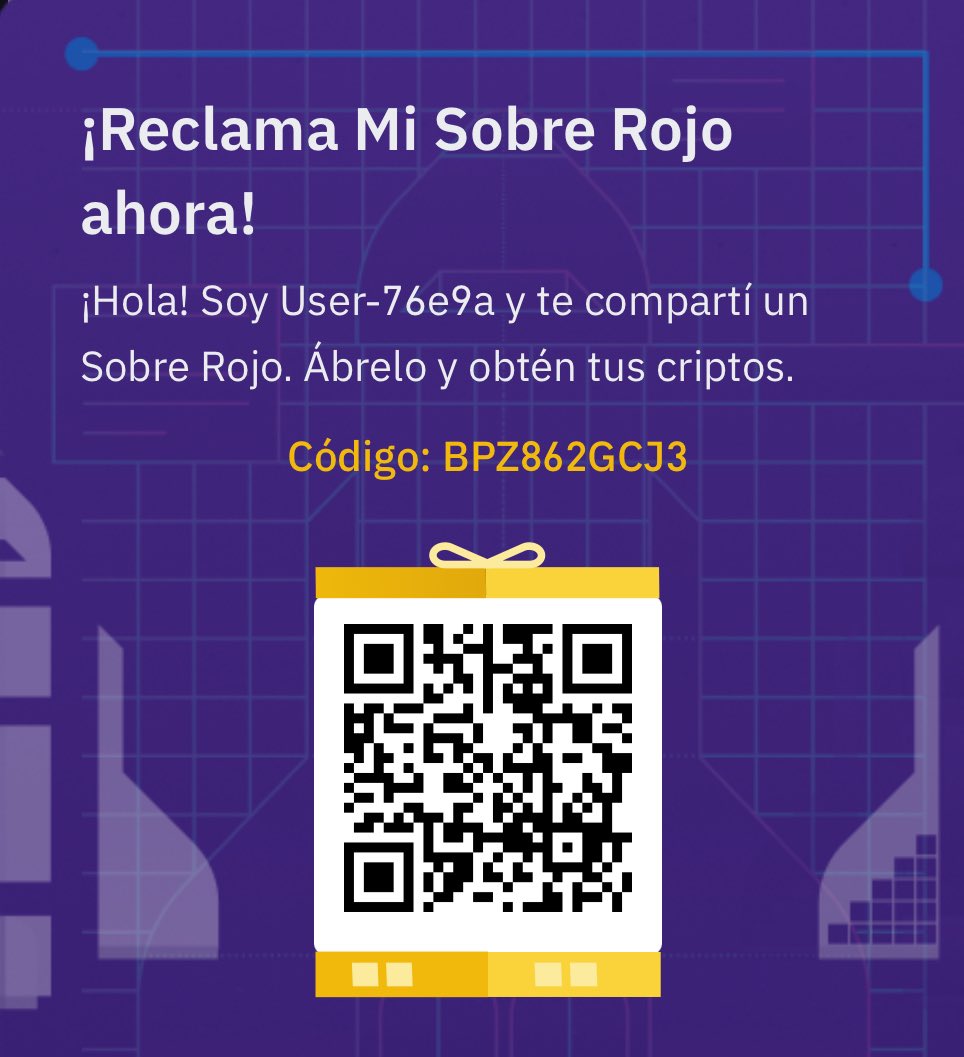

In the fast-paced world of cryptocurrency, promotions and giveaways often serve as a powerful draw for both seasoned investors and curious newcomers. Recently, Binance, one of the leading cryptocurrency exchanges, has been offering “Red Packets” worth $3 USD, with a limited supply of just 10 packets per code. These promotions, often accompanied by catchy hashtags like #bitcoin and #crypto, are a testament to the ongoing efforts to make cryptocurrency more accessible and appealing to a broader audience. The use of engaging language and visuals, such as emojis and bold text, is a strategic move to capture attention in the crowded digital space.

The allure of these promotions lies in their ability to demystify cryptocurrency and make it more approachable. For newcomers, the idea of receiving free cryptocurrency can be an enticing introduction to the world of digital assets. For seasoned investors, these promotions can serve as a reminder of the potential rewards that come with investing in cryptocurrency. Moreover, these promotions often come with educational content, helping users understand the basics of cryptocurrency and how to get started.

Institutional Involvement and Market Dynamics

Bitcoin’s Price Breakout

Bitcoin, the flagship cryptocurrency, has recently shown strong buying momentum, breaking out of a price channel that started at $74,600. This breakout is a significant indicator of bullish sentiment in the market. The price movement reflects the broader trend of increasing institutional interest and investment in cryptocurrencies. As more institutions recognize the potential of digital assets, the market dynamics are shifting, leading to more stable and sustained growth.

The breakout from the price channel is not just a technical indicator but also a reflection of the growing confidence in Bitcoin as a store of value. This confidence is fueled by the increasing number of institutions that are allocating a portion of their portfolios to Bitcoin. This trend is likely to continue as more institutions seek to diversify their holdings and hedge against inflation.

MicroStrategy’s Bold Move

MicroStrategy, a prominent business intelligence company, has doubled down on its Bitcoin bet by increasing its capital plan to $84 billion and raising BTC yield targets. This move signals an unprecedented level of institutional commitment to cryptocurrency. MicroStrategy’s 13.7% BTC yield and $5.8 billion gain year-to-date showcase the significant returns that can be achieved through strategic cryptocurrency investments. This bold move by MicroStrategy is likely to inspire other institutions to follow suit, further driving the adoption and integration of cryptocurrencies into mainstream finance.

MicroStrategy’s decision to increase its Bitcoin holdings is a clear indication of the company’s belief in the long-term potential of cryptocurrency. By allocating a significant portion of its capital to Bitcoin, MicroStrategy is not only hedging against inflation but also positioning itself as a leader in the digital asset space. This move is likely to encourage other companies to explore the potential of cryptocurrency and consider adding it to their investment portfolios.

Technical Analysis and Market Trends

Ascending Triangle Pattern

Bitcoin is currently consolidating within an ascending triangle pattern, rebounding from the support trendline. The Ichimoku Cloud, a popular technical analysis tool, is acting as strong support, indicating bullish momentum. A breakout from this pattern could signal a significant upward movement in Bitcoin’s price. Technical analysis tools like the Ichimoku Cloud provide valuable insights into market trends and potential price movements, helping investors make informed decisions.

The ascending triangle pattern is a bullish continuation pattern that indicates a potential upward breakout. The Ichimoku Cloud, on the other hand, is a versatile indicator that provides a comprehensive view of the market trend, support and resistance levels, and potential price movements. By combining these two tools, investors can gain a clearer picture of the market dynamics and make more informed trading decisions.

Japan’s Strategic Bitcoin Reserve

In Japan, there is a clear divide between supportive Diet members and hesitant central bank/MOF officials regarding the adoption of a Strategic Bitcoin Reserve. This debate reflects the global conversation around the role of cryptocurrencies in national economies. As more countries explore the potential benefits and risks of integrating cryptocurrencies into their financial systems, the future of digital assets continues to evolve. The outcome of Japan’s deliberations could set a precedent for other nations, influencing the global cryptocurrency landscape.

The debate in Japan highlights the complexities involved in integrating cryptocurrencies into national economies. While some see the potential benefits of cryptocurrencies, such as increased financial inclusion and innovation, others are concerned about the risks, such as volatility and regulatory challenges. As Japan navigates these complexities, it is likely to provide valuable insights into the potential role of cryptocurrencies in national economies.

The Future of Cryptocurrency

Increasing Accessibility and Adoption

Promotions like Binance’s Red Packets and the increasing institutional involvement in cryptocurrency are paving the way for greater accessibility and adoption. As more people become familiar with digital assets, the market is likely to see sustained growth and innovation. The use of engaging marketing strategies and the integration of cryptocurrencies into mainstream finance are crucial steps towards achieving widespread adoption.

The future of cryptocurrency is bright, with increasing accessibility and adoption driving sustained growth and innovation. As more people become familiar with digital assets, the market is likely to see a surge in demand, leading to increased liquidity and stability. Moreover, the integration of cryptocurrencies into mainstream finance is likely to open up new opportunities for investment and innovation.

The Role of Technical Analysis

Technical analysis tools like the Ichimoku Cloud play a vital role in helping investors navigate the volatile cryptocurrency market. By providing insights into market trends and potential price movements, these tools enable investors to make informed decisions and capitalize on market opportunities. As the cryptocurrency market continues to evolve, the importance of technical analysis in investment strategies cannot be overstated.

Technical analysis is a crucial component of successful cryptocurrency investing. By providing a comprehensive view of the market dynamics, technical analysis tools enable investors to make informed decisions and capitalize on market opportunities. As the cryptocurrency market continues to evolve, the importance of technical analysis in investment strategies is likely to increase.

Conclusion: Embracing the Cryptocurrency Revolution

The current state of cryptocurrency is marked by increasing institutional involvement, strategic promotions, and technical analysis. As more institutions and individuals recognize the potential of digital assets, the market is poised for sustained growth and innovation. The future of cryptocurrency is bright, and those who embrace this revolution are likely to reap significant rewards. Whether you are a seasoned investor or a curious newcomer, the world of cryptocurrency offers endless opportunities for growth and success.

The cryptocurrency revolution is here, and it is transforming the way we think about money and finance. As more institutions and individuals embrace this revolution, the market is likely to see sustained growth and innovation. The future of cryptocurrency is bright, and those who are willing to take the plunge are likely to reap significant rewards. Whether you are a seasoned investor or a curious newcomer, the world of cryptocurrency offers endless opportunities for growth and success.