Bitcoin’s Rise Amidst Economic Uncertainty

In the dynamic world of finance, Bitcoin has emerged as a resilient force, thriving as traditional economic systems grapple with instability. Once a niche curiosity, Bitcoin is now a significant player in global finance. Let’s explore the factors driving Bitcoin’s growth, its implications for the traditional economy, and what the future might hold.

The Economic Backdrop

A Shaky Foundation

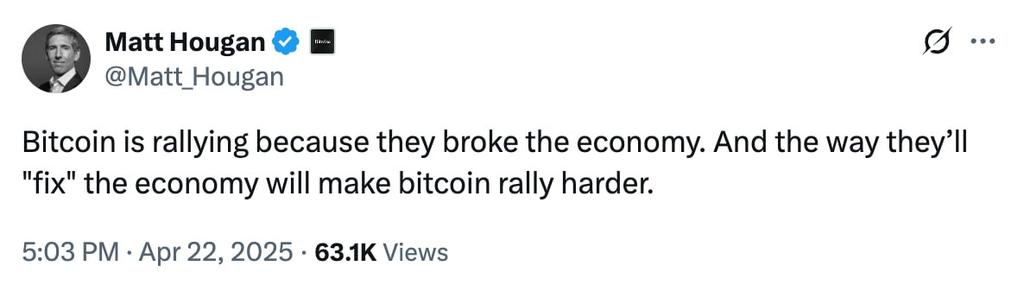

The current economic landscape, shaped by policies like those under the Trump administration, is a subject of intense debate. Critics argue these policies have introduced chaos, leading to uncertainty and volatility. Matt Hougan, CIO of Bitwise, believes this chaos is fueling Bitcoin’s rise. The traditional economy, heavily reliant on fiat currencies and centralized control, is struggling to maintain stability in the face of unprecedented challenges. This instability creates an opportunity for Bitcoin, which operates independently of these traditional mechanisms[1].

Bitcoin’s Role

Bitcoin, with its decentralized nature and finite supply, offers an alternative to the traditional financial system. It is not subject to the same political and economic pressures that affect fiat currencies. This independence makes it an attractive option for investors seeking stability and growth in uncertain times. As the traditional economy falters, Bitcoin’s value proposition becomes increasingly compelling.

Market Trends and Technical Analysis

Bullish Signals

The technical analysis of Bitcoin paints a bullish picture. The cryptocurrency has shown robust upward trends on the intraday level, with significant gains in recent weeks. For instance, on April 22, 2025, Bitcoin saw a notable increase, reinforcing its upward trajectory[6]. This trend is supported by various technical indicators, such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD), which suggest strong momentum and room for further growth[10].

Layer 2 Innovations

Bitcoin’s Layer 2 solutions are unlocking powerful DeFi (Decentralized Finance) potentials. Innovations such as cross-chain lending via Ordinals and BRC20 are expanding the utility and appeal of Bitcoin. These developments are not only enhancing Bitcoin’s functionality but also attracting more investors and users to the ecosystem[4].

Ethereum’s Performance

While Bitcoin steals the spotlight, Ethereum is also making waves. The second-largest cryptocurrency by market capitalization has seen an 8% increase in value, indicating a broader bullish sentiment in the crypto market. Ethereum’s rally is supported by its own set of technical indicators and market dynamics, adding to the overall positive outlook for cryptocurrencies[11].

The Road Ahead

Navigating the Chaos

Matt Hougan suggests that “fixing the chaos” in the traditional economy could push Bitcoin even higher. This implies that as the traditional system stabilizes, it could lead to a more favorable environment for Bitcoin. However, it also means that Bitcoin’s value could be further enhanced if the traditional system continues to struggle. This duality highlights the unique position of Bitcoin in the financial landscape.

Bitcoin’s Future

The future of Bitcoin looks promising, but it is not without challenges. Regulatory scrutiny, market volatility, and technological hurdles are some of the obstacles that Bitcoin must navigate. However, the cryptocurrency’s resilience and adaptability have proven to be its strongest assets. As the traditional economy continues to evolve, Bitcoin is poised to play an increasingly significant role.

Conclusion: A Paradigm Shift

The ascendancy of Bitcoin amidst a faltering traditional economy signals a shift in the financial paradigm. This digital currency, with its decentralized nature and finite supply, offers an alternative to the traditional financial system. As the traditional economy struggles to maintain stability, Bitcoin’s value proposition becomes increasingly compelling. The technical analysis and market trends support a bullish outlook for Bitcoin, with innovations in Layer 2 solutions and Ethereum’s performance adding to the positive sentiment. The road ahead for Bitcoin is filled with both opportunities and challenges, but its resilience and adaptability make it a formidable player in the global financial arena. As we move forward, it is clear that Bitcoin is not just a passing fad but a significant force shaping the future of finance.