Bitcoin’s Bearish Momentum: A Deep Dive into the Current Market Sentiment

The Current Landscape

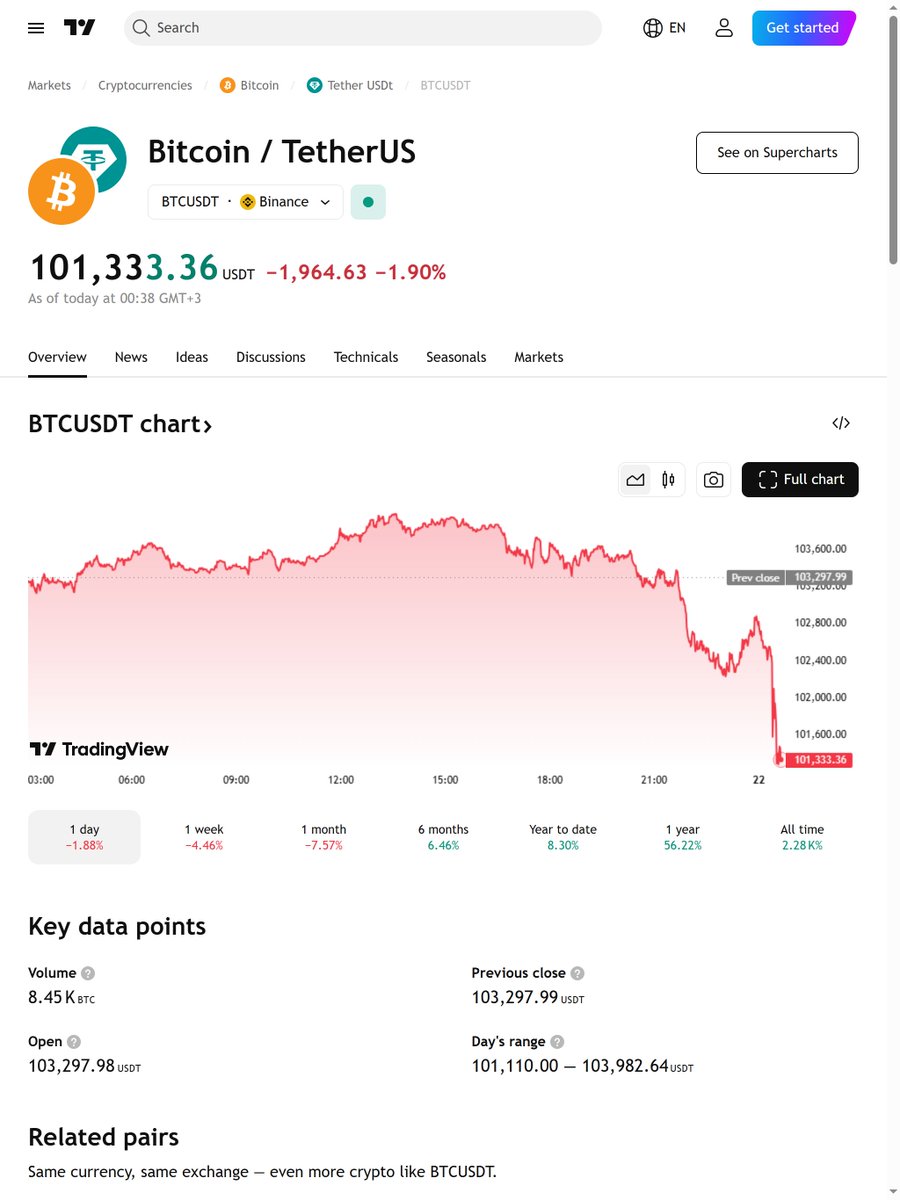

In the dynamic world of cryptocurrency, Bitcoin (BTC) has once again captured the spotlight. As of March 29, 2025, the market sentiment surrounding Bitcoin is a blend of caution and opportunity. The price of Bitcoin has been experiencing bearish momentum, with analysts and traders alike keeping a close eye on its movements. This report aims to provide a comprehensive analysis of the current market sentiment, technical indicators, and potential future scenarios for Bitcoin.

Technical Analysis: The Bearish Trend

Support and Resistance Levels

One of the key aspects of technical analysis is identifying support and resistance levels. These levels act as barriers to the price’s movement. Currently, Bitcoin has formed a strong support level at $80,000. This price level has successfully withstood selling pressure multiple times in the past, demonstrating its significance in the market [1].

Chart Patterns and Indicators

Several chart patterns and indicators are currently in play. For instance, a double top pattern has been detected on the daily chart, indicating a potential reversal in the upward trend. Additionally, Bitcoin has formed lower highs and broken below previous structures, confirming the Previous Day Low (PDL) [2].

Candlestick Analysis

The broader trend since late 2023 has been bullish, with Bitcoin reaching a peak above $110,000 in early 2025. However, the market is currently experiencing a multi-week corrective phase. This phase is characterized by a series of bearish candlesticks, indicating a potential shift in market sentiment [3].

Market Sentiment: Caution Ahead

Social Media and Community Sentiment

Social media platforms like Twitter have been abuzz with discussions about Bitcoin’s current bearish momentum. Analysts and traders are sharing their insights, with many expressing caution. For example, one analyst noted that Bitcoin faces bearish momentum amid a decline, while another highlighted the importance of applying probability theory to Bitcoin technical analysis [4, 5].

Historical Context

Historical data can provide valuable insights into potential future movements. For instance, past Bitcoin halvings in 2016 and 2020 led to strong returns in the subsequent years. This historical context suggests that while the current sentiment may be bearish, there could be opportunities for significant gains in the future [6].

Probabilistic Thinking: Mapping Possible Futures

The Importance of Probabilistic Thinking

Technical analysis is not about predicting one future but about mapping many possible futures, each with its own probability. This approach allows traders to prepare for various scenarios and make more informed decisions. For example, instead of predicting a specific price point, traders can assess the likelihood of different price movements and adjust their strategies accordingly [7].

Applying Probability Theory

By applying probability theory to Bitcoin technical analysis, traders can gain a more nuanced understanding of the market. This involves considering various factors, such as historical price movements, current market conditions, and potential external influences. For instance, the current bearish momentum could be a temporary correction or the beginning of a longer-term downtrend. By assessing the probabilities of these scenarios, traders can make more informed decisions.

Conclusion: Navigating the Bearish Momentum

The Path Forward

As Bitcoin continues to experience bearish momentum, it is crucial for traders and investors to stay informed and adaptable. By understanding the technical indicators, market sentiment, and historical context, they can navigate the current landscape more effectively. Moreover, adopting a probabilistic approach to technical analysis can provide a more comprehensive view of potential future movements.

Final Thoughts

The current bearish momentum in the Bitcoin market presents both challenges and opportunities. While caution is warranted, it is also essential to remain open to the possibility of future gains. By staying informed and adaptable, traders and investors can position themselves to take advantage of the ever-changing cryptocurrency market.

—

Sources

[1] CoinDesk

[2] TradingView

[3] Coinbase

[4] BecauseBitcoin.com

[5] Srosh Mayi

[6] CoinMarketCap

[7] Seeking Alpha