The Glittering Allure of Gold

Imagine a world where uncertainty is the only constant. In such a world, investors often turn to assets that have stood the test of time. Gold, often dubbed the “safe haven asset,” has been a beacon of stability in tumultuous times. As we stand on March 26, 2025, let’s dive into the spot gold market to understand the forces that drive its price, the technical patterns at play, and the broader economic context that shapes this lustrous metal’s value.

The Current Market Landscape

A Bearish Trend with Bullish Potential

The spot gold market is currently navigating a new H1 range, exhibiting a minor bearish trend. This trend is a result of various factors, including market sentiment, economic indicators, and geopolitical events. However, it’s crucial to remember that markets are dynamic, and trends can shift rapidly. The current bearish trend could very well be the calm before a bullish storm.

The Influence of Economic Policies

U.S. economic policies are a significant influencer in the gold market. Changes in interest rates, inflation rates, and fiscal policies can all impact the price of gold. As of March 2025, the U.S. Federal Reserve’s policies have been under the microscope of gold investors. The Fed’s stance on interest rates, in particular, can influence the opportunity cost of holding gold, which does not yield interest or dividends. Lower interest rates can make gold more attractive, as the opportunity cost of holding it decreases.

The Role of Safe Haven Assets

Gold’s appeal lies in its status as a safe haven asset. During times of economic uncertainty or market volatility, investors often flock to gold, driving up its price. This inverse relationship with riskier assets, such as stocks, is a crucial factor to consider when analyzing the gold market. For instance, during the 2008 financial crisis, gold prices surged as investors sought safety [1].

Technical Analysis: The Art of Predicting Price Movements

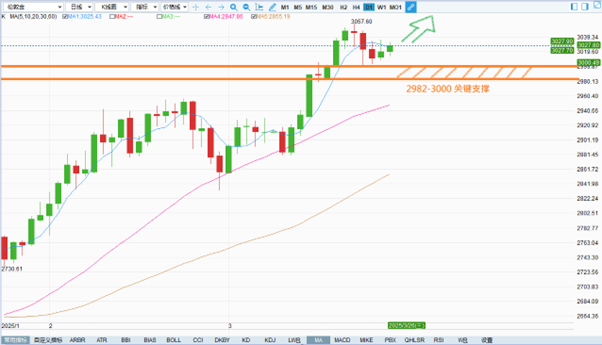

The H1 Bullish CHoCH Pattern

Technical analysis involves studying historical price data and trading volumes to predict future price movements. One such pattern observed in the current market is the H1 bullish CHoCH (Change of Character) pattern. This pattern suggests a potential shift in market sentiment, which could lead to a bullish trend. The CHoCH pattern is characterized by a change in the market’s character, from bearish to bullish, and is often accompanied by increased trading volume.

The Importance of Clear Breakouts

In technical analysis, a breakout occurs when the price of an asset moves above a resistance level or below a support level. In the current market, traders are waiting for a clear breakout to look for continuation sells. This strategy involves selling the asset if the price breaks out of the current range in a bearish direction. However, if the price breaks out in a bullish direction, it could signal a trend reversal.

The Omnichain and DeFi Impact

The Rise of Digital Assets

The financial world is evolving, and digital assets like cryptocurrencies and NFTs (Non-Fungible Tokens) are gaining traction. These assets, often associated with blockchain technology, are part of the broader DeFi (Decentralized Finance) ecosystem. While they are not direct competitors to gold, they do offer alternative investment opportunities that can influence the gold market. For instance, the rise of Bitcoin has led some investors to view it as “digital gold,” potentially diverting investment away from the physical metal.

The Omnichain Revolution

The concept of omnichain refers to the interoperability of different blockchain networks. This technology allows for the seamless transfer of assets between different blockchains, potentially making digital assets more accessible and liquid. As the omnichain revolution unfolds, it could impact the demand for traditional safe haven assets like gold. If digital assets become more widely accepted and used, they could potentially challenge gold’s status as a safe haven.

The Gold Market and the Broader Economy

The Interplay of Market Trends

The gold market does not exist in isolation. It is influenced by a myriad of factors, including market trends, economic indicators, and geopolitical events. For instance, a strong U.S. dollar can make gold more expensive for foreign buyers, potentially reducing demand. Conversely, a weak dollar can make gold more affordable, potentially increasing demand.

The Impact of Global Events

Global events, such as political instability or economic crises, can also impact the gold market. These events can increase the demand for safe haven assets, driving up the price of gold. For example, during the 2022 Russian invasion of Ukraine, gold prices surged as investors sought safety amidst the geopolitical uncertainty.

Conclusion: The Golden Path Forward

Navigating the Spot Gold Market

As we navigate the spot gold market on this March day in 2025, it’s clear that the market is influenced by a complex interplay of factors. From technical analysis patterns to economic policies and global events, each element plays a role in shaping the price of gold. Understanding these dynamics can help investors make informed decisions and navigate the market more effectively.

The Enduring Appeal of Gold

Despite the rise of digital assets and the ever-changing economic landscape, gold’s enduring appeal as a safe haven asset remains. Its lustrous allure and historical significance continue to captivate investors, making it a staple in many portfolios. Gold’s status as a tangible, physical asset also provides a sense of security that digital assets may not offer.

The Future of the Gold Market

As we look to the future, it’s essential to stay informed about the factors influencing the gold market. Whether you’re a seasoned investor or a curious observer, understanding the dynamics of the spot gold market can provide valuable insights into the broader economic landscape. The gold market, like the metal itself, is subject to change. But one thing is certain: gold’s enduring appeal will continue to shine brightly in the investment world.

—

Sources: