The Bitcoin Ballet: A 2025 Analysis

The Dance of Digital Gold

Imagine Bitcoin as a ballerina, gracefully pirouetting on the grand stage of the global financial market. Her moves are a captivating mix of elegance and unpredictability, reflecting the dual nature of this digital asset. As we stand on March 31, 2025, Bitcoin is mid-performance, her dance influenced by the music of market forces. Let’s take a seat in the front row and analyze her moves.

The Choreography: Technical Analysis

The Stage: Structural Demand and Resistance

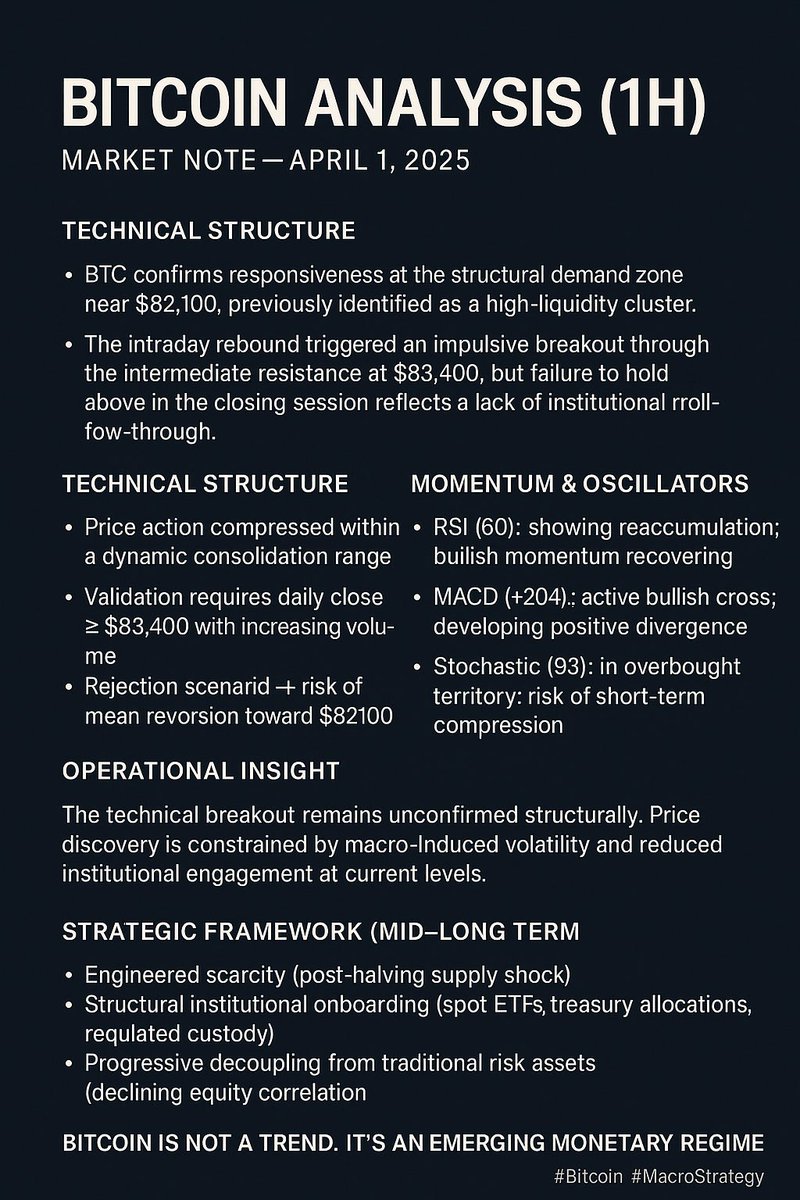

Bitcoin’s recent performance has been a masterclass in technical analysis. On March 31, 2025, Bitcoin found support at a structural demand zone near $82,100. This high-liquidity cluster acted as a springboard, propelling Bitcoin to break through the intermediate resistance at $83,400[1]. This dance move illustrates how technical analysis can help identify optimal entry and exit points, enhancing our appreciation of Bitcoin’s value proposition[2].

The Trap: Symmetrical Triangles

But the market isn’t always a smooth dance floor. Sometimes, it sets traps. A symmetrical triangle forming in Bitcoin’s chart suggests a potential 20% move. This pattern can lure traders into a false sense of security before Bitcoin makes a significant move[3]. Understanding these patterns is key to navigating the cryptocurrency market’s twists and turns.

The Music: Fundamental Analysis

The Rival: Bitcoin vs. Gold

While technical analysis focuses on Bitcoin’s dance moves, fundamental analysis looks at the music—the underlying factors driving her performance. Let’s compare Bitcoin to gold. As of March 31, 2025, MicroStrategy’s Bitcoin holdings, bought at an average price of $67,468, are up 22% at $82,500. Meanwhile, gold, trading at $3,127.83 per ounce, has seen a more significant rise from its July 2023 price of $1,964, suggesting a potential over 50% gain for early buyers[6]. This comparison highlights the different value propositions of Bitcoin and gold. While Bitcoin offers the potential for high returns, gold provides a more stable store of value. Both, however, have their place in a diversified portfolio, and understanding their historical evolution can help investors make smarter decisions[9].

The Ensemble: Altcoins

The Supporting Cast: XRP and Friends

Bitcoin might be the star of the show, but the ensemble cast of altcoins plays a significant role in the cryptocurrency market. Understanding altcoin trends is crucial for a comprehensive market analysis. Take XRP, for instance. Its dance moves are influenced by regulatory developments and market sentiment[8].

The Symphony: Altcoin Trends

Altcoins like XRP, Ethereum, and others add depth and complexity to the cryptocurrency market. Each has its own rhythm, influenced by factors such as technological advancements, regulatory changes, and market demand. Keeping an eye on these altcoins can provide valuable insights into broader market trends and potential investment opportunities.

The Encore: The Future of Bitcoin

The Forecast: Market Insights and Profitable Signals

The future of Bitcoin is as unpredictable as it is exciting. Accurate market insights and real-time analysis can help traders navigate this volatile landscape. Platforms offering profitable signals and trading strategies can elevate a trader’s game, providing the tools needed to make informed decisions[4].

The Masterclass: The Elite Trading Game

Elevating your trading game involves more than just following signals. It requires a deep understanding of both technical and fundamental analysis, as well as the ability to adapt to changing market conditions. The elite trader is one who can see the bigger picture, anticipating market moves before they happen.

The Grand Finale: The Never-Ending Dance

The Show Must Go On

Bitcoin’s dance with the market is far from over. As we look to the future, it’s clear that both technical and fundamental analysis will continue to play crucial roles in understanding and predicting Bitcoin’s movements. The market is a dynamic stage, and Bitcoin is a dancer that never stands still.

So, as we watch this digital ballerina perform, let’s remember that every move is a lesson, every pattern a story. And as the music plays on, we too can learn to dance with the market, finding our rhythm in the ever-changing world of cryptocurrency.

—

References

[1] Bitcoin Analysis (1H) | Market Note – April 1, 2025

[2] Fundamentals and technicals both matter

[3] New #Bitcoin & #Crypto analysis update video

[4] Accurate market insights, real-time analysis, and profitable signals

[5] When will @0xPolygon team announce $MATIC and $POL buyback from holders

[6] MicroStrategy’s 528,185 BTC

[7] Understanding Altcoin Trends: What’s in Store for XRP and Friends

[8] Bitcoin vs. Gold

[9] Bitcoin Analysis