The Emotional Rollercoaster of Stock Market Investing

The Illusion of Control

The Art of Technical Analysis

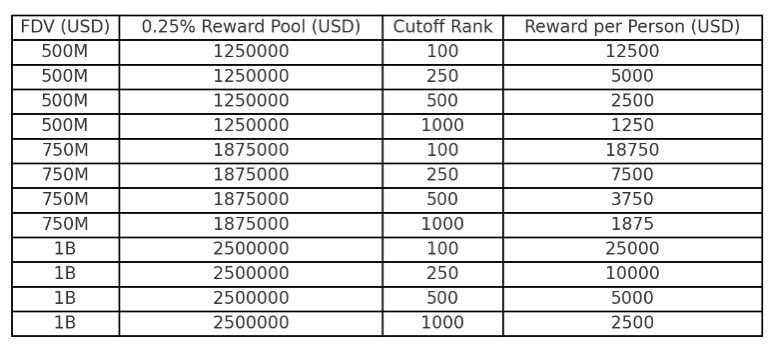

Investing in the stock market often feels like a high-stakes game of chess. You meticulously analyze charts, scrutinize financial reports, and draw intricate lines on your graphs. You believe that by understanding the past, you can predict the future. This method, known as technical analysis, is a cornerstone of many investors’ strategies. It involves studying historical market data, primarily price and volume, to forecast future price movements. Tools like moving averages, trend lines, and support and resistance levels are essential in this approach. For instance, an investor might identify a long-term trend line support level at $475, a price they might consider buying at if the stock reaches that level.

However, technical analysis is not an infallible science. Markets are influenced by an array of factors, many of which are unpredictable. Economic indicators, geopolitical events, investor sentiment, and even the weather can all play a role. This unpredictability is where the emotional rollercoaster begins.

The Market’s Indifference

The stock market is an impersonal entity. It doesn’t care about your analysis, your feelings, or the lines you’ve so carefully drawn. It operates on its own rules, influenced by a myriad of external and internal factors. This indifference can be frustrating, but it’s also a fundamental aspect of the market’s nature. Understanding this indifference is crucial for any investor. It means accepting that the market will not always behave as you expect and that losses are a part of the game.

The Emotional Impact

The Thrill of the Chase

Investing can be an exhilarating experience. The thrill of spotting a potential opportunity, the excitement of making a trade, and the satisfaction of seeing a profit are all part of the appeal. These highs can be intoxicating, making you feel like you’re on top of the world. However, the market’s unpredictability means that these highs are often followed by lows.

The Agony of Defeat

When the market moves against you, it can be devastating. You might feel a sense of loss, not just financially, but also emotionally. Doubts can creep in, questioning your analysis, your strategy, even your sanity. This is where many investors make their biggest mistakes. Emotional reactions can lead to impulsive decisions, further exacerbating losses. It’s essential to recognize these emotions and learn to manage them effectively.

Coping with the Rollercoaster

Acceptance

The first step in coping with the emotional rollercoaster of investing is acceptance. You must accept that the market is unpredictable and that losses are a part of the game. This doesn’t mean you should be reckless, but rather that you should be prepared for the inevitable ups and downs. Acceptance allows you to approach investing with a clear mind, ready to adapt to changing conditions.

Discipline

Discipline is key in investing. This means sticking to your strategy, even when the market is against you. It means not letting your emotions dictate your actions. It means being patient and waiting for the right opportunities. Discipline helps you stay focused on your long-term goals, rather than being swayed by short-term market fluctuations.

Diversification

Diversification is another important strategy. By spreading your investments across different sectors, industries, and asset classes, you can reduce your risk. This doesn’t mean you’ll avoid losses altogether, but it can help smooth out the rollercoaster ride. Diversification ensures that a downturn in one area doesn’t devastate your entire portfolio.

Conclusion: The Market’s Indifference is Your Opportunity

The stock market’s indifference is a double-edged sword. On one hand, it can be frustrating and even painful. But on the other hand, it presents opportunities. By understanding and accepting this indifference, by maintaining discipline and diversification, you can turn the emotional rollercoaster of investing into a rewarding journey.

The market doesn’t care about your feelings or the lines you scribble. But that’s okay. Because in the end, it’s your actions, not your feelings, that determine your success. So, keep analyzing, keep learning, and most importantly, keep investing. The market might not care, but you should. Because your future self will thank you.