Swiss National Bank President Dismisses Bitcoin as Reserve Asset: A Detailed Analysis

Introduction

In a recent revelation, the Swiss National Bank’s (SNB) top official, Martin Schlegel, likened Bitcoin to an unreliable ship in his firm refusal to consider it for the nation’s monetary reserves. This narrative unfolds amidst a pivotal Swiss movement that calls for the SNB to embrace Bitcoin as it does gold. Schlegel’s metaphorical stance unveils pivotal concerns regarding Bitcoin’s merit as a financial stronghold, shedding light on the intricate dance between digital currencies and central banking.

Key Concerns Raised by SNB President Martin Schlegel

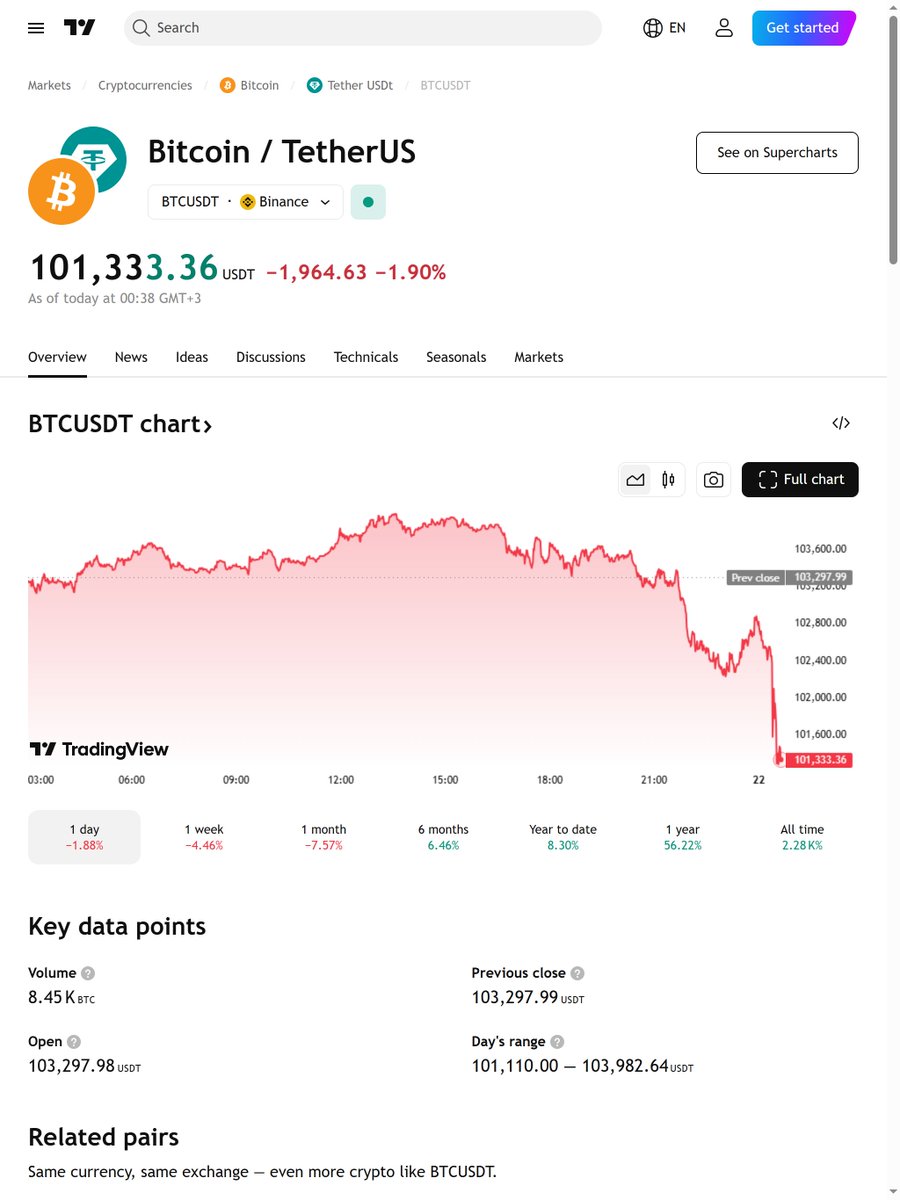

1. Volatility: Schlegel painted Bitcoin as a wild stallion, galloping uncontrollably due to its erratic price swings. For central banks like the SNB, seeking stability akin to a sturdy fortress, Bitcoin’s unpredictable nature poses a grave challenge, threatening the resilience of financial foundations.

2. Liquidity: Schlegel drew a comparison between Bitcoin and a frozen river, lacking the swift flow necessary for immediate financial maneuvers. Central banks crave assets akin to a ready-to-sail ship, ensuring quick adaptation to economic storms.

3. Security Weaknesses: Alert like a watchman, Schlegel highlighted Bitcoin’s digital vulnerabilities as open gates for lurking threats. The delicateness of the tech-backed currency unveils cracks in the fortress of central bank reserves, jeopardizing financial safekeeping.

The Bitcoin Initiative in Switzerland

Like a lone knight in a quest for sovereignty, the movement to integrate Bitcoin into the SNB’s coffers reshapes Switzerland’s financial destiny. Advocates envision a financial sanctuary shielded by the allure of Bitcoin, a diversified fortress against traditional foes. However, this quest braves formidable obstacles, needing 100,000 loyal allies for a shot at national validation.

Global Context: Bitcoin as a Reserve Asset

Undeterred by Switzerland’s verdict, the global choir echoes, exploring Bitcoin’s hidden treasures. As if reading cryptic signs, Standard Chartered foresees Bitcoin’s ascent to $500,000 by 2028, propelled by a wave of institutional knights. Across the seas, U.S. states ponder Bitcoin’s strategic worth, signaling a shift towards a new financial kingdom.

Conclusion

The Swiss National Bank’s verdict resembles a cautious ruler contemplating alliances with enigmatic forces, wary of volatility’s storm, liquidity’s calm, and security’s watchful gaze. Amid the world’s financial tapestry unrolling, the saga of Bitcoin’s quest for a central role twirls, with each nation and institution crafting tales of cryptic integration.

References

- Swissinfo: Swiss central bank chief rejects holding bitcoin in reserves

- Entrevue: Bitcoin Rejected by Switzerland: End of the Reserve Currency Dream?

- Bitget: The Swiss National Bank’s president denies the idea of serving as a reserve for the Swiss National Bank

- TradingView: Bitcoin To $500,000: Standard Chartered Doubles Down On 2028 Target

- VanEck: VanEck Mid-February 2025 Bitcoin ChainCheck

Additional Insights

1. Cryptocurrency Market Capitalization: The realm of cryptocurrencies, though vast, remains a niche within the realm of finance, a whisper amidst the financial symphony.

2. Institutional Interest: While central banks stand aloof, the allure of Bitcoin captivates the hearts of institutional powerhouses, a dance that might shape the future melody of markets.

3. Regulatory Environment: Like a shifting breeze, the regulations surrounding cryptocurrencies vary across lands, molding the path towards Bitcoin’s throne as a reserve asset.

Related sources:

[1] www.swissinfo.ch

[2] entrevue.fr

[3] www.bitget.com

[5] www.vaneck.com