A Glimpse into the Future: Cryptocurrency Market on March 31, 2025

In the ever-evolving world of cryptocurrency, March 31, 2025, presents a landscape that is both promising and perilous. The market is at a crossroads, with clear indications of both growth and caution. This report delves into the current state of the cryptocurrency market, highlighting key trends, the role of technology, and the future of AI in this dynamic sector.

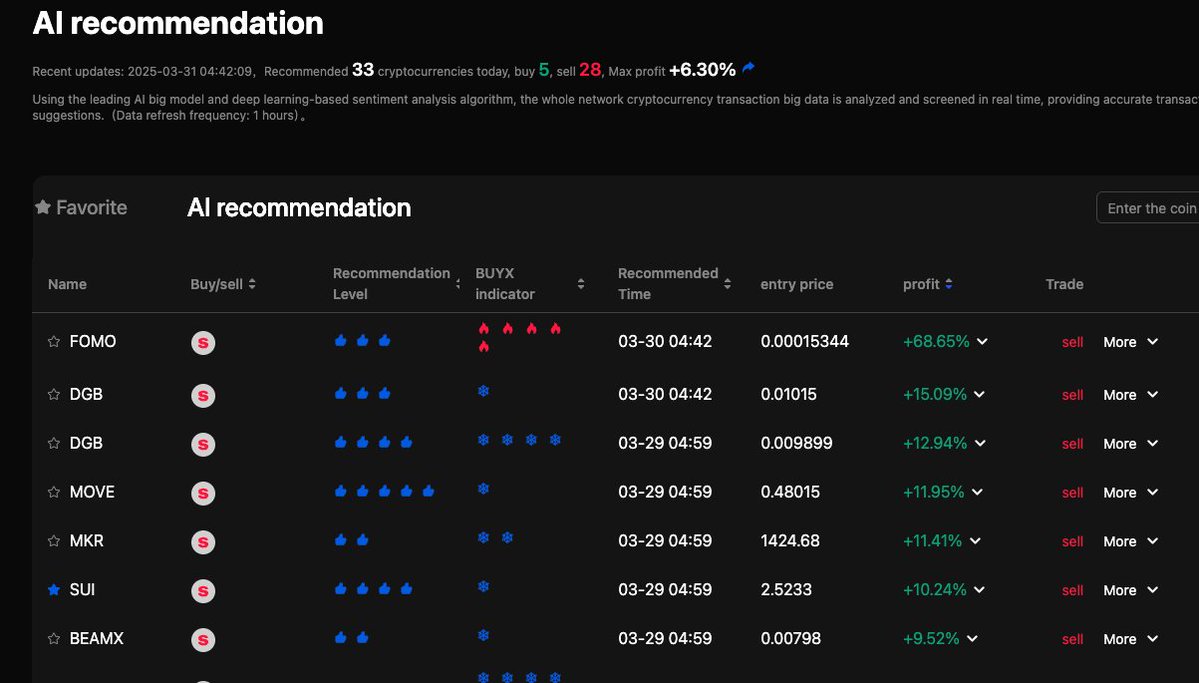

A Polarized Market

The cryptocurrency market on March 31, 2025, is a study in contrasts. Among the 33 targets screened by AI, only 5 show promise, primarily focusing on the Real-World Asset (RWA) track and compliance agreements. The remaining 28 require vigilance, indicating a market that is as polarized as it is dynamic. This polarization is a result of various factors, including regulatory pressures, technological advancements, and market sentiment.

The Bearish Trend

Descending Channel Pattern

The total cryptocurrency market cap is currently consolidating within a descending channel pattern. This pattern is a clear indication of a bearish trend, where the market is making lower highs and lower lows. The resistance trendline has been acting as a barrier, preventing the market from breaking out to the upside. This trend suggests that investors are cautious, and there is a lack of confidence in the market’s ability to sustain upward momentum.

Ichimoku Cloud Resistance

Adding to the bearish sentiment is the Ichimoku Cloud, which is acting as a resistance barrier above the channel. The Ichimoku Cloud is a comprehensive indicator that provides insights into trend direction, momentum, and support/resistance levels. Its presence above the channel suggests that any upward movement is likely to be met with significant resistance. This indicator is widely used by traders to identify potential turning points in the market.

The Role of AI and Bots

AI-Driven Market Screening

AI has become an integral part of the cryptocurrency market, with platforms like Buyx.ink using AI to screen targets. This technology can analyze vast amounts of data to identify potential growth opportunities and risks, providing traders with valuable insights. AI algorithms can process market data, news sentiment, and social media trends to predict market movements with a high degree of accuracy.

DAO Services

Decentralized Autonomous Organizations (DAOs) are also playing a significant role. Services like Sniper CopyBot, Market AnalysisBot, and APTM MiningBot offer trading strategies, technical analysis, and virtual mining tools, respectively. These services leverage AI and blockchain technology to provide users with advanced trading and mining capabilities. DAOs operate on the principle of decentralization, ensuring that decisions are made collectively and transparently.

Community and Development

Community Growth

Platforms like CoinGecko are not just about monitoring prices and volumes. They also track community growth, open-source code development, key events, and on-chain metrics. This holistic approach provides a comprehensive view of the market, helping traders and investors make informed decisions. Community engagement is crucial in the cryptocurrency ecosystem, as it fosters trust and collaboration.

Open-Source Development

The open-source nature of many cryptocurrency projects fosters innovation and collaboration. Developers from around the world can contribute to these projects, leading to rapid advancements and improvements. This collaborative environment is a key driver of growth in the cryptocurrency market. Open-source development allows for transparency and continuous improvement, making the technology more robust and secure.

The Future of AI in Crypto

Specialized AI Models

The future of AI in cryptocurrency looks promising, with specialized models being developed to cater to specific needs. For instance, AI agents can be used for market prediction, risk management, and even automated trading. These models can analyze market data, identify patterns, and make predictions with a high degree of accuracy. Specialized AI models can also be used for portfolio management, fraud detection, and regulatory compliance.

The Role of Openledger

Openledger is at the forefront of this evolution, providing insights into the role of AI agents in crypto. Their work highlights the potential of AI to revolutionize the way we interact with the cryptocurrency market, from trading to mining and beyond. Openledger’s research and development efforts are focused on creating AI-driven solutions that can enhance the efficiency and security of cryptocurrency transactions.

Conclusion: Navigating the Polarized Market

As we stand at this crossroads, it’s clear that the cryptocurrency market is a complex and dynamic landscape. While there are opportunities for growth, there are also significant risks. The key to navigating this market lies in staying informed, leveraging technology, and being prepared to adapt to changing conditions.

The future of cryptocurrency is bright, but it’s not without its challenges. As we continue to explore this evolving landscape, let’s remember that every challenge is an opportunity for growth. So, whether you’re a seasoned trader or a newcomer to the world of crypto, stay informed, stay vigilant, and most importantly, stay curious.